Have you ever wondered what a payroll specialist does all day? We’ll explain the job description for a payroll specialist. Payroll specialists are important because they ensure employees get paid correctly and on time.

What is a Payroll Specialist?

A payroll specialist ensures that employees are paid the right amount of money on time. They handle all the tasks related to paying employees, including calculating wages, making deductions for taxes, and keeping records of payments. Payroll specialists are very important for any company because they ensure everyone gets their paycheck without any problems.

Benefits of Being a Payroll Specialist

Here are some benefits of being a payroll specialist:

- Good Salary: Payroll specialists earn a good salary. The average pay is around 945 per year in the United States, including an average base salary of about 260 per year.

- Job Security: Every company needs someone to handle payroll. This means there are always payroll specialist job opportunities.

- Benefits: In addition to a good salary, payroll specialists often receive extra benefits. These include health insurance, retirement plans like 401(k), paid time off, and sometimes bonuses.

- Career Growth: There are many chances to move up in this career. With experience and more education, payroll specialists can become senior payroll specialists or payroll managers.

- Helping Others: Payroll specialists help employees ensure they get paid correctly and on time. This is very satisfying because you know your work is important to others.

Being a payroll specialist is a good job with many benefits.

Main Responsibilities of a Payroll Specialist

A payroll specialist has many important duties. They handle all the tasks that make sure employees are paid correctly and on time. Let’s look at their main responsibilities in more detail.

Processing Payroll:

Payroll specialists are in charge of calculating how much money each employee should get. They figure out wages and salaries by looking at how many hours people worked and their pay rates.

They also add in any bonuses or extra payments. Besides, they subtract things like taxes, retirement contributions, and health insurance from paychecks. It’s very important that they do this correctly so everyone gets paid the right amount.

Maintaining Records:

Payroll specialists keep detailed records of all payments and deductions for each employee’s payroll. These payroll records include information like how much someone was paid, what deductions were taken out, and any bonuses they received.

This is important because it helps the company track payroll expenses and provides proof in case there are any questions or problems later. Accurate records also help with tax filings and audits.

Ensuring Compliance:

Payroll specialists must make sure the company follows all the laws and regulations related to payroll. This means they have to know federal, state, and local tax laws and make sure they apply them correctly when processing payroll.

They need to stay updated on any changes in these laws. If the company doesn’t follow the rules, it can get into trouble and might have to pay fines.

Handling Inquiries:

Employees often have questions about their paychecks. They might want to know why a certain amount was deducted or why their pay is different from what they expected. Payroll specialists are the ones who answer these questions.

They help employees understand their paychecks and solve any problems that come up. Explaining things clearly and calmly is important in this part of the job.

They play a critical specialist role in ensuring everyone gets paid correctly and on time.

Required Skills for Payroll Specialists

To be a good payroll specialist, you need to have certain skills. These skills help you do your job well and make sure everyone gets paid correctly.

- Attention to Detail: Payroll specialists must be very careful when they do their work. They need to make sure that all the numbers are correct. If they make a mistake, someone might get paid the wrong amount. This is why being detail-oriented is so important. Double-checking calculations and being precise helps avoid errors.

- Time Management: Payroll specialists need to manage their time well. They have to meet payroll deadlines to make sure employees get paid on time. This means they need to plan their work and stay organized. Good time management skills help them finish all their tasks before the payroll deadline.

- Technical Skills: Payroll specialists use computers and special software to do their job. They need to be good at using payroll software and Microsoft Excel. These tools help them keep track of all the payments and payroll deductions. Knowing how to use these programs well makes the job easier and more accurate.

- Communication Skills: Payroll specialists talk to employees and other departments. They need to explain things clearly and answer questions about paychecks. Good communication skills help them share information and solve problems. Being able to listen and speak clearly is very important in this job.

Educational Qualifications

To become a payroll specialist, you usually need some education and payroll specialist training. Let’s see what kind of education and certifications are needed.

- Degree Requirements: Most payroll specialists have a college degree. They often study subjects like accounting, finance, or business. Having a degree helps them understand the basics of payroll and finance.

- Certifications: Getting certified can help you become a better payroll specialist. One important certification is the Certified Payroll Professional (CPP). This shows that you know a lot about payroll and can do the job well.

- Training Programs: Many payroll specialists learn on the job. They get training from their employers and attend workshops. These training programs help them learn new skills and stay updated on the latest payroll laws and software. Ongoing training is important to keep improving and doing the job well.

Commonly Used Software

Payroll specialists use different types of software to do their jobs. These tools help them manage payroll, track time, and handle payroll taxes. Let’s look at some of the software they use.

- Payroll Software: Payroll specialists use payroll software to manage all the details of paying employees. Programs like ADP and QuickBooks help them calculate wages, salaries, and deductions. Using payroll software helps save time and reduces mistakes.

- Timekeeping Systems: Payroll specialists also use timekeeping systems. These systems track how many hours employees work. This information is important for calculating paychecks. Timekeeping systems make it easy to see who worked when and for how long.

- Tax Software: Payroll specialists need to handle taxes, too. They use tax software to make sure all the tax forms are filled out correctly. This software helps them file payroll tax returns and make sure the company follows tax laws.

Ensuring Compliance with Tax Regulations

Payroll specialists ensure that the company follows all tax laws and regulations. This is called payroll compliance. Let’s see what they do to ensure compliance.

- Tax Laws: Payroll specialists need to understand tax laws at the federal, state, and local levels. This means they know the rules about how much tax to take out of each paycheck. They also know when and how to pay these taxes to the government. Staying updated on tax laws helps them make sure the company is following all the rules.

- Reporting Requirements: Payroll specialists have to file payroll tax returns. These are reports that show how much tax was taken out of employees’ paychecks and how much was paid to the government. Filing these reports on time is very important. It helps show that the company is paying the right amount of taxes.

- Audits: Sometimes, the government checks to ensure companies follow tax laws. This is called a payroll audit. Payroll specialists prepare for audits by keeping detailed records of all payroll information. If there is an audit, they provide the information needed to show that everything was done correctly. Being prepared for audits helps the company avoid problems and fines.

Payroll specialists use various software tools to manage payroll, track time, and handle taxes.

Payroll Salary and Compensation

Payroll specialists play a vital role in making sure employees get paid correctly and on time. Let’s explore their salary and compensation details.

Average Salary:

The average salary for payroll specialists can vary based on where they work and their experience. In the United States, the estimated total pay for a payroll specialist is about $67,945 per year. This includes an average base salary of around $59,260 per year. These numbers are the midpoint, so some payroll specialists earn more, and some earn less.

Benefits:

Payroll specialists often get various benefits as part of their payroll compensation package. These benefits can include health insurance, which helps cover medical expenses. They might also get retirement plans, like a 401(k), where the company helps them save for the future. Other common benefits include paid time off, dental insurance, and sometimes even bonuses.

Factors Affecting Salary:

Several factors can influence payroll earnings.

- Experience: Payroll specialists with more years of experience tend to earn higher salaries. As they gain more skills and knowledge, their value to the company increases.

- Education: Having a higher level of education, such as a degree in accounting or finance, can lead to better pay. Certifications, like becoming a Certified Payroll Professional (CPP), can also boost salary.

- Industry: The industry where a payroll specialist works can impact their salary computation. For example, payroll specialists in large corporations or specialized industries may earn more than those in smaller businesses or non-profits.

Payroll specialists can earn a good salary, especially as they gain more experience and education. They also receive valuable benefits that add to their overall payroll compensation.

Career Growth Potential

Being a payroll specialist can lead to many career opportunities. Let’s explore how you can grow in this field.

- Career Advancement: Payroll specialists can move up to higher positions. For example, they can become senior payroll specialists or payroll managers. They take on more payroll specialist responsibilities and manage larger teams. Advancing your career can also mean a higher salary and more job satisfaction.

- Continuing Education: Learning doesn’t stop once you become a payroll specialist. Ongoing training is important for payroll specialist career growth. There are always new things to learn, like changes in tax laws or new payroll software.

- Networking: Meeting other professionals in your field can help you grow your career. Joining professional organizations for payroll specialists is a good idea. These groups often hold conferences and meetings where you can learn and meet people.

Industries Employing Payroll Specialists

Payroll specialists are needed in many different types of businesses and organizations. Let’s look at where you might find a job as a payroll specialist.

- Corporate Sectors: Large companies and multinational corporations often have many employees. They need payroll specialists to handle all the payroll tasks.

- Small Businesses: Small to medium-sized businesses also need payroll specialists. These businesses might not have as many employees, but they still need someone to manage payroll.

- Government and Non-Profit: Public sector and non-profit organizations hire payroll specialists too. These organizations need to manage their payroll just like any other business. Working in government or for a non-profit can be very rewarding and offer job stability.

A career as a payroll specialist offers many opportunities for growth and advancement.

Common Challenges Faced by Payroll Specialists

Being a payroll specialist is not always easy. There are several challenges they must overcome. Let’s look at some of these common challenges.

Regulatory Changes:

Payroll laws and regulations can change often. Payroll specialists need to keep up with these changes.

They must learn new rules and make sure the company follows them. This can be tough because laws can be different in each state and country. Staying updated helps avoid mistakes and keeps the company out of trouble.

Technology Updates:

Payroll systems and software are always improving. Payroll specialists need to learn how to use new technology.

This can include updates to existing software or learning entirely new systems. Adapting to new technology helps payroll specialists work more efficiently and accurately.

Accuracy:

Making sure that payroll is error-free is very important. Even small mistakes can cause big problems. Employees depend on their paychecks to be correct.

Payroll specialists must double-check their work to ensure everything is right. This means paying close attention to details and being very careful with calculations.

Collaboration with Other Departments

Payroll specialists don’t work alone. They need to work with other departments in the company. This teamwork helps ensure everything runs smoothly.

Human Resources:

Payroll specialists work closely with the Human Resources (HR) department. HR provides important information about employees, such as their work hours, pay rates, and benefits. Payroll specialists use this information to process payroll correctly. They also help HR with tasks like enrolling employees in benefit programs.

Finance:

The payroll department needs to coordinate with the finance department. Finance ensures that there is enough money to pay employees and that all financial records are accurate.

Payroll specialists share payroll data with finance to help with budgeting and financial reporting. Working together ensures the company’s finances are in order.

IT:

Technology is a big part of payroll processing. Payroll specialists often work with the Information Technology (IT) department.

IT helps set up and maintain payroll systems. They troubleshoot any technical problems that might come up. Collaborating with IT ensures that the payroll systems are working correctly and securely.

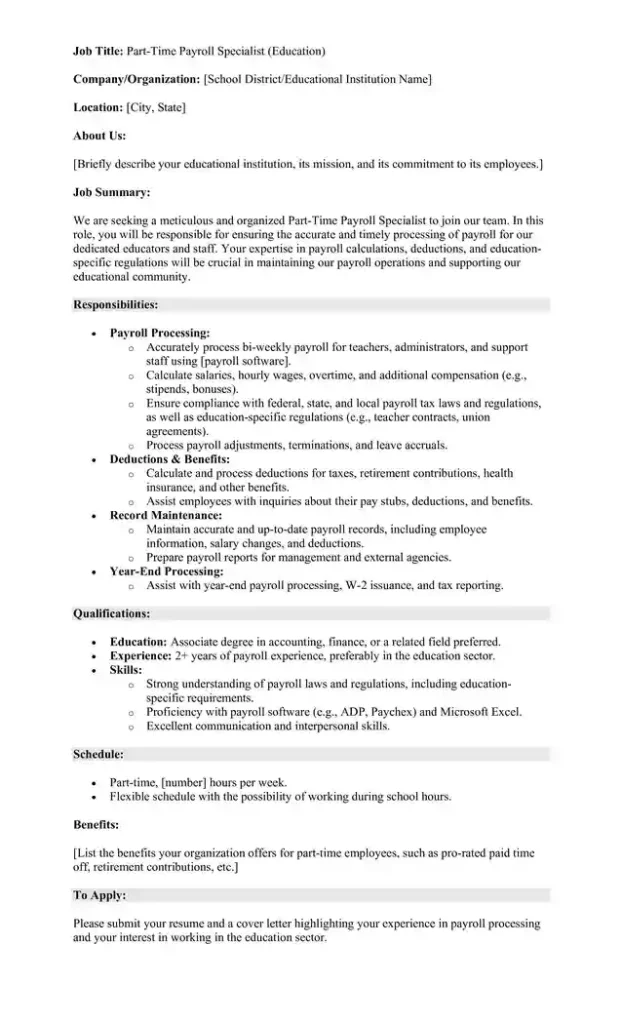

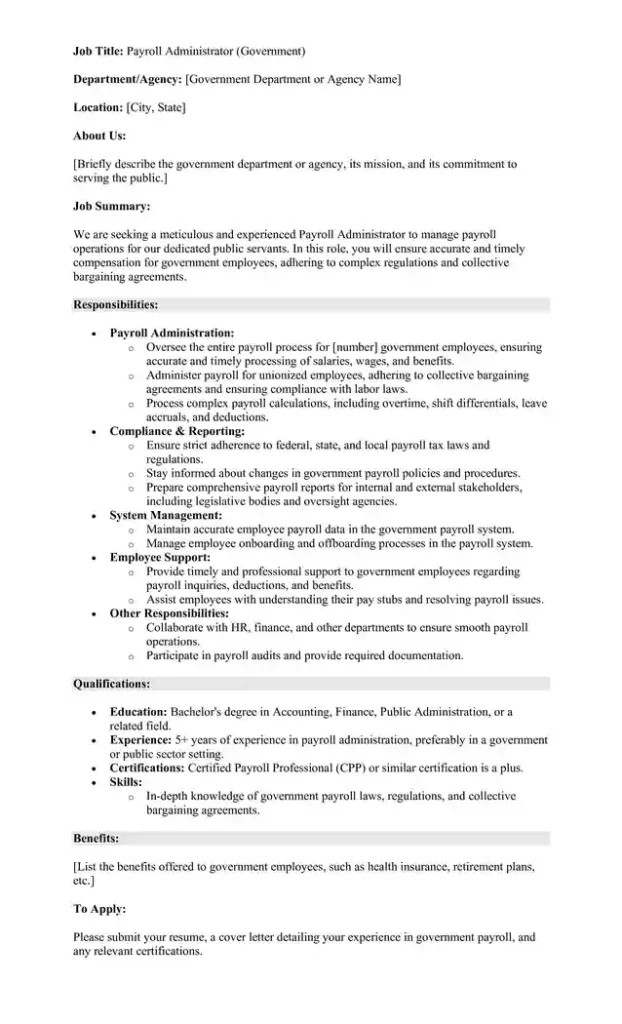

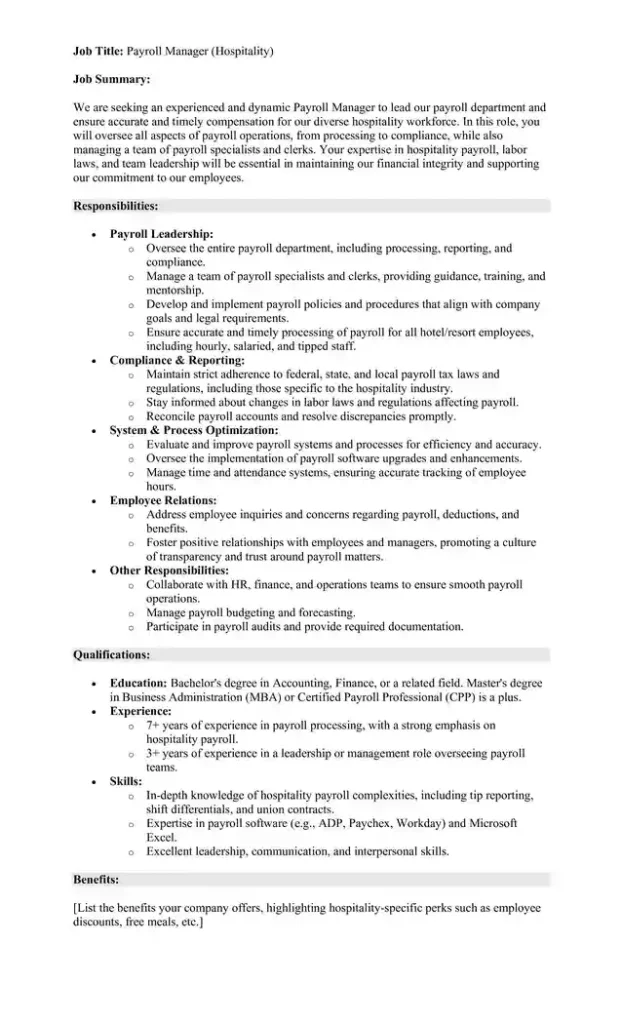

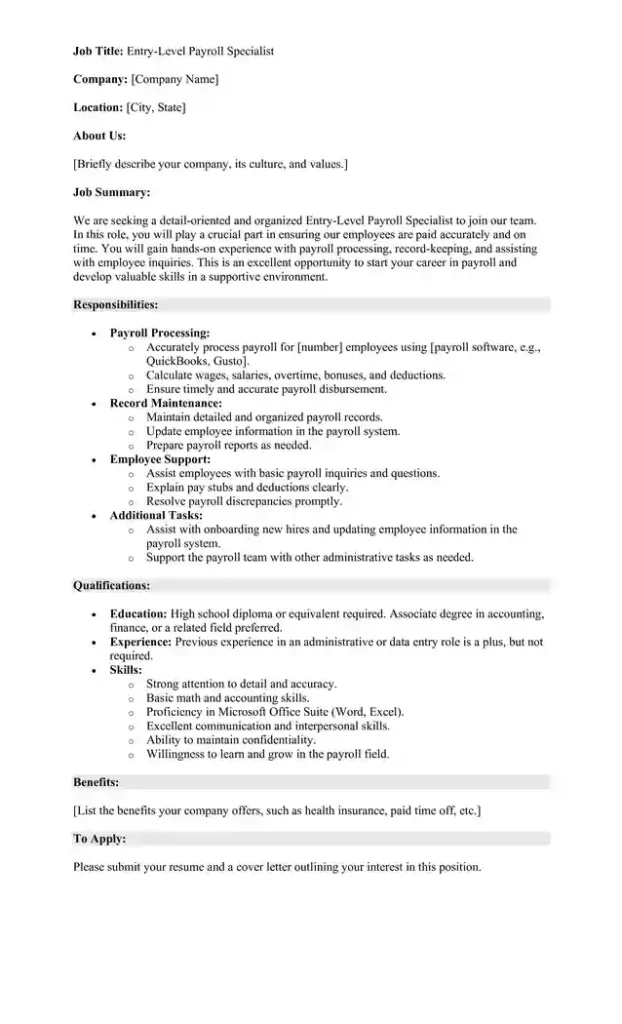

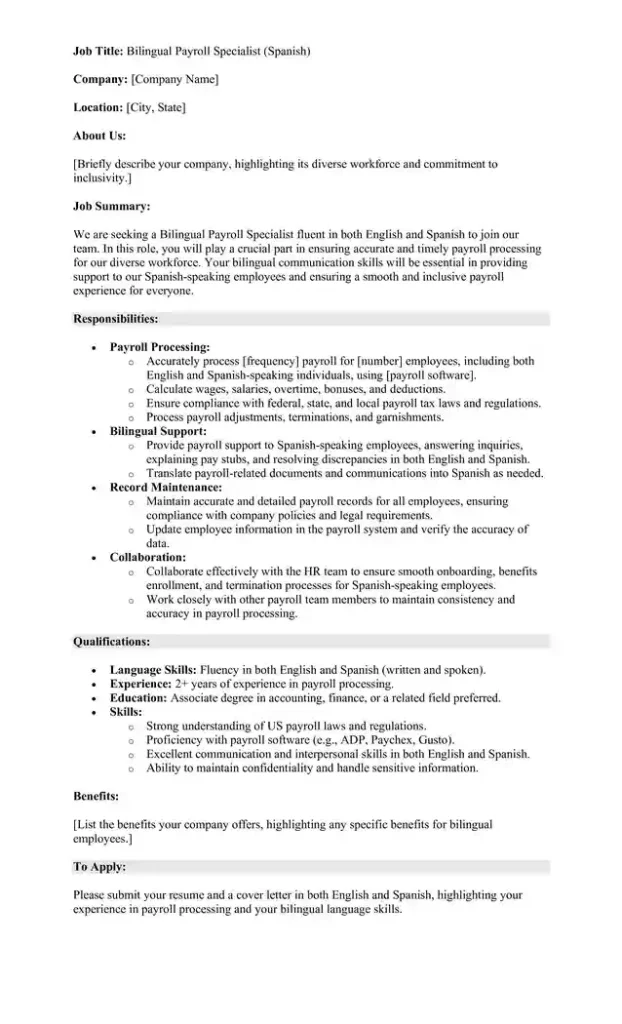

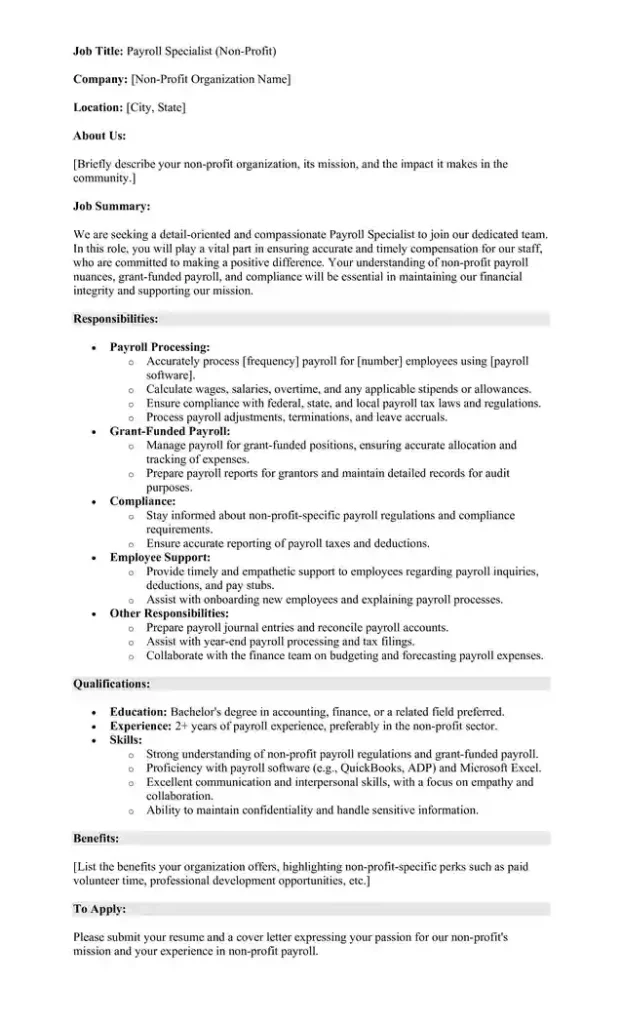

Sample Job Description for a Payroll Specialist

Payroll specialist job description template

Conclusion

Payroll specialists play a crucial role in any organization. They make sure payroll processing is accurate and timely, follow tax laws, and communicate well with employees. This career offers chances for growth and learning.

It is a rewarding path for those interested in payroll management. If you want to become a payroll specialist, focus on gaining the necessary skills, education, and certifications. This will help you excel in this field. Understanding the job description for a payroll specialist can guide you in building a successful career in payroll management.

Alexander is a skilled HR expert who writes clear and compelling job descriptions. He has spent over 15 years in the HR field, helping companies find and keep the best employees. With a degree in Human Resources Management from the University of Chicago, he has the knowledge to back up his experience.