What Does a Bank Statement Look Like – A bank statement, albeit a common aspect of financial administration, plays a crucial role. It is a guiding beacon, steering account holders through their financial dealings and balances.

What are the Bank Statements

It is a certified record of financial transactions conducted during a specific period on a bank account held by an individual or a business with a financial institution.

They are excellent resources to aid account holders in monitoring their finances, comprehending their expenditure patterns, and identifying any discrepancies or fraudulent actions on their accounts.

At its simplest, it includes your account overview, transaction specifics, and, if relevant, overdraft protection details. Each of these elements delivers crucial information about your financial state and activity.

What Does a Bank Statement Look Like? Detailed Overview

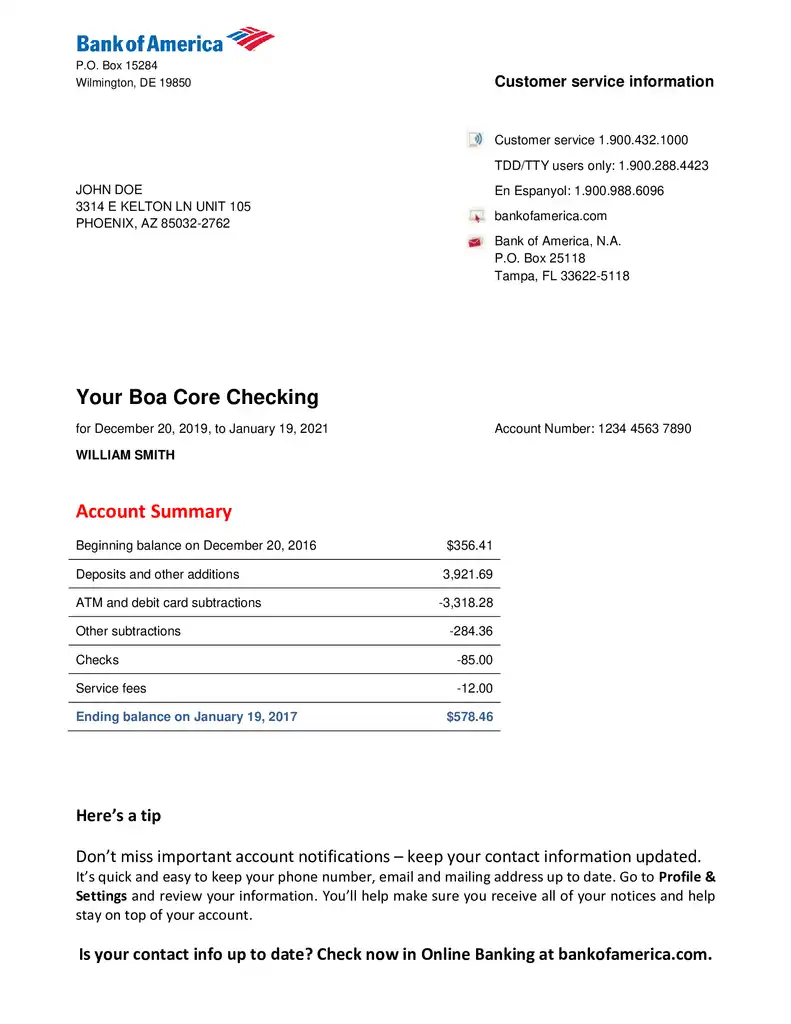

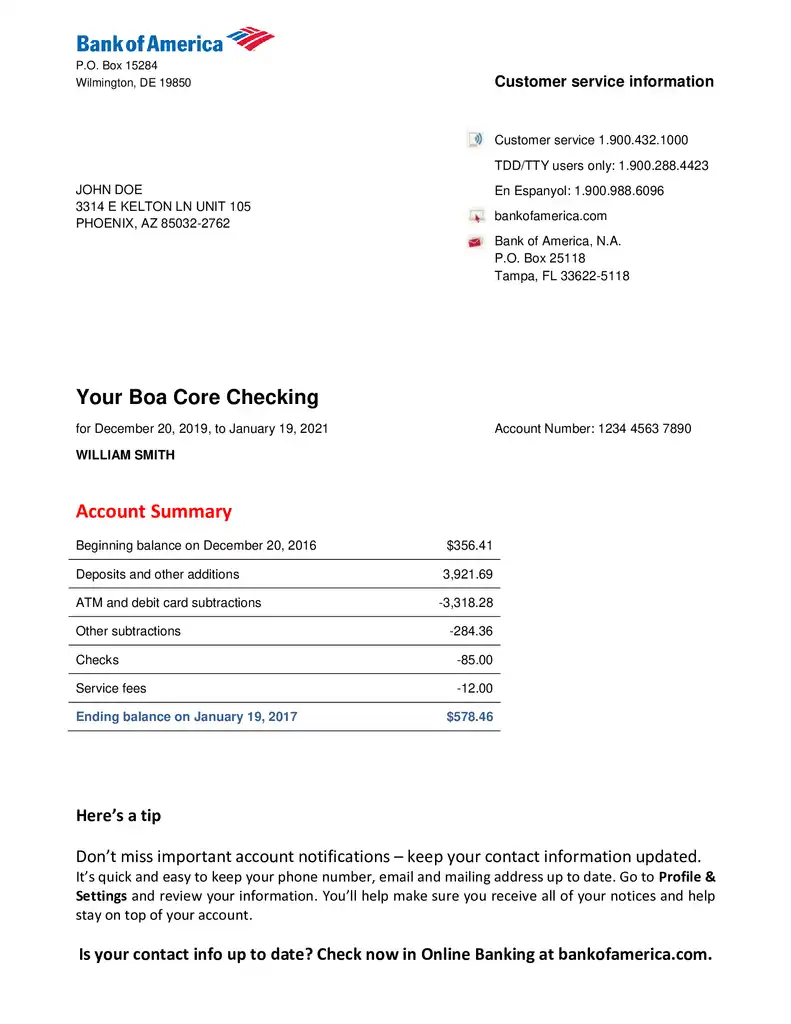

Every bank statement contains key components that aid account holders in comprehending their financial status better. These fundamental elements as:

- Account summary: A concise review of the account, presenting the opening and closing balances.

- Detailed transaction history: Data about specific transactions, including dates, amounts, and parties involved.

- Fees: Any costs linked with the account, such as monthly maintenance or overdraft charges.

- Interest earned: If the account earns interest, the statement will specify the amount earned during the statement cycle.

Recognizing these components will enable account holders to manage their finances effectively and swiftly spot any irregularities or dubious activities.

Delving Deeper into Account Summary

The account summary segment gives a consolidated snapshot of your financial activity over a particular timeframe. This section usually appears at the start of the statement. It overviews the initial and final credit, total deposits, withdrawals, and any fees or interest accrued during the statement cycle.

Starting Balance

It indicates the total amount of money in your account at the beginning of the statement cycle. As per the Federal Reserve, it is the final balance from your previous and acts as the reference point for tracking all transactions during the current period.

Deposits

This part outlines all the credits to your account during the statement cycle. Deposits can vary- from paycheck deposits and transfers from other accounts to interest payments and cash or check deposits.

Withdrawals

Likewise, this section of the account summary details all the money withdrawn from your account. Withdrawals could include ATM withdrawals, checks issued, direct debits, bill payments, debit card purchases, and bank charges.

Fees and Interest

This section includes any charges incurred by the bank during the statement cycle, such as maintenance, ATM, or overdraft charges. Interest paid or earned on the account will also be covered here. It is especially important for interest-bearing accounts like savings accounts or interest-checking accounts.

Ending Balance

indicates the total amount of funds in your account at the end of the statement cycle. The American Bankers Association clarifies that it is calculated by taking the starting balance, adding all deposits and credits, and subtracting all withdrawals and debits.

Thoroughly reviews your financial transactions, enabling you to quickly evaluate your spending patterns and overall financial well-being during a specified period.

Transaction Details Explored

- Deposits and Credits

These entries mark all monetary additions to your account, including salary deposits, interest credits, and other deposits.

- Withdrawals and Debits

A mirror to deposits and credits, these deductions range from bill payments to ATM withdrawals and checks issued.

- Check Numbers and Payment References

For tracking and verification, the bank includes check numbers and payment references.

Understanding Overdraft Protection Details

Overdraft protection is a service financial institutions provide to prevent checks, ATM withdrawals, and debit card transactions from bouncing when you do not have enough funds in your account. Though highly beneficial, this feature comes with its intricacies and potential costs.

What is Overdraft Protection?

Overdraft protection is a line of credit attached to your checking account. As the Federal Reserve explains, if you make a transaction that exceeds the amount in your checking account, the bank will cover the difference, thus preventing the transaction from being declined or a check from bouncing.

Details on a Bank Statement

Details related to your overdraft protection can typically be found in a separate section on your bank statement. This information would usually include:

- Overdraft limit: The maximum amount the bank allows you to overdraw from your account.

- Overdraft amount: The amount you have used from your overdraft limit during the statement period.

- Overdraft fees: Any charges or interest incurred from using the overdraft protection service.

Costs and Fees

While overdraft protection provides the convenience of covering transactions when funds are low, it is crucial to remember that it is not a free service. The Consumer Financial Protection Bureau (CFPB) states that banks may charge a fee for each transaction that overdraws an account or impose interest on the overdraft amount.

Hence, it is vital to understand these fees to avoid unexpected charges.

Should You opt for Overdraft Protection?

Whether overdraft protection is suitable depends on individual financial habits and needs. For those who occasionally overdraw their account, overdraft protection could be useful to avoid bounced checks and declined transactions. However, the costs associated with the service should be considered, as they can add up quickly.

Additional Information on a Bank Statement

Additional information may be included beyond the primary components of a bank statement. These could pertain to interest earned, fees charged, or even year-to-date information. Including these sections depends on the bank, the type of account, and the particular services the account holder avails.

Interest Earned

For interest-bearing accounts, such as savings or interest-checking accounts, banks typically include a section in the statement that details the interest earned for the statement period. It would encompass the interest rate applied and the total interest accrued. The American Bankers Association (ABA) outlines that this component is essential for customers to understand the growth of their funds due to the interest applied by the bank.

Fees Charged

Banks usually have a schedule of fees for various services, including monthly maintenance, ATM, or overdraft fees. A comprehensive list of fees applied during the statement period is often included in the bank statement. According to the Office of the Comptroller of the Currency (OCC), customers must be aware of these fees as they can significantly impact the account balance over time.

Year-to-Date Information

This section summarizes all credits and debits in the account since the beginning of the year. The Consumer Financial Protection Bureau (CFPB) notes that this can help customers track their annual spending habits and understand their overall financial standing for the year.

This additional information in a bank statement gives an account holder a more comprehensive understanding of their financial status and aids in making more informed financial decisions.

Different Formats of Bank Statements

In the dynamic banking world, customers can access their bank statements in various formats based on their preferences and convenience. These formats can be categorized into two types: paper statements and electronic statements. Both formats contain the same crucial information; however, their delivery and access methods differ.

Paper Statement

A traditional method, paper bank statements are physical documents printed and mailed to customers by their financial institutions, typically monthly. These hardcopy statements provide an official record of the account activities and can be manually filed and stored by the account holders.

According to the Consumer Financial Protection Bureau (CFPB), paper statements are often preferred by those who find it easier to review financial information in a tangible format.

Electronic Statement (e-Statement)

With technological advancement, banks now provide the option of electronic statements or e-statements. An e-statement is the digital equivalent of a paper statement, accessed and viewed online via the bank’s website or mobile app.

The Federal Reserve Bank of Philadelphia explains that e-statements provide the same information as a paper statement in a digitized format that can be accessed anytime and anywhere. E-statements are environmentally friendly, eliminate the risk of mail theft, and typically arrive faster than paper statements.

The choice between paper and electronic statements depends on the account holder’s comfort with technology, personal preferences, and the need for convenience. Regardless of the format, it is important to regularly review bank statements to monitor account activities and maintain financial health.

Importance of Bank Statements

Bank statements are essential in individuals’ and businesses’ financial management toolkits. They hold significant value for many reasons, ranging from financial tracking to proving one’s financial stability.

Financial Tracking and Management

Bank statements offer a comprehensive view of all transactions in an account for a specific period. According to the Consumer Financial Protection Bureau (CFPB), regularly reviewing bank statements enables account holders to track their spending, manage their budget, and spot any unusual transactions or discrepancies. It aids in maintaining financial health and making informed financial decisions.

Identification of Fraudulent Activities

Regularly reviewing bank statements can often notice fraudulent activities, such as unauthorized withdrawals or transactions. The Federal Trade Commission (FTC) emphasizes that quick detection and reporting of such activities can limit the financial impact and aid in quicker resolution.

Proof of Income and Expenses

Bank statements often serve as proof of income and expenses in various scenarios. They may be required when applying for loans, renting property, or filing taxes. Banks typically maintain a record of these documents, making them a reliable source for this information.

Reconciliation of Accounts

For businesses, bank statements are vital for the reconciliation of accounts. This process involves comparing the company’s internal records with the bank statement to ensure accuracy and identify discrepancies.

A bank statement is more than just a piece of paper or a digital document; it is crucial to maintaining financial well-being and stability.

Privacy and Bank Statements

Bank statements, carrying a wealth of personal and financial information, are documents of high sensitivity. The privacy of these statements is paramount to preventing identity theft and financial fraud. Therefore, it is crucial to understand how to protect this information and what your bank does to ensure your data’s security.

Account Safety

Bank statements contain detailed information about your financial transactions, including your account number, transaction locations, and sometimes even your contact details.

To ensure information safety, store your paper bank statements in a secure location and dispose of them appropriately, preferably by shredding them. For electronic statements, you should use secure and private internet connections to access them and keep your computer and mobile devices’ security software up to date.

Personal Information Protection

To protect your personal information, banks adopt stringent security measures in line with state and federal regulations. These include data encryption for online banking, secure login procedures, automatic logout from online sessions, and regular system audits.

Banks are also required by the Gramm-Leach-Bliley Act to provide privacy notices to their customers, explaining what personal information they collect, why they collect it, and how they protect it. As a consumer, you can opt-out if you do not want your information shared with certain third parties.

Banks take significant steps to protect your data, and it is essential to be proactive in securing your bank statements and safeguarding your financial health.

Bank Statement Errors

Despite rigorous processes and automated systems, bank statements can be corrected. These could be human error, system glitches, or even fraudulent activity. As a consumer, understanding how to identify and address these errors is key to maintaining your financial health.

How to Spot Them

Errors can manifest in various forms on a bank statement. These might include incorrect charges, unrecognized transactions, double charges, missing deposits, computational mistakes in your account balance, or even discrepancies in your personal information.

A regular and thorough review of your bank statement is the first step in spotting these errors. As the Federal Trade Commission (FTC) suggested, you should compare your bank statement with your financial records and receipts to ensure consistency and accuracy.

How to Resolve Them

Upon identifying an error, the first step is to contact your bank immediately. The sooner the bank is made aware of the issue, the quicker it can address and rectify it.

The process of resolution usually involves submitting a detailed claim about the error. This would include information about the nature of the error, transaction details, and any other pertinent information.

The Consumer Financial Protection Bureau (CFPB) stipulates that banks are typically required to investigate and resolve these issues within ten business days for electronic transaction errors or 30 days for other errors. If the bank needs more time, it must re-credit the disputed amount into the account until the investigation is completed.

Understanding how to spot and address errors on your bank statement is crucial in ensuring financial health and protecting resources.

Conclusion

What Does a Bank Statement Look Like – A bank statement, while seemingly ordinary, plays an essential role in personal and business financial management. Serving as an official record of financial activities, it helps account holders navigate their financial transactions and balances, thus aiding in effective money management.

Bank statements contain several key elements, including an account summary that provides an overview of financial activity and transaction details. It offers insight into deposits, withdrawals, and applicable fees or interest. In addition, information on overdraft protection provides account holders with details of this service, highlighting its benefits and potential costs.

In the digital era, bank statements come in paper and electronic formats. While they contain the same crucial information, choosing between these two is often a matter of personal preference and comfort with technology. Regardless of the format, regularly reviewing your bank statement cannot be overstated. It helps in financial tracking and management, identification of fraudulent activities, proof of income and expenses, and reconciliation of accounts in the case of businesses.

Despite the robust processes in place, bank statements can sometimes contain errors. Therefore, knowing how to spot and address these errors is important to maintaining financial health. On the other hand, given the wealth of personal and financial information they contain, the privacy of bank statements is paramount, and efforts must be made to protect this information to prevent identity theft and financial fraud.

Bank statements are vital financial tools. They help guide account holders through their financial transactions and balances, enable effective money management, and contribute significantly to maintaining financial well-being. Therefore, a thorough understanding of bank statements, their elements, and how to use them effectively is an important aspect of personal and business finance.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.