Example of credit card authorization forms – The terms of credit card authorization must be familiar to credit card owners. It is a document sheet signed by the owner to find permission from the merchant to charge the credit card. Besides, it is also important for other necessities like a business. Sure, the merchants may provide the form for the customers. However, the merchant can permit the cardholders to create the credit card authorization forms themselves. Of course, it is with some requirements that cover some important points. Let’s learn more about it!

Benefits credit card authorization form

You may wonder whether using the form template is legal for this activity. You should not worry; it is legal as long as the related merchant doesn’t require you to use the form directly from the office. There are ready-to-use templates that make this job easy. Let’s see why these templates are so helpful:

- Saves Time: Making a form can take ages! But with a ready form, fill in the blanks. It’s super quick!

- Looks Professional: These forms look neat. When people see them, they’ll think you’re very organized.

- Easy on the Pocket: Getting someone to make a form can cost money. But many templates are free or cost very little.

- Make It Yours: Want to add your logo or some special words? No problem! These forms let you do that.

- Fewer Mistakes: Starting from zero means you need to remember something. Templates have all the important stuff already.

- Many Choices: There are lots of different templates. So you can pick the one that fits your needs best.

- Go Digital: Many forms work on computers too! It means you don’t always need to print them.

- Follow the Rules: These forms are made to ensure you don’t break any rules.

- Learn Easily: Not sure about credit card stuff? These forms can help you understand better.

- Stay Safe: These templates ensure you only ask for what’s needed. It keeps everyone’s information safe.

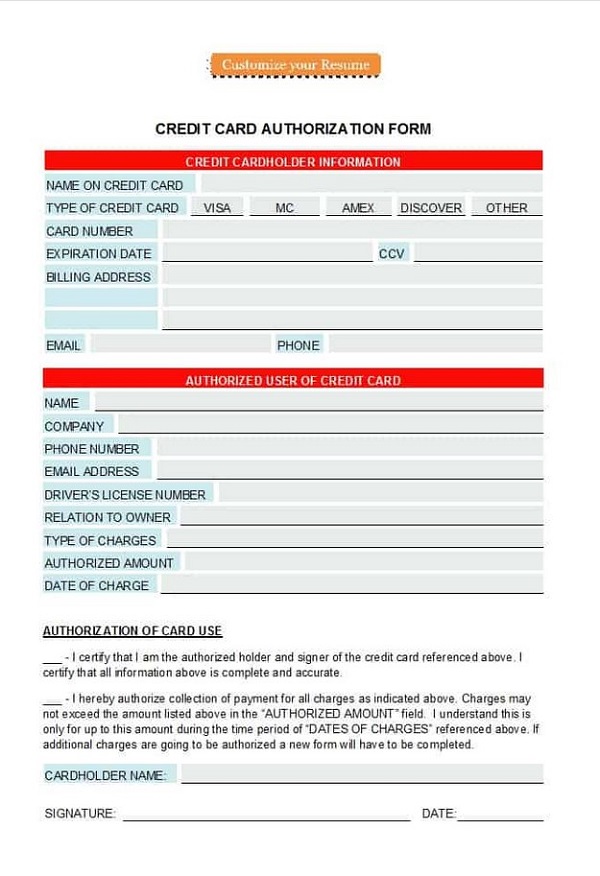

Parts of a Credit Card Authorization Form Template

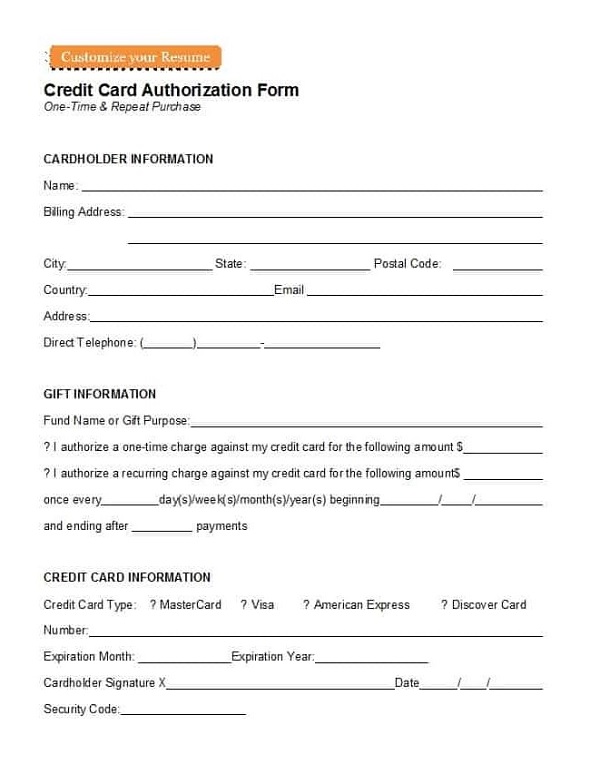

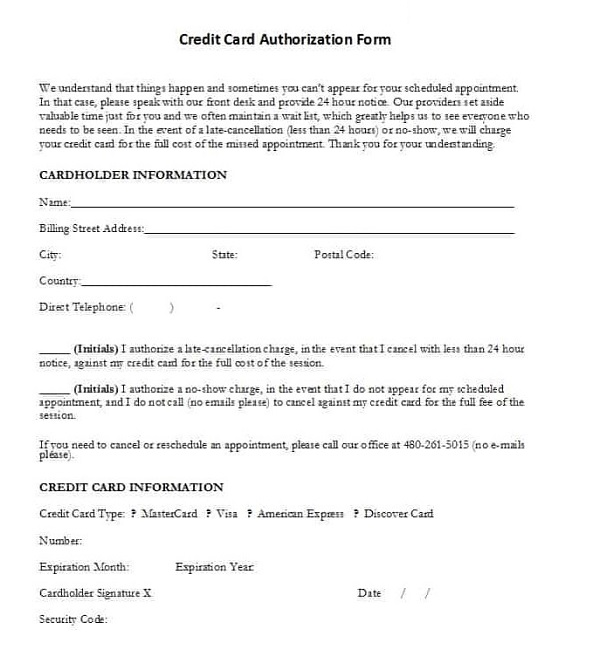

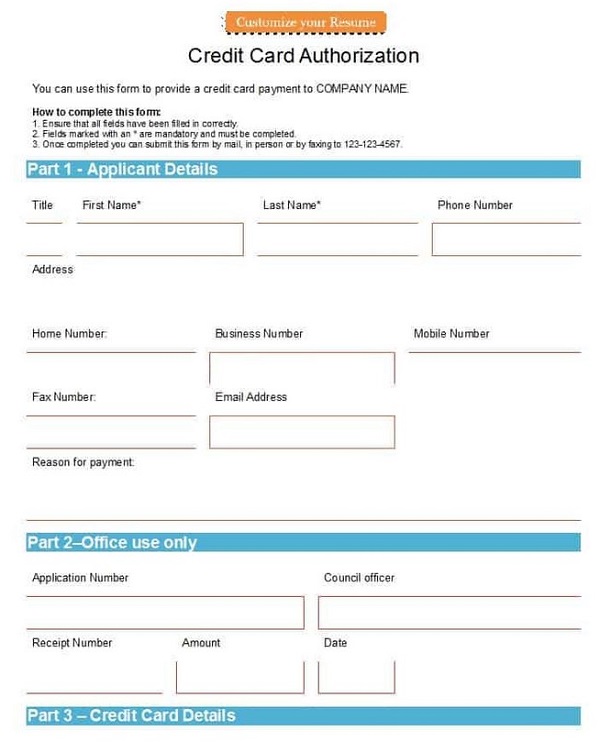

When you see a credit card authorization form template, you’ll notice it’s split into different sections. Each section has a unique job. Let’s explore the common parts of this form:

- Header: This is the top part. It usually has the name of the business or company and sometimes its logo. It tells you who the form is from.

- Personal Details: Here, you write your name, address, and other contact details like phone number and email. It helps the company know who is giving the permission.

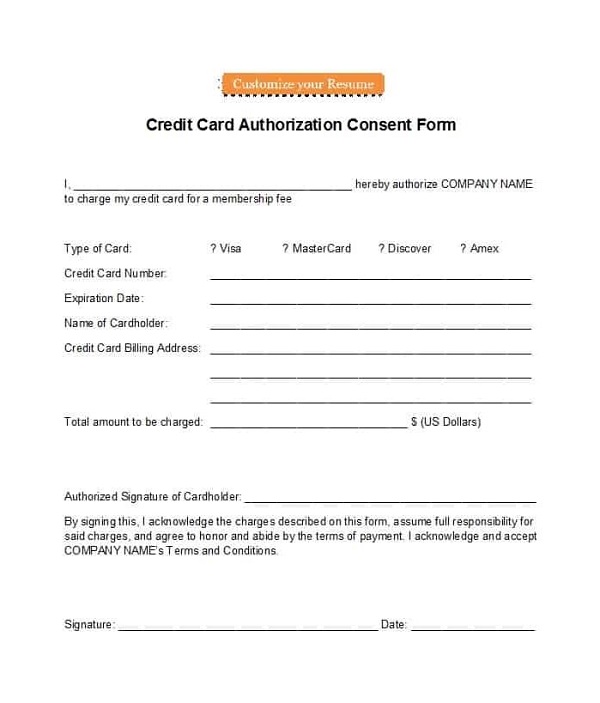

- Credit Card Information: This is where the main details go. You fill in your credit card number, the expiration date, and that special CVV code (the 3 or 4-digit number on the back).

- Transaction Details: This section explains what the charge is for. It might list things like product names, amounts, or dates.

- Authorization Type: This tells the company how often they can charge the card. It could be once, every month, or some other way.

- Terms and Conditions: This is the rule book! It explains how the form works and what the company promises to do (and not do).

- Signature Line: At the bottom, there’s a place for you to sign. You say, “Yes, I agree to all of this.”

- Date Line: There’s a spot for the date next to or below the signature. It helps everyone remember when you said “yes.”

- Footer: Sometimes, at the very bottom, there’s more information. It might be the company’s address, website, or phone number.

- Special Notes or Instructions: Some forms have an extra section for any special details or things you want to mention.

Bonus – Security Features: Some fancy forms might have watermarks or special colors. It is to make sure no one makes fake forms.

A credit card authorization form template is like a puzzle. Each piece has its place and job. When they all come together, they make a clear picture of what you and the company agree to!

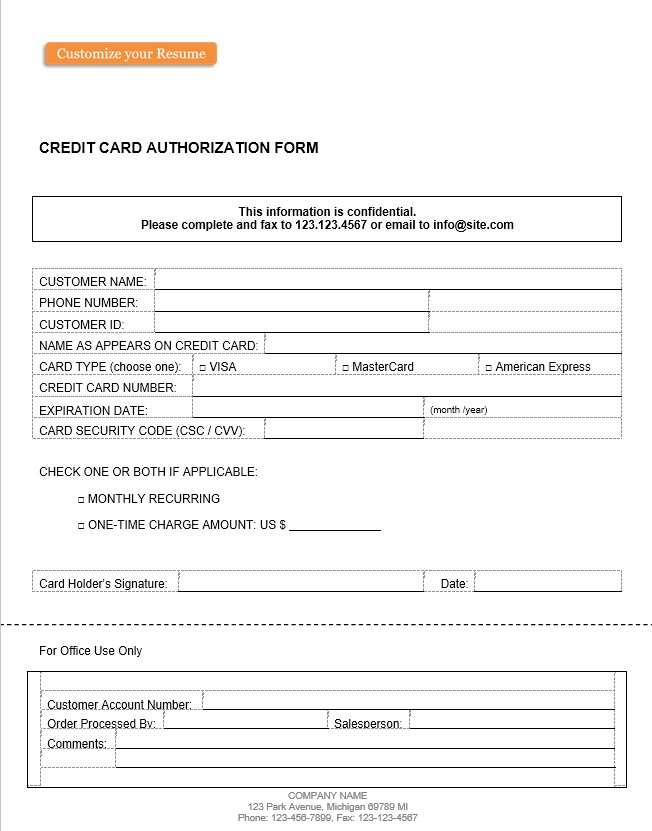

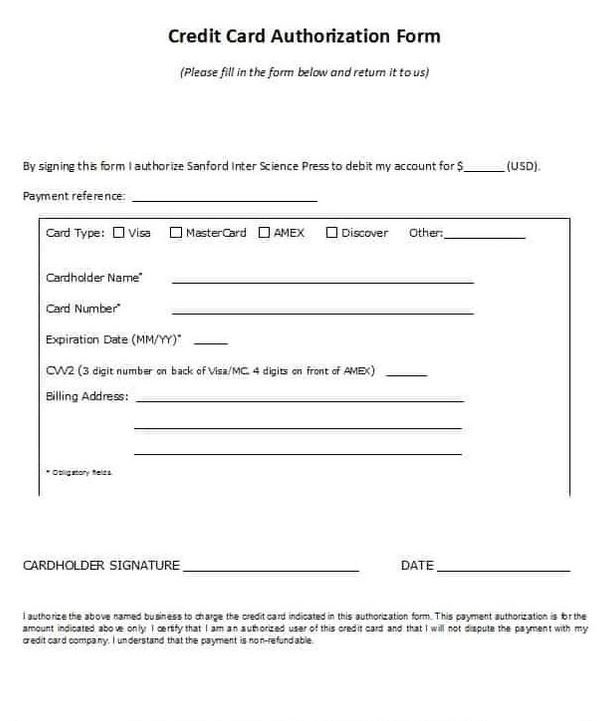

Credit Card Authorization Forms

Credit Card Authorization Template USCIS

is for the U.S. Citizenship and Immigration Services (USCIS). People use it to pay for visa applications, green cards, and other services with a credit card.

Credit Card Authorization Form Canada

A general form used in Canada for businesses that need to charge a client’s credit card. It’s handy for many different services.

This form is for a single charge. Businesses use it when they need to charge a credit card just once, only a few times.

Steps to Complete and Legalize the Form

Handling a credit card authorization form might sound tricky, but with the right steps, it’s pretty simple! Here’s a step-by-step guide to help you complete and submit the form.

1. Gather All Necessary Info: Before starting, make sure you have all the needed details. It includes your credit card, personal details, and any information about the transaction (like the amount or the reason for the charge).

2. Start with Personal Details: Fill in your name, address, and other contact info in the spaces. Make sure to write so it’s easy to read.

3. Enter Credit Card Information: Carefully write down your credit card number, expiration date, and CVV code. Double-check to avoid mistakes.

4. Fill in Transaction Details: This section might ask about what you’re buying or how much you’re paying. Fill in the correct details.

5. Choose the Authorization Type: Mark the right box to tell the company how often they can charge your card. Is it a one-time thing? Or every month?

6. Read the Terms and Conditions: This part is super important. It tells you all the rules. Read it carefully to know what you’re agreeing to.

7. Sign and Date: Once everything is correct, sign your name at the bottom. It is like shaking hands on a promise. Also, write down the date.

8. Submit the Form: Now, give the form to the company or merchant. It could mean mailing it, giving it in person, or sending it online.

9. Wait and Watch: The company will check everything after you hand in the form. They might call or message you to say “okay” or ask questions.

10. Keep a Copy: Always keep a copy of the form for yourself. It’s like a receipt to remember what you agreed to.

Filling out a credit card authorization form is like following a recipe. If you do each step in order, everything will turn out great! After you’re done, the company will ensure everything is okay and the deal is complete.

Why Businesses and People Need Credit Card Forms

When a business wants to charge someone’s credit card, they need permission. It is where the credit card form comes in. It’s like a pinky promise between the store and the person buying something.

For Businesses:

- Stay Safe: This form proves that the person said, “Yes, you can charge my card.” It helps stores stay safe from any problems later.

- Easy Payments: If a person shops there often, the store doesn’t need to ask for card details every time. It makes things faster!

- Money Comes In Regularly: Stores know they’ll get their money, especially if they charge the card more than once.

- People Trust Them More: When people see stores doing things correctly, they feel more comfortable shopping there.

For People Using Their Cards:

- No Surprise Charges: Stores can’t just take any money they want. The form tells them how much.

- A Paper Promise: If someone needs to remember what they paid for, they can review the form.

- Super Simple: People don’t need to keep giving their card details for things they buy often.

- Know What’s Happening: The form reminds people what they agreed to pay.

Different Types of Credit Card Authorization Form Templates

Credit card authorization forms are super handy for businesses. They’re like special keys that let you charge a customer’s credit card. But guess what? There isn’t just one key that fits all locks. Different situations need different types of keys or, in this case, templates. Let’s look at some of the main types of credit card authorization form templates:

1. Standard Credit or Debit Cards Template

- What is it? It is your basic, everyday kind of form. It’s like a comfy T-shirt you can wear anywhere.

- Best For: All kinds of businesses. It’s universal and can be used for various purchases.

- What’s Special: It’s simple. No frills, no fuss.

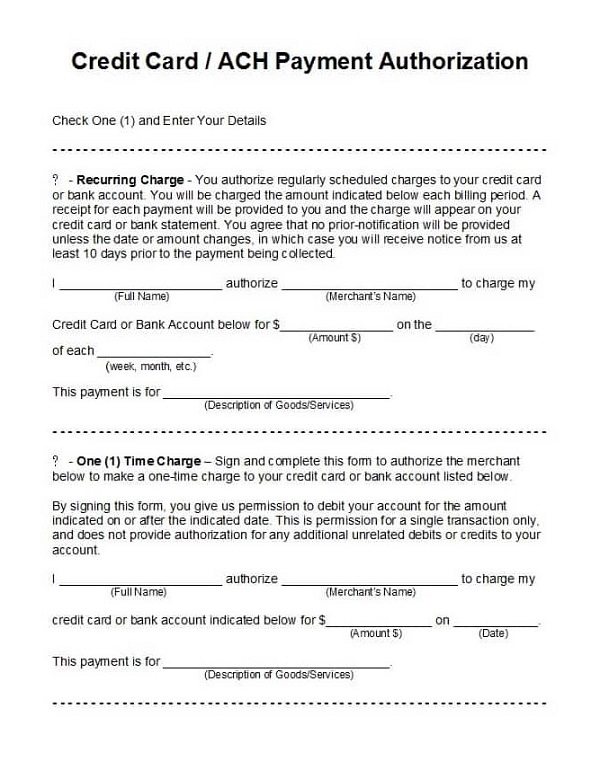

2. Recurring Payment Template

- What is it? It is like a calendar reminder for payments. It’s for when customers get charged regularly.

- Best For Businesses that charge customers repeatedly, like monthly subscriptions.

- What’s Special: It details how often and how much a customer will be charged.

3. Blank Form Template

- What is it? Think of this as a blank canvas. You can paint whatever you want on it!

- Best For Businesses that have many different payment situations.

- What’s Special: Super flexible! You can add or remove info to suit the payment.

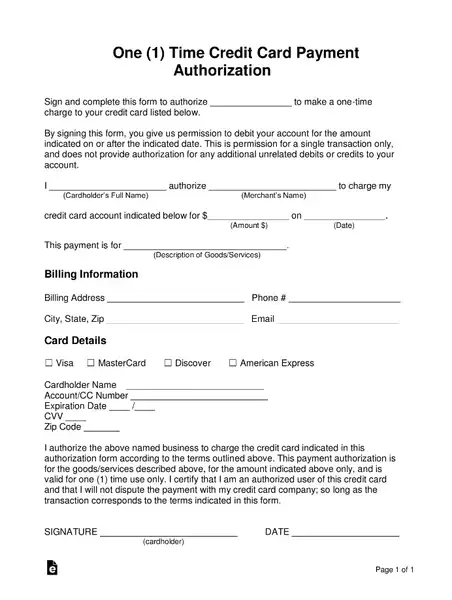

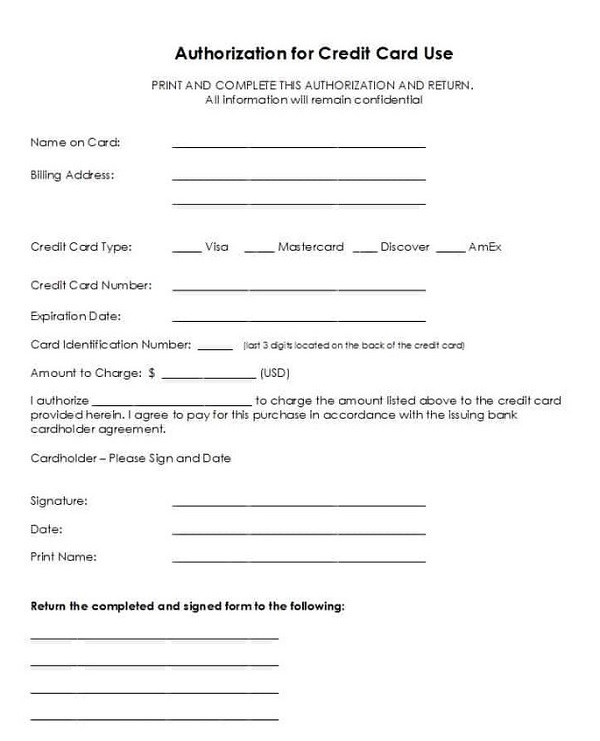

4. One-Time Payment Template

- What is it? It is like a single-use coupon. Use it once, and it’s done.

- Best For Businesses with customers who pay just once for a product or service.

- What’s Special: It’s simple because it’s only for one transaction.

5. Authorization and Consent Template

- What is it? It is like asking for a special permission slip.

- Best For: When you want to ensure customers know they’re getting charged.

- What’s Special: It ensures customers are 100% okay with the charge.

No matter which template you pick, remember: It’s important to have all the needed info on it. That way, both you and your customer know what’s happening. And with the right form, making payments is smooth and easy for everyone!

When to Use a Credit Card Form?

When to use a credit card form? Here are some times when it’s a good idea:

Recurring Payments:

- Subscription Services: Do you offer monthly magazines, streaming music, or a gym membership? If you charge your customers every month, you need their permission. This form helps with that.

- Paying Bit by Bit: Some customers might want to buy something expensive but pay a little at a time. This form lets you charge their card for each payment.

- No Surprises: When customers sign this form, they know you’ll charge them in the future. It means fewer problems for you.

Big Purchases:

Buying something pricey? This form can help:

- Proof: If a customer buys something expensive, this form shows they said it was okay to charge their card.

- Trust: Customers will feel better knowing you’ll only charge what you agreed.

- Payments Over Time: This form lets you charge the rest later if a customer pays some now and some.

Buying Over the Phone or Online:

Sometimes, customers buy things without being in the store:

- Not in Person: If someone orders on the phone or online, they can’t enter their card PIN or sign a paper. This form is like their online signature.

- Protection: This form helps ensure customers can’t say they didn’t allow the purchase.

- Quick and Easy: For businesses selling a lot online or on the phone, this form makes things simple for everyone.

Common Mistakes to Avoid

Everyone makes mistakes. But when it comes to money, it’s better to be careful. When filling out or making a credit card form, here are some mistakes people often make:

- Not Enough Details: Sometimes, people must fill out all the sections in the form. It can confuse later on. Always make sure to complete every part.

- Wrong Card Information: Mixing up numbers or misspelling names is easy. Always double-check card details like the card number, expiry date, and cardholder’s name.

- Forgetting the Date: Dates are important. They tell when the form was filled out. Always remember to write the current date.

- Missing Signatures: The signature is like a promise. With it, the form might be valid. Always sign where needed.

- Not Reading the Terms: The form might have small print or terms. It’s always good to read everything before signing.

- Using Outdated Forms: Sometimes, forms change. Always make sure to use the latest version of the form.

- Not Keeping a Copy: It’s smart to keep a copy of the form for yourself. This way, you can look back at it if needed.

- Not Checking for Expiry: Credit cards have an end date. Make sure the card is valid.

- Forgetting to Update: You must update the form if a card’s details change (like if you get a new card).

- Not Checking Amounts: Always make sure the amount of money on the form is correct. You want to be charged only a little.

These forms deal with money. It’s always best to take extra time to check and ensure everything is right.

Tips for Using the Template

Using a credit card form is helpful, but you’ve got to do it right. Here are some tips to make sure things go smoothly:

- Details, Details:

- Every Bit Counts: Don’t leave anything blank when completing the form. Write down everything, like the customer’s full name, the numbers on their card, how much they’re paying, and more.

- Double-Check: After writing, look over the form again. Make sure all the details are correct.

- Stay Updated:

- Changing Times: Rules about credit cards can change. Laws might be different next year or even next month!

- Stay in the Know: Every once in a while, look up the latest rules. Make sure your form is still good to use.

- Keep It Safe:

- Top Secret: These forms are private, like a customer’s card number. You would want that info to be recovered and recovered.

- Lock It Up: Store the forms in a safe play in a locked cabinet or a secure computer.

- Clear Language:

- Easy to Read: When customers look at the form, they should get it immediately. Use simple words and clear sentences.

- No Confusion: Make sure everything on the form is straightforward. You want customers to understand what they agree to.

Where to Find Credit Card Authorization Form Templates

Finding the right credit card authorization form is easier. The internet is packed with options! Here’s where you can look and some advice on picking the best one for you:

- Online Template Libraries:

- What They Are: These websites are filled with templates for all sorts of things, including credit card forms.

- Why They’re Cool: You can often download templates for free or for a small fee. Plus, there’s a lot to choose from.

- Business Software Websites:

- What They Are: Sites that offer software for businesses sometimes have templates too.

- Why They’re Cool: These templates are often very professional-looking and may come with tools to help you fill them out.

- Merchant Services Providers:

- What They Are: Companies that help businesses handle credit card payments.

- Why They’re Cool: Their templates are made just for this purpose. They know the ins and outs of credit card payments.

- Official Banking Websites:

- What They Are: The websites of big banks and credit card companies.

- Why They’re Cool: They’re super trustworthy and often offer easy-to-use and easy-to-understand forms.

Editable credit card authorization form: Customization to Fit Specific Needs

However, each merchant may have a special logo or some specific points that others may not have. So, what is to do? You should not worry since the template can be easily edited. As long as you know the specific points or characteristics of the merchant, editing it is not impossible. Some sites even provide templates based on the merchants’ brands. Of course, it eases you more in finding one that suits you.

So, after editing and data submission, what are the things to do to legalize the form? Like the other forms, you may need to sign it and bring it to the merchant’s customer service for further treatment. Next, the credit card authorization process can be done as it should be.

Your business is unique, so your forms should be, too! That’s where editable templates come in:

Why Editable is Awesome:

- Your Brand, Your Way: Add your logo, colors, and anything else that screams “you.”

- Every Merchant is Different: There’s something special about your form that others don’t. With an editable template, you can add it in.

Making Changes:

- Simple Tweaks: Use basic tools on your computer or software to change text and colors.

- Bigger Edits: Some online platforms let you drag and drop different parts of the form to rearrange them.

Before You Finish:

- Check Everything: Make sure all the important bits are there, like spaces for card numbers and signatures.

- Ask a Friend: Sometimes, a fresh pair of eyes will catch something you missed. Have someone else look over your form before you start using it.

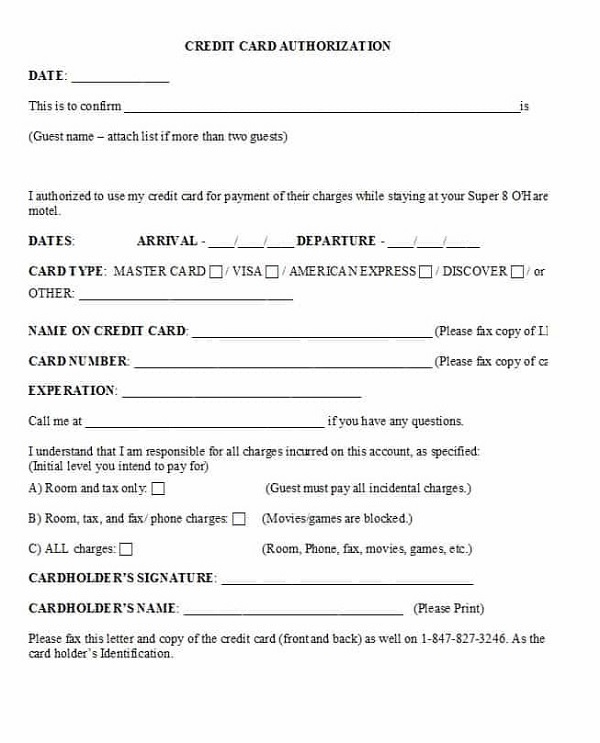

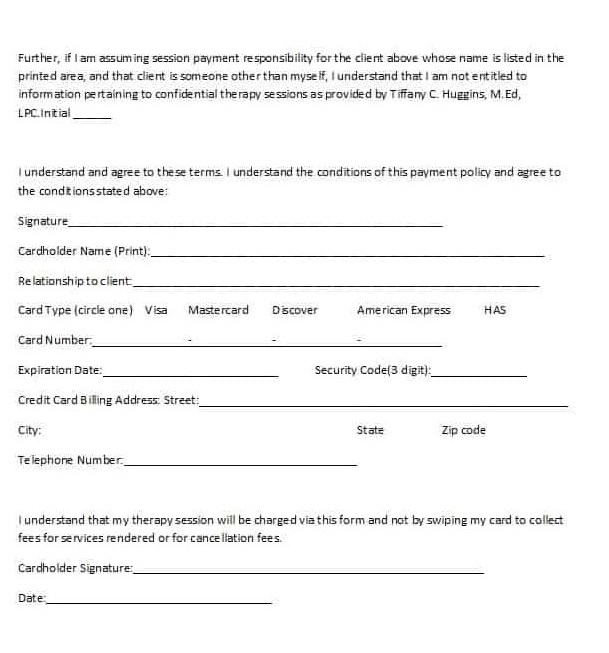

Example of Credit Card Authorization Forms

Tips to Remember When Using a Credit Card Authorization Template

Using credit card authorization forms is smart. It helps keep your business safe. But you need to use them the right way. Here are some easy-to-follow tips:

- Keep Customer Data Safe:

- No Storing Security Codes: Don’t keep the customer’s security code after a transaction. It is a big no-no.

- Beware of Identity Theft: Always protect your customers’ sensitive info. If not, your business might face big troubles.

- Communicate with Your Customer:

- Send Sales Invoices: After a sale, email your customer. It should have your business details and what they bought. It includes how many, what kind, and the cost.

- Include Policies: Always tell your customers about your refund and cancel rules.

- Don’t Use Faxes for Payments:

- Go Online: Ask your customers to pay on a safe online page. This page should have spaces for all the customer’s details.

- Use Checkboxes: Add a box on the form. Customers can say they got the form and agree to your sale terms.

- Handle Different Addresses Carefully:

- Double-Check Addresses: Sometimes, a customer’s billing and shipping addresses differ. If so, get a paper from the customer. It should say they’re okay with shipping to a different place.

- Use Email for Proof: Instead of fax, get an email from your customer. They can say they got your form and share an okay code.

- Always Have Written Proof:

- If anything goes wrong, you’ll need proof. Keep all papers and emails safe. This way, you can show them if you have to go to court. Always having everything in writing is key.

Using these tips will help keep your business and your customers safe. Always be careful and think of safety first!

Hotel Credit Card Authorization Templates

Unfortunately, you may not have enough time to create the forms yourself. For this matter, the template of the form is necessary to have. Interestingly, there are now some sites out there that provide templates for various necessities. One of them is the credit card authorization form template. This way, you can put less effort into making the entire form yourself. All you need to do is submit your data to it. Meanwhile, the form template is available for many merchants.

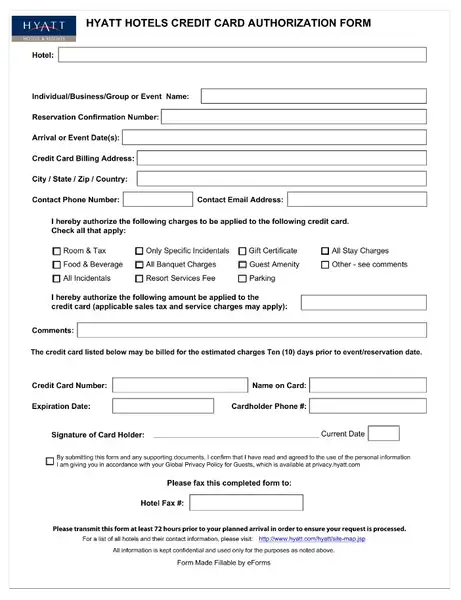

Hyatt Credit Card Authorization Template

A form used by Hyatt Hotels to let guests charge payments to their credit cards. It’s handy for reserving rooms and other services at their hotels.

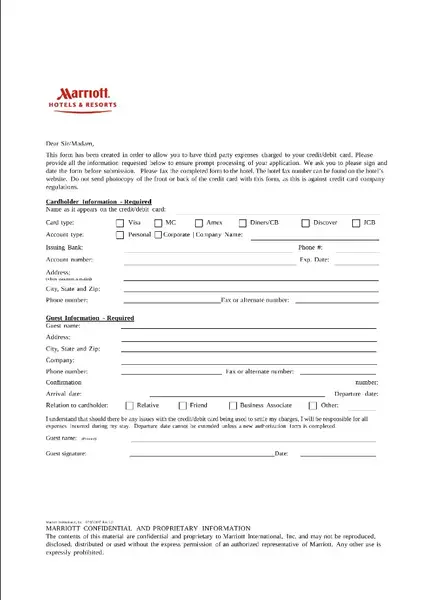

Marriott Credit Card Authorization Template

This template is for the Marriott chain of hotels. Guests fill it out to allow the hotel to charge their card for room bookings and other amenities.

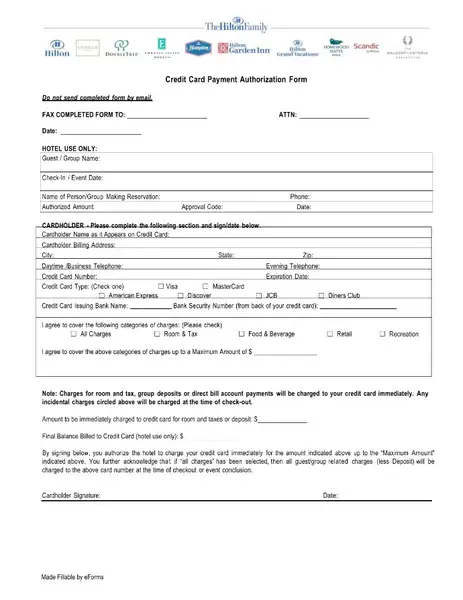

Hotel Hilton Credit Card Authorization Template

A specific form for Hilton Hotels. It lets guests use their credit cards for stays, meals, and other hotel services.

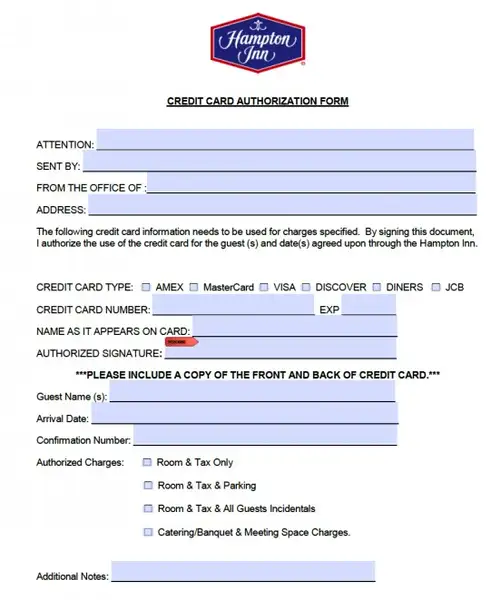

Hampton INN Credit Card Authorization Template

Hampton Inn uses this form. It’s for guests who want to pay for their stay or other services using a credit card.

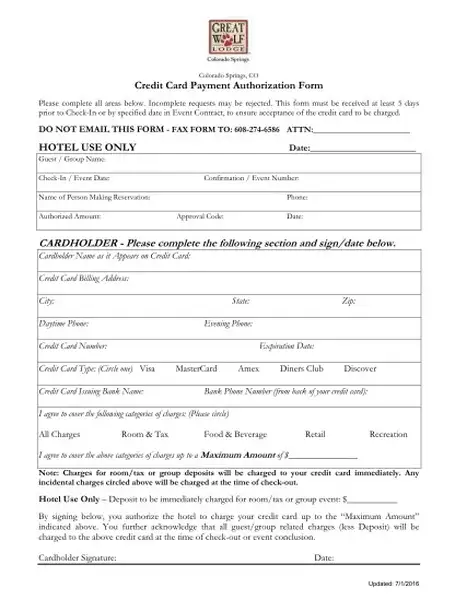

Great Wolf Lodge Credit Card Authorization Template

is for guests at the Great Wolf Lodge. The form lets the resort charge a guest’s credit card for room bookings, activities, etc.

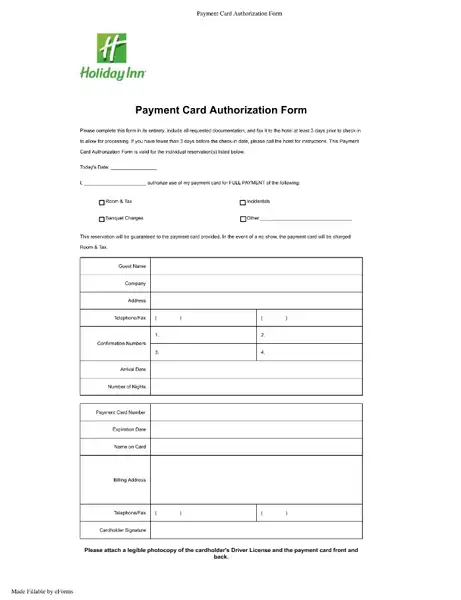

Holiday INN Credit Card Authorization Form

Used by the Holiday Inn hotel chain. It allows guests to pay for their bookings, meals, and other services with a credit card.

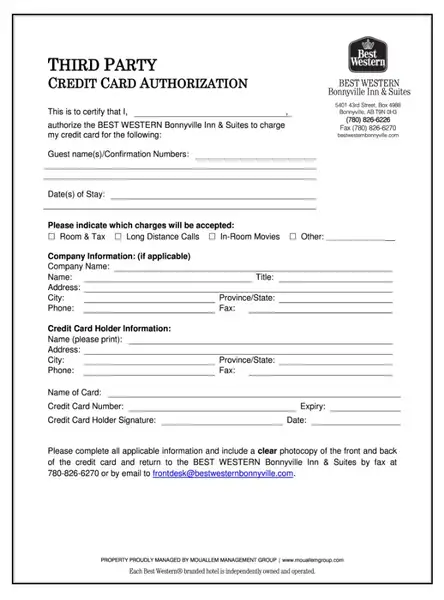

Western Credit Card Authorization Form

A general template often used by businesses in the Western region. It’s for charging credit cards for various services or products.

Each of these templates helps businesses and customers. They make sure everyone agrees on charges to credit cards. Always read them well before signing!

FAQs About Credit Card Authorization Forms Template

What is a Credit Card Authorization Template?

A credit card authorization template is a form. It allows a business to charge a customer’s credit card. The customer permits by signing this form.

Why do businesses use these templates?

Businesses use these forms to make sure they can get paid. It proves the customer said, “Yes, you can charge my card.”

Can I create a template for my business?

Yes, you can make your own. However, many businesses use standard forms. These are forms that many people and businesses accept and trust.

Is it safe to use a Credit Card Authorization Template?

Yes, if used correctly. Always keep customer information safe. Don’t keep security codes after a sale. And make sure you use secure methods for customers to give you their information.

How long should I keep a filled-out form?

You should keep the form for as long as your business needs it. It’s good to have proof of a sale. But always remember to keep the form in a safe place.

Can I charge a customer’s card without this form?

No, it’s not a good idea. With the form, you have proof that the customer said it was okay. It can lead to problems later.

What should I do if a customer wants to avoid filling out the form?

Talk to the customer. Explain why the form is important. If they still say no, think about other ways to get paid.

Do online businesses also need these templates?

Yes, online businesses often use digital versions of these forms. Customers click a box to say they agree.

How often should I update my template?

Check every once in a while to make sure your form is still okay. Credit card rules can change. It’s good to make sure your form still follows all the rules.

Can I use one form for many sales to the same customer?

Some forms are for just one sale. Others are for many sales over time. Read the form to see which type it is.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.