A free simple promissory note template must be used to generate the right promissory note. In the business world, we can make sure that the funds will be needed for the business. Many businesses look for the funds for their business investment.

Because there are certain amounts of money which are involved, the debtor and the creditor have to make promissory notes to avoid potential issues. It will specify every term and condition of the repayment as well as the amount of the loan. One thing for, the promissory note is important.

Importance of the Promissory Note Template

Legal Proof

In the litigious world, we can make sure that people have to make sure the honesty as well as trustworthiness. Although people think that they are credible and reliable, they will still be trusted by the other party, especially when the funds are involved.

A written proof will be needed to ensure the debt payment on a particular date. Verbal promises will not work in this circumstance. This might be the reason why the debtor will generate the promissory notes because it can be used as legal proof, which can ensure loan repayment. It can also be used for securing the loan’s truthfulness.

Business Investment

When people are making the promissory note, it means that they will legalize the terms of the loans and discuss the note constituents. At the same time, they will mostly eliminate the disagreements. It can also be a clarification that they make a business investment by making a loan for a business venture. It will not be a loan of personal investment that is made for running the business. It will also state that there is assurance that the debtor will pay the fund, and there is no claim that can be made to the business from the fund which the creditor lends.

Repayment Process

By generating the promissory note, it means that the debtor and the creditor will be made to decide on the terms and conditions associated with the process of the fun repayment. It will include the payment schedule. The loan length and the interest payment will also be decided when generating the note.

Tax Issues

When people are taking a loan, there will be a tax implication which is based on the loan size. The note will sort out the tax issues. The note will prove that the fund is a loan instead of a gift. Get the right free simple promissory note template right away.

Writing a Promissory Note

Here’s a simplified breakdown of how to write one:

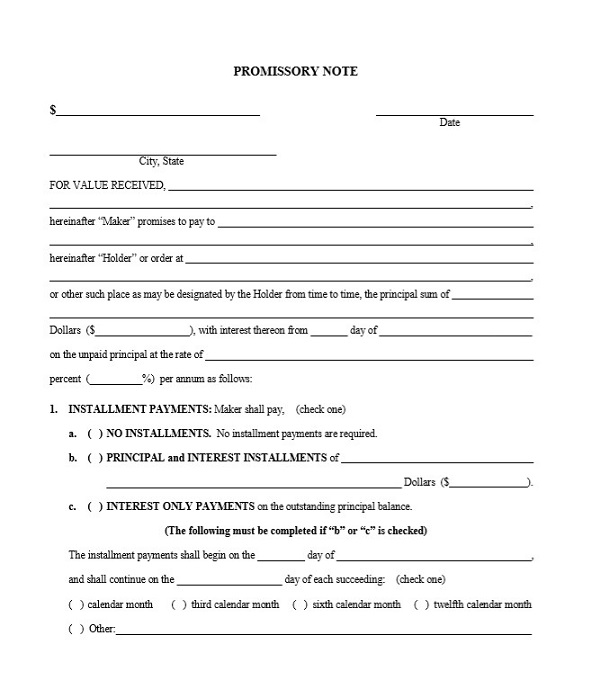

Who’s Involved?

- Write the full names of the person who is lending the money and the person who is borrowing the money.

- Write where they live and their phone numbers.

- If a shop or company is lending the money, write its full name.

How Much Money?

- Write the total money being borrowed.

- If there’s extra money to pay for borrowing (interest), write the rate and the total money with interest.

How to Pay Back?

- Tell me how the money will be given back.

- Common ways are small payments over time or all money at once.

When to Give Money Back?

- Write when the money should be given back.

- Also, write the last date to pay off all the money.

What if Money Isn’t Given Back?

- Explain what will happen if the money isn’t given back.

- This might include giving back something bought with the money or other actions.

Sign and Make it Official

- Both the person lending and borrowing need to sign and put the date to make it official.

Extra Step: Notary

- If wanted, a notary can watch the signing and stamp the note. This isn’t needed but can make the note stronger.

Understanding Different Types of Promissory Notes

Promissory notes come in different types based on the reason for the loan. Here’s a simple explanation of each type:

Simple Promissory Note:

A basic promise to pay back a loan. No extra things like houses or cars are promised if the loan isn’t paid back.

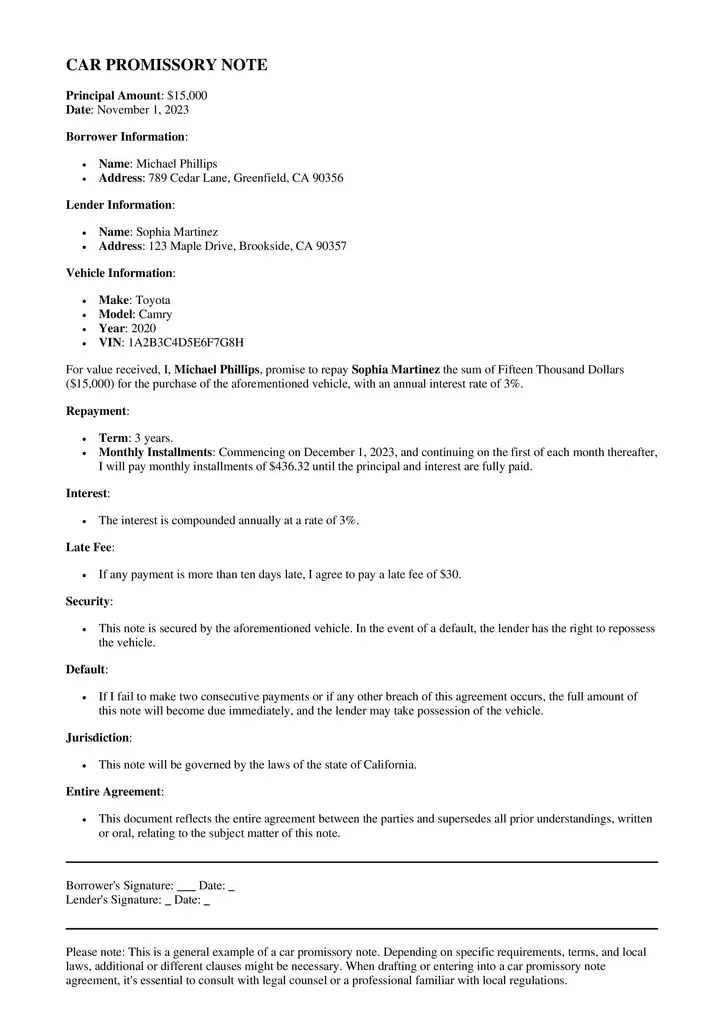

Car Promissory Note:

A promise to pay back a loan used to buy a car. It should have details about the car, like the make and model.

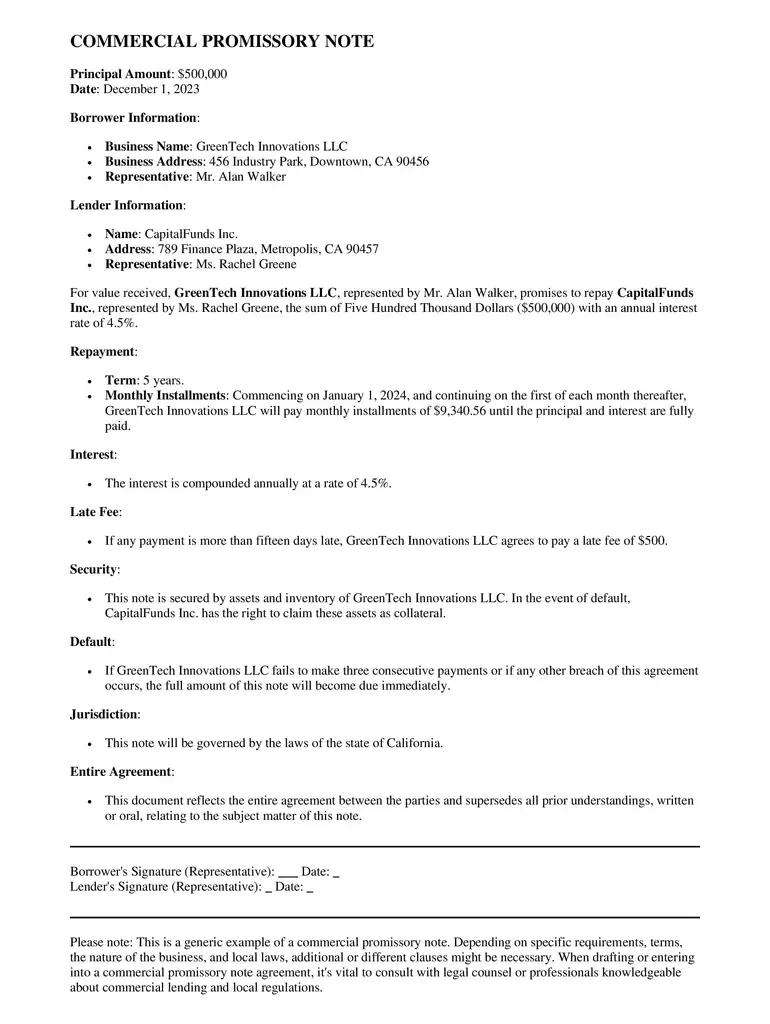

Commercial Promissory Note:

A promise to pay back a loan from a business lender like a bank. If the borrower can’t pay back, the lender might ask for all the money at once and might take some of the borrower’s stuff until they get paid.

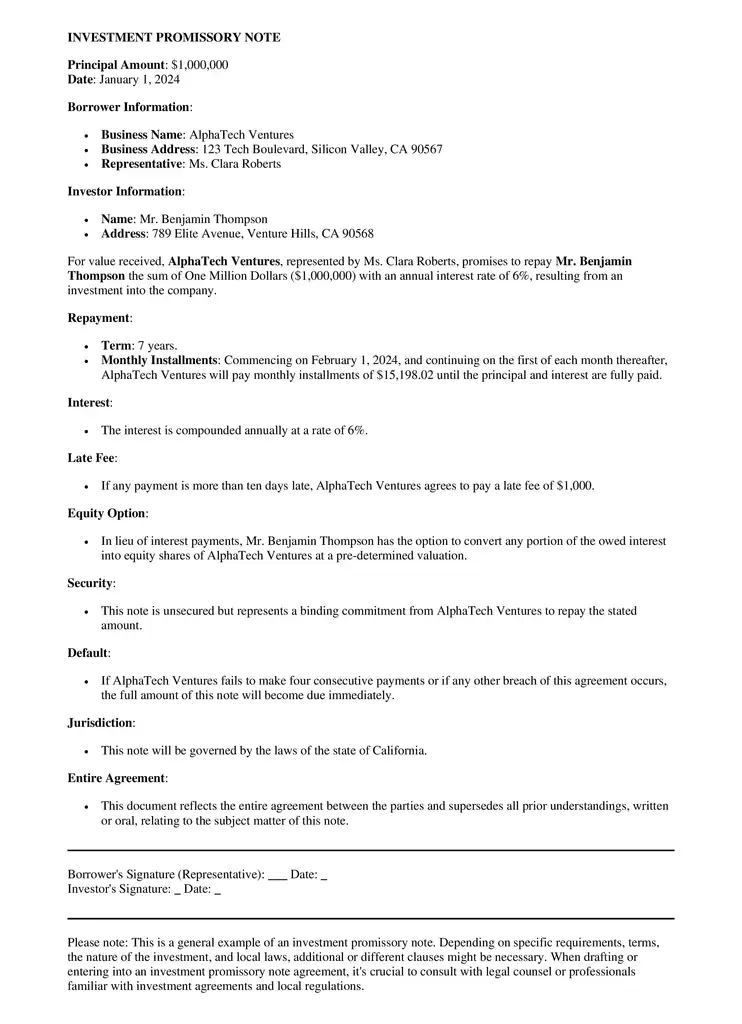

Investment Promissory Note:

A special note is used by businesses to get investment money. It promises to pay back the investors over time. If the business can’t pay back, the investor might get ownership of the business.

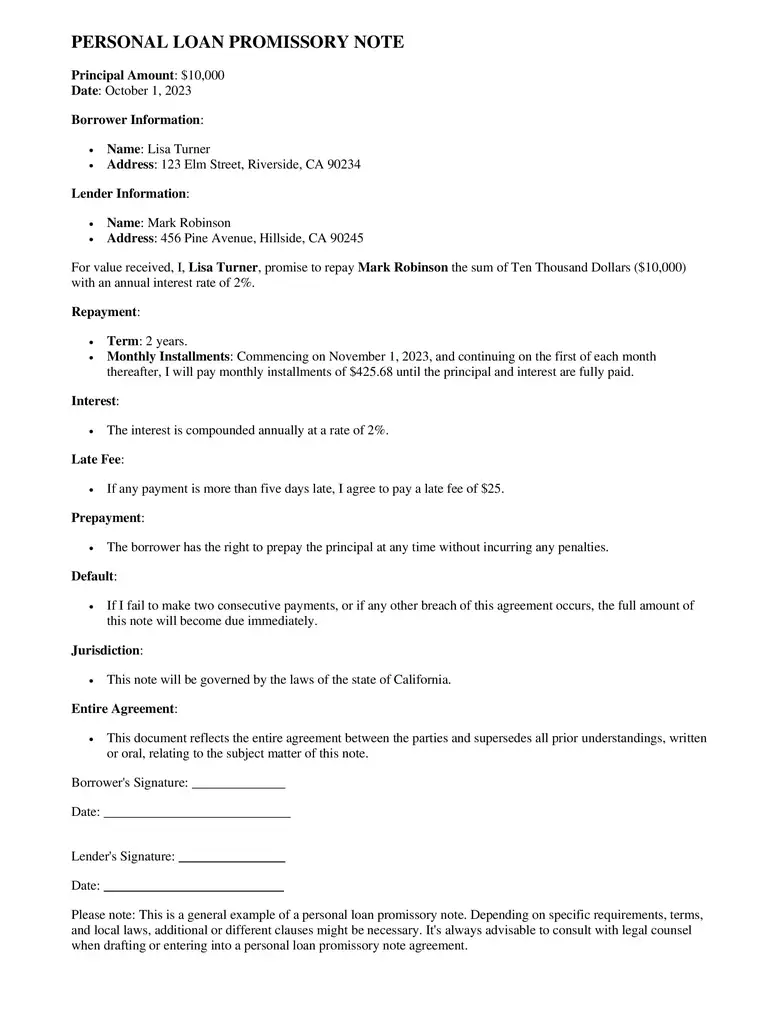

Personal Loan Promissory Notes:

A written promise to pay back a loan between friends or family. It’s good to have, even with people you know well, to avoid any problems later.

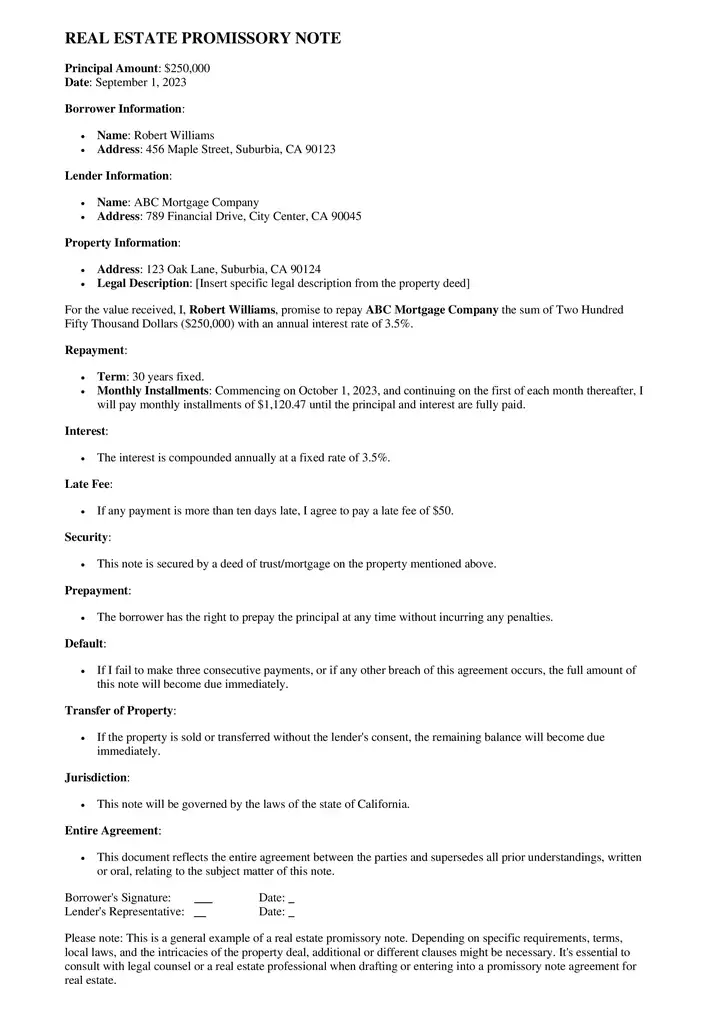

Real Estate Promissory Note:

A promise to pay back a loan, with the borrower’s property as a promise, if they can’t pay back the money. If the borrower doesn’t pay, the lender can claim part of the property.

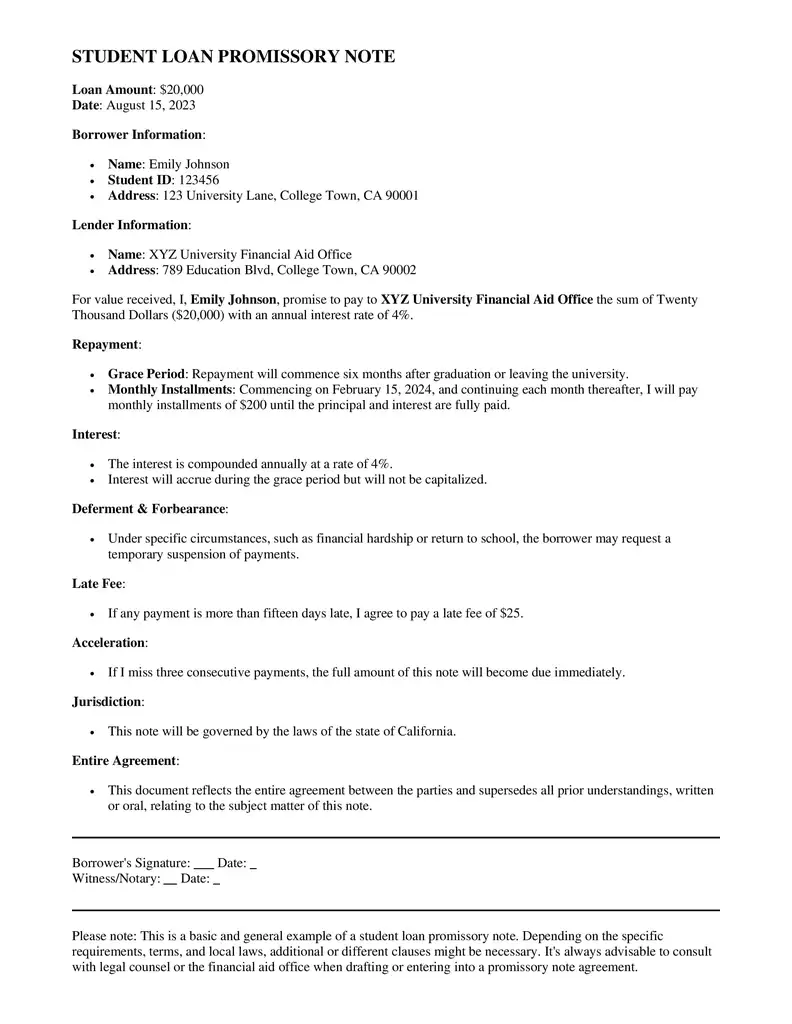

Student Loan Promissory Note:

A promise to pay back money borrowed for school. Usually, it’s between a student and the government, but it can also be with family members helping with school costs.

Can You Write Your Promissory Note?

Yes, you can definitely write your promissory note. Here are some common situations when you might need a free simple promissory note template:

- Student Loans: When borrowing money for school.

- Bank Loans: When getting money from a bank for various needs.

- Car Loans: When borrowing money to buy a car.

- Personal Loans: When lending or borrowing money with family or friends.

A promissory note can go by different names, but that doesn’t change what it does. It’s still a promise to pay back money. Here are some other names for a promissory note:

- Debt Note: Another name for a promise to pay back money.

- Demand Note: A note that asks for payback when requested.

- Commercial Paper: A professional name for a promise not in business.

- Notes Payable: Just another fancy name for a promissory note.

Different places might use different names for a promissory note. It’s okay to use any of these names when writing your note. No matter the name, it serves as a promise to pay back a loan.

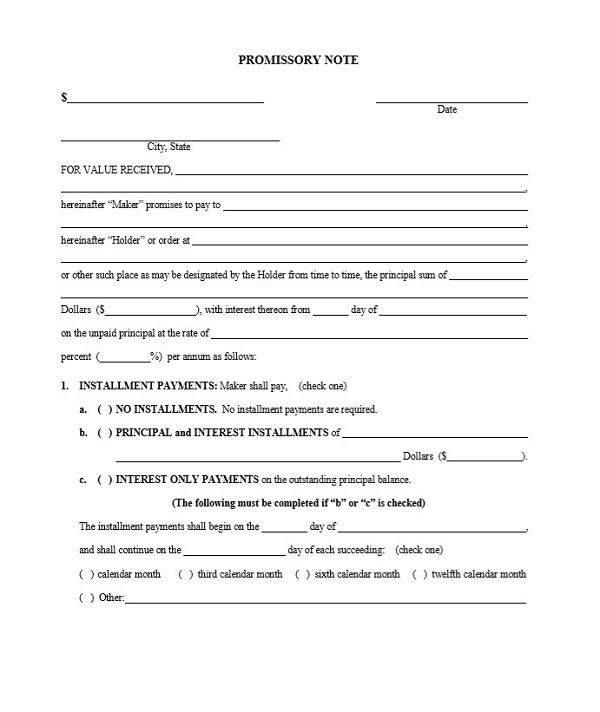

Common Repayment Options

When you borrow money, there are different ways you can pay it back. Here are four common repayment options:

Installment Payments:

- Paying back a little bit of the loan plus some extra (interest) every month until all the money is paid back.

- Common for buying costly things like cars or boats.

- You can pay some money upfront (a down payment) to lower the total cost.

Installment Payments with a Final Balloon Payment:

- Paying back a little every month for a while, then paying back a big chunk (the balloon) at the end.

- Often used for home loans.

- You pay a low interest for some time, like five years, then decide whether to reset the loan or pay off the big remaining amount.

Due on a Specific Date:

- Paying back all the money plus extra (interest) on one specific date.

- Good for smaller loans.

- You don’t have to worry about monthly payments, but you need to pay everything back on that one date.

Due on Demand:

- Paying back the money whenever you can is often used between family and friends.

- There’s no fixed date or monthly payments, but you pay back when you’re able to.

Why Using a Promissory Note Template is Good

A promissory note template helps make writing a loan agreement easy and fast. Here’s why it’s good to use one:

Saves Time

- Templates are ready to use, so you don’t have to start from scratch.

- They help you remember all the important details quickly.

Saves Money

- Free templates mean you don’t have to spend money to make a free simple promissory note template.

- You might not need to hire a lawyer to write a basic note.

Follows the Law

- Most templates are made to match legal rules.

- They keep the agreement looking professional and following the law.

Keeps Things the Same

- Using a template keeps all your loan notes looking the same.

- It makes sure you don’t forget any important parts.

Helps You Learn

- Templates show you what a promissory note should look like.

- They help you learn about loans and legal rules.

Easy to Change

- You can change parts of the template to fit your needs.

- It’s a helpful guide but can be changed.

Makes Things Clear

- Everything is written so everyone understands the agreement.

- It helps talk about the loan and the payback plan easily.

Free Simple Promissory Note Template

Microsoft Office Promissory Note Template

Microsoft Office has a template for making money promises, too. It’s like a digital helper that makes writing down money promises easy on the computer.

Promissory Note with Payment Schedule

Sometimes, a promissory note has a payment schedule. This schedule is like a plan that shows how much money will be paid back and when. It helps both the person who borrowed the money and the person who lent the money know when payments will be made. This type of promissory note is like a calendar for paying back borrowed money.

Open Ended Promissory Note Template

An open-ended promissory note template is like a friendly chat about money. It doesn’t say exactly when the money should be paid back. It’s good for times when the payback time is not fixed.

Interest Only Promissory Note Template

This template is for promises where only the extra money (interest) is paid for some time. It’s like a plan for paying a little now and the rest later.

Promissory Note Between Parent and Child

This is a special promise note template for families. It helps parents and kids write down money promises in a kind and clear way.

Wonder Legal Promissory Note

Wonder Legal has a way to help write money promises, too. It’s like a helper who knows a lot about law, making sure the promise note is written just right.

Secured Promissory Note Template

This template is like a strong box that keeps a treasure safe. It makes sure something valuable is promised if the money isn’t paid back. It’s a safe way to lend money.

Promissory note template by States

When people borrow money, they often write a promise to pay it back. This promise is called a promissory note. Different states have different rules for these notes.

Every state has its own set of rules for lending and borrowing money. The promise notes look different in each state.

Promissory note template Georgia

In Georgia, a promise note template helps write down how much money is borrowed when it will be paid back, and what happens if it’s not paid back on time. It follows the rules of Georgia for lending money.

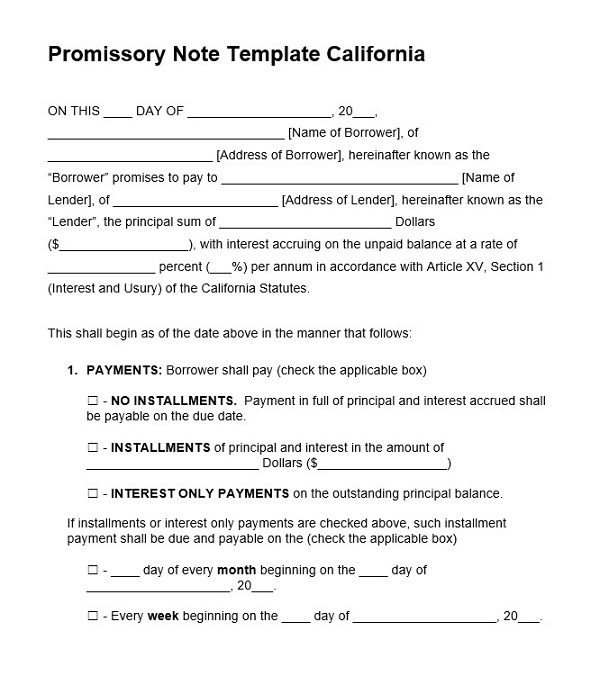

Promissory note template California

In California, the template makes it clear about the money borrowed, when to pay it back, and what to do if payment is late. It follows California’s rules for lending money.

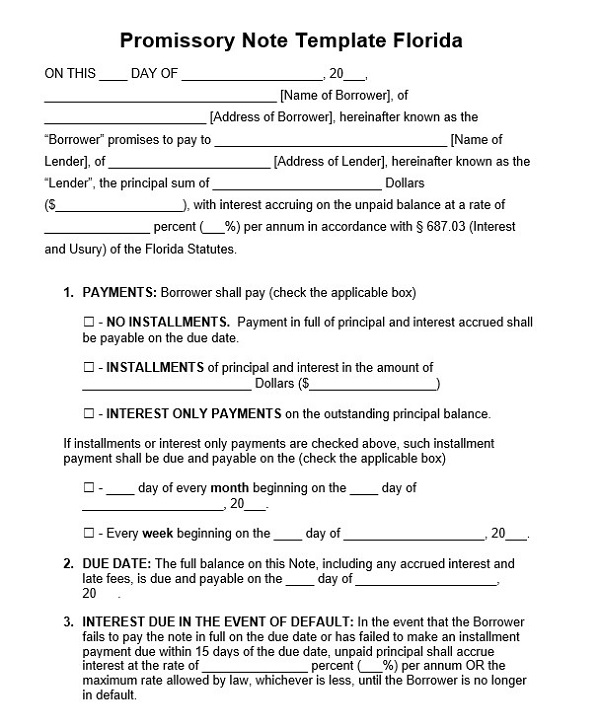

Promissory note template Florida

Florida’s template is made to fit Florida’s lending rules. It helps write down the money details when to pay back, and what happens if payment is late.

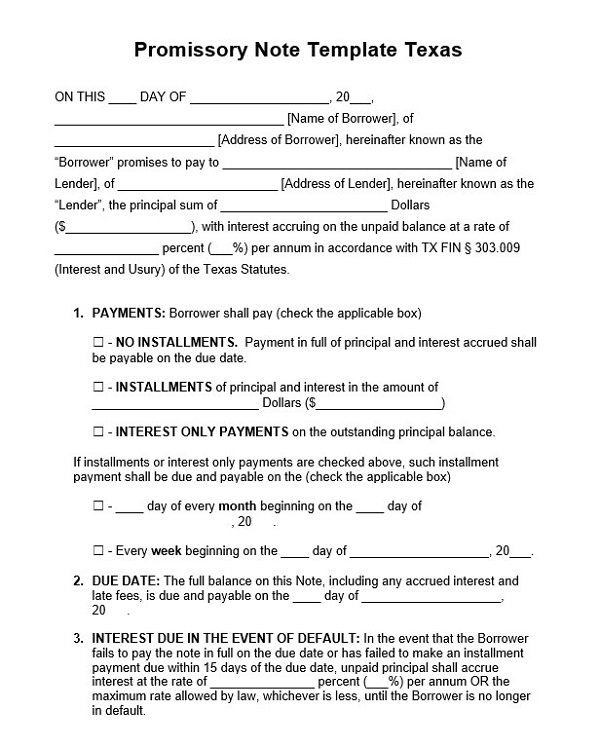

Promissory note template Texas

The Texas template follows Texas lending rules. It helps write down the money borrowed, the payback time, and the steps if the payback is late.

Promissory note template Ohio

Ohio’s template is like a stepping stone for making money promises. It shows the Ohio way of writing down who borrowed money, how much, and when it will be paid back.

Promissory note template Illinois

In Illinois, the template acts like a blueprint. It helps people sketch out the money promises following Illinois’ special rules.

Promissory note template UK

The template in the UK is like a wise friend. It helps people in the UK write down money promises in a way that everyone understands.

Promissory note template Michigan

Michigan’s template is like a pathway for making money promises. It shows how to write down the promise to pay back money the Michigan way.

Promissory note template New York’s

New York’s template is like a guidebook. It helps people write down money promises so everyone knows when the money should be paid back, all according to New York’s rules.

Promissory note template Washington

In Washington State, the template is like a handbook for money promises. It helps people write down the borrowed money details and the payback time, following Washington State’s rules.

Making Your Promissory Note Secure

Securing It takes steps to ensure that the lender can get their money back if the borrower cannot pay. Here’s a simple guide on how to do that:

Use Collateral:

Collateral is valuable, like a house or car, that the borrower promises to give to the lender if they can’t pay back the loan.

Mention the collateral clearly in the promissory note.

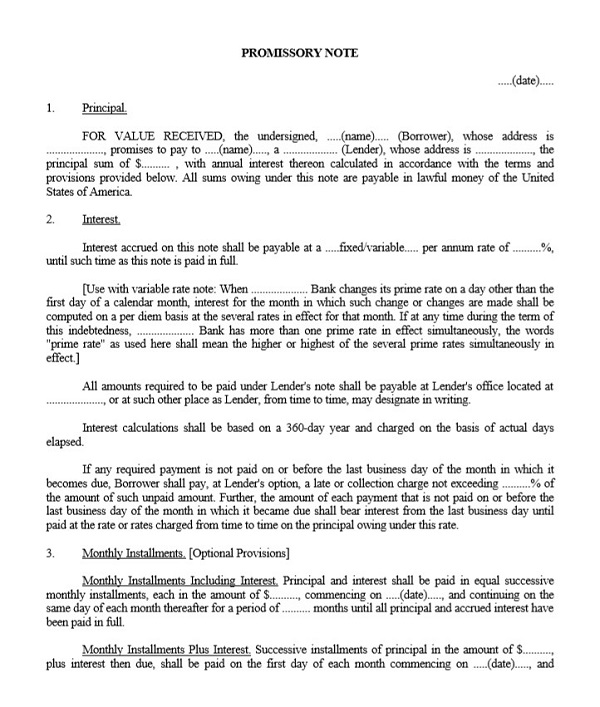

Interest Rate:

Having an interest rate helps the lender earn some money for lending their money.

Payment Plan:

A clear payment plan helps everyone know when payments should be made.

Include the amount, how often, and by when the payments should be finished.

Late Payment Fees:

If payments are late, having a fee can encourage the borrower to pay on time.

Legal Clauses:

Include what will happen if the borrower can’t pay back, like taking the collateral or going to court.

Get It Notarized:

Having a notary watch you sign the promissory note and stamp it can make the note stronger.

Keep Records:

Keep records of all payments made and any other agreements related to the loan.

Consult a Lawyer:

If you can, talk to a lawyer to make sure your promissory note is well-secured and follows the law.

Extra Terms for Your Promissory Note: Know the Details

Here’s a simple explanation of these terms:

Acceleration:

A rule says the whole loan must be paid back right away if certain things happen, like missed payments or bankruptcy.

Amendment:

Any changes to the note must be written down and agreed upon by everyone involved to avoid misunderstandings.

Joint and Several Liability:

If more than one person borrows the money, each person is responsible for paying back the whole amount, not just part of it.

Governing Laws:

Mentioning which state’s laws will be used if there are any problems or questions about the note.

Collateral:

If something valuable is promised to the lender, if the loan isn’t paid back, it should be described here. If there’s no collateral, this part can be skipped.

Right to Transfer:

A rule about whether the borrower can let someone else take over the promissory note and the responsibility to pay back the loan.

Prepayment:

Rules about whether the borrower can pay back the loan early and if there’s a cost for doing that.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.