Did you find a mistake on your credit report? It could make it harder to get a good loan. Don’t worry! A credit dispute letter is how you fix it. Get a credit dispute letter example, learn how to do it, and protect your money future!

What is a Credit Dispute Letter?

It’s a special letter you send to a credit bureau (like Equifax, Experian, or TransUnion) when your credit report has a mistake. Think of it like raising your hand in class and saying, “Wait! That’s not right!”

When Do You Need a Dispute Letter?

Think of a credit dispute letter as a way to say, “Hey, that’s wrong!” Here’s when to use it:

- Wrong Name, Address, etc.: Is your name spelled wrong? Is an old address listed? These details matter!

- Someone Else’s Stuff: Do you see accounts you never opened? This could be a mix-up or a sign of identity theft.

- Wrong Payment Info: Did you pay on time, but it says you were late?

- Closed Accounts Showing Open: Did you close an account, but it still looks active?

- Same Debt Listed Twice: This makes it look like you owe more than you do.

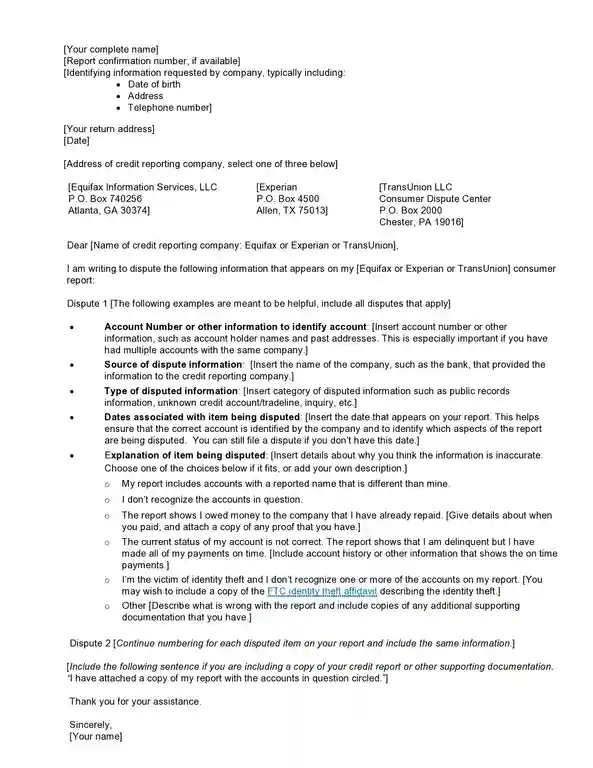

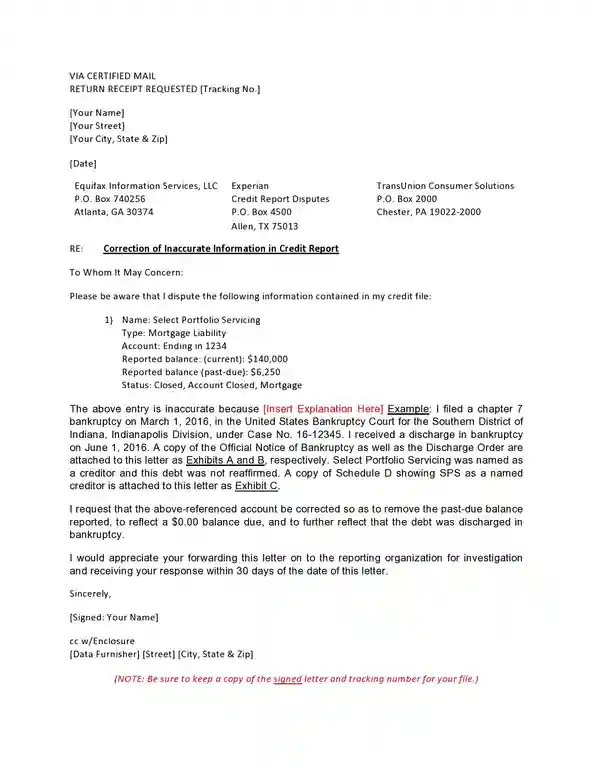

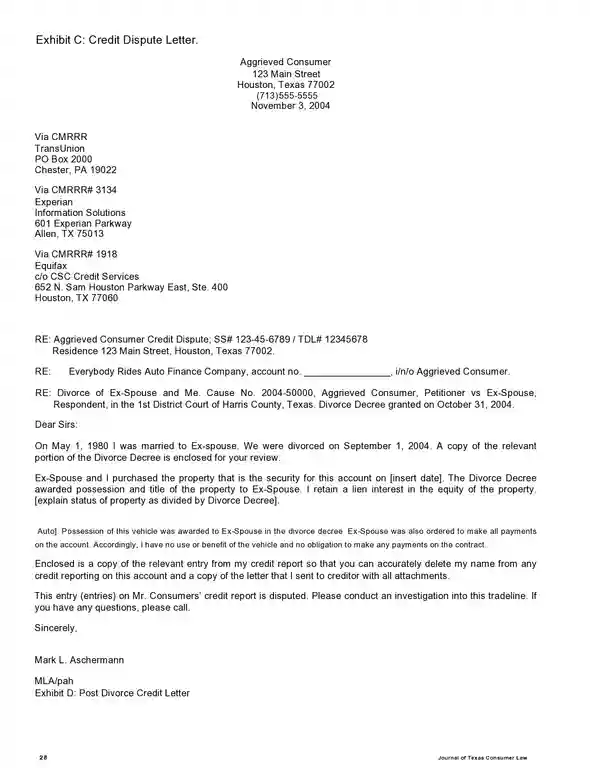

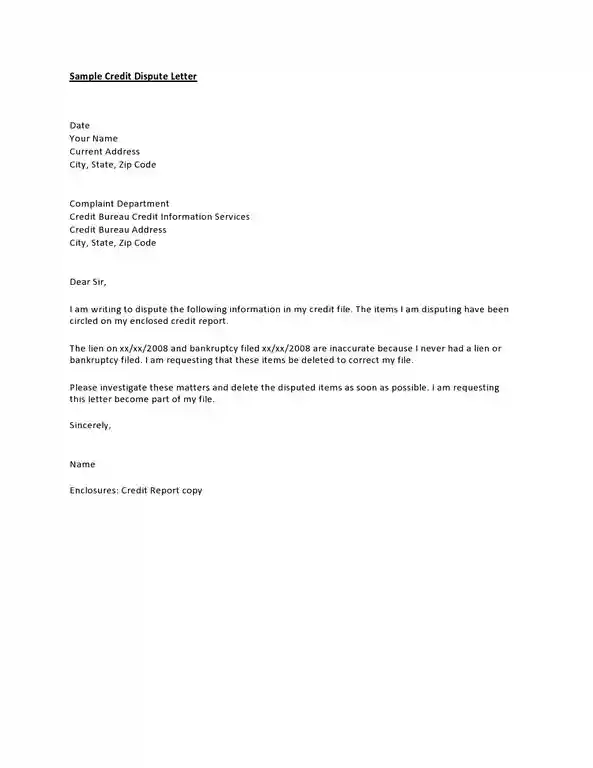

What to Include in Your Credit Dispute Letter Example

It sounds fancy, but it’s just a clear letter. Here’s what to include:

- Your Info: Name, address, phone number, and Social Security number.

- Date: When you’re sending the letter.

- Credit Bureau’s Info: Find this on their website or your credit report.

- The Mistake: Be specific! Account number, what’s wrong, and why it’s wrong.

- Ask for a Fix: Do you want it deleted or changed? Say so.

- Your Rights: Remind them you’re protected by the Fair Credit Reporting Act.

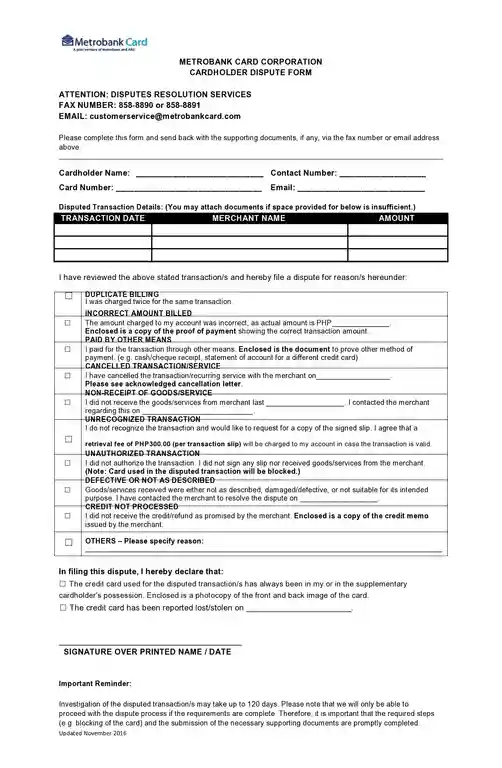

What Kind of Documentation Should You Include with Your Dispute Letter?

The best supporting documentation depends on the specific error you’re disputing. Here’s a breakdown of common scenarios and the types of documents to include:

Incorrect Payment History:

- Bills or statements showing timely payments

- Cancelled checks or bank statements as proof of payment

Incorrect Account Balance:

- Most recent account statement showing the correct balance

Account Doesn’t Belong to You:

- Identity theft affidavit (get this from the police if fraud is involved)

- Correspondence from the company confirming it isn’t your account

Account Listed as Open When Closed:

- Account closure letter or confirmation from the company

Duplicate Debt Listings

- Highlight both entries on your credit report and provide statements showing it’s the same debt.

Important Notes:

- Copies, Not Originals: Always send copies of your documents, never the originals.

- The More the Better: While not every dispute requires extensive documentation, including supporting evidence strengthens your case and can speed up the process.

- Be Organized: Clearly label each document and reference it in your dispute letter.

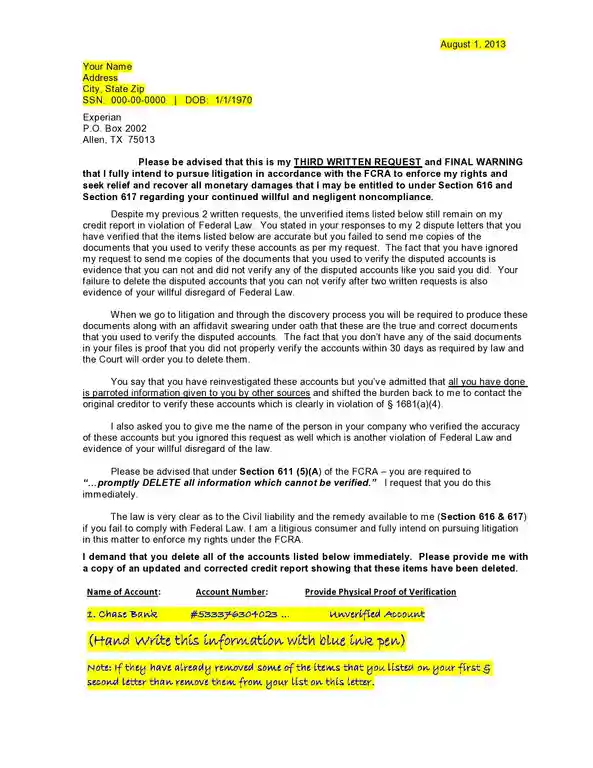

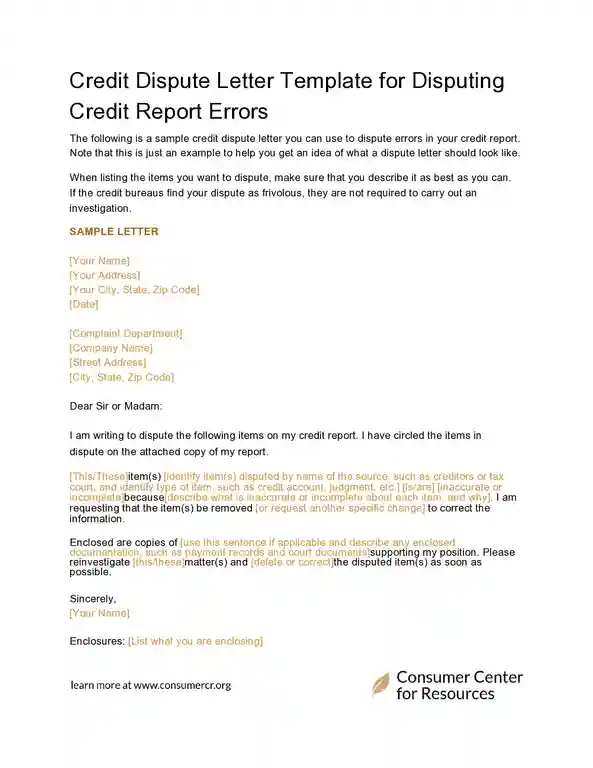

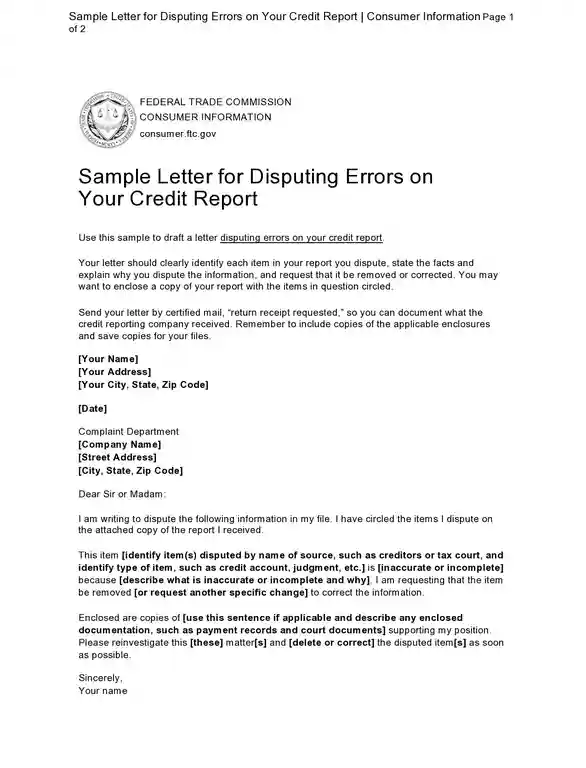

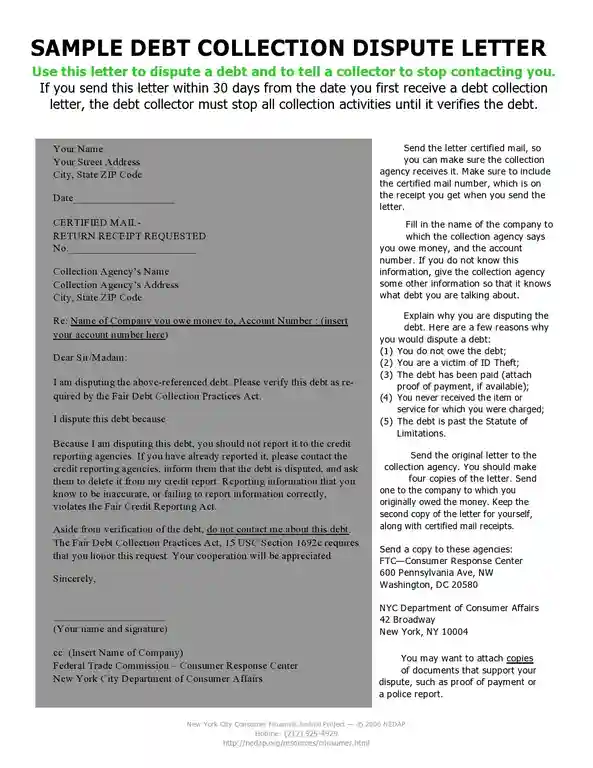

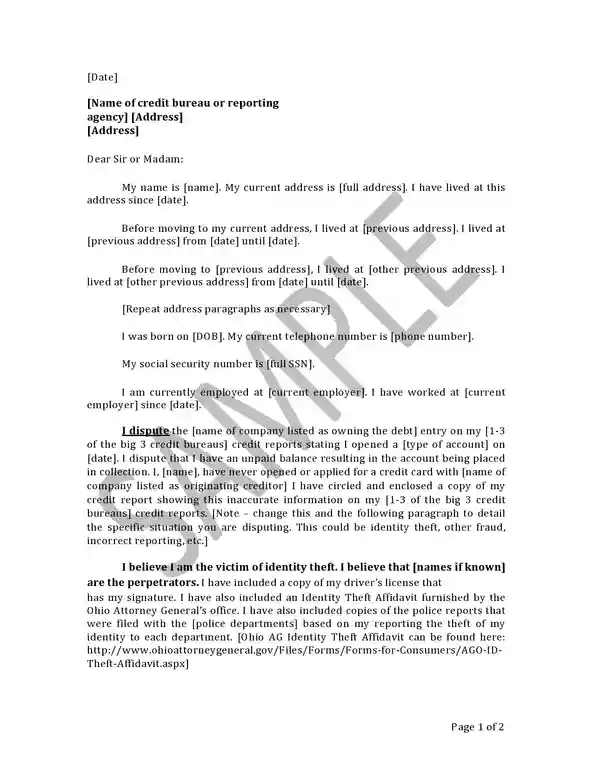

Credit Dispute Letter Example

Does a Dispute Letter Hurt My Credit Score?

No, sending a dispute letter won’t automatically hurt your credit score. Here’s why:

The Good Stuff

- Fixing Mistakes Helps: If there’s a mistake on your report (like a late payment you didn’t make), fixing it could improve your score!

- “Under Review” is Okay: While they check things, your report might say “under review.” This just lets lenders know it’s being looked at and usually doesn’t hurt your score much.

- Timing Matters: If a big mistake is hurting your score, fixing it takes time. Your score might stay a little lower until it’s finished.

Important to Know

- Accuracy is Key: Disputes help keep your report correct, which is super important for a good score.

- Not a Magic Wand: If your score is already low, a dispute might help a little, but other things matter too.

- The Big Picture: Think of a dispute letter like a check-up for your credit report. It won’t hurt and might even make your score healthier!

How Long Do Disputes Take?

Here’s what to expect:

The Law Says:

- Usually 30 Days: Most of the time, credit bureaus have 30 days to look into your dispute.

- Sometimes 45 Days: If you give extra information or dispute something right after getting a free credit report, it might take a bit longer.

What Happens

- You Send the Dispute: You tell the credit bureau about the mistake.

- They Investigate: The credit bureau talks to the company that reported the wrong information.

- You Get Results: They’ll let you know if: The mistake is fixed (yay!), They think the information is correct (you can try again!) and They can’t be sure who’s right (you can add a note to your report)

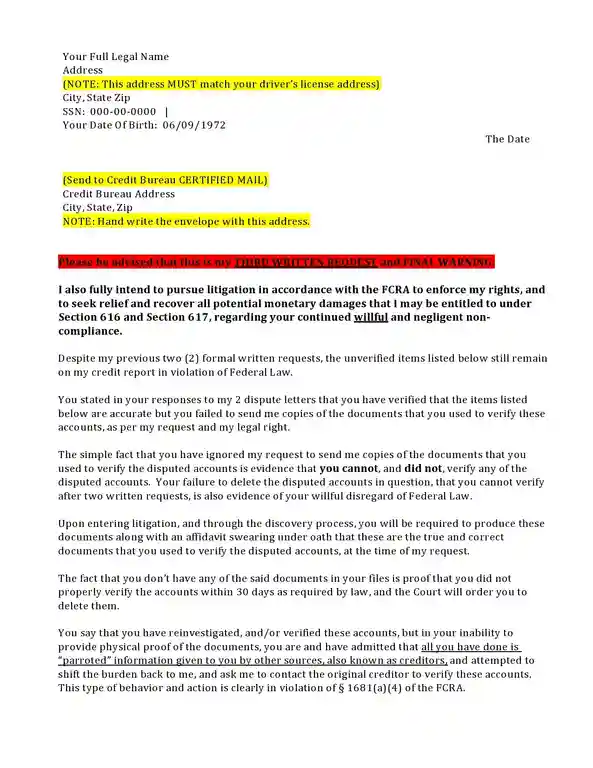

What If the Credit Bureau Doesn’t Fix the Mistake?

You checked, and you know the information is wrong. Don’t give up! Here’s what you can do:

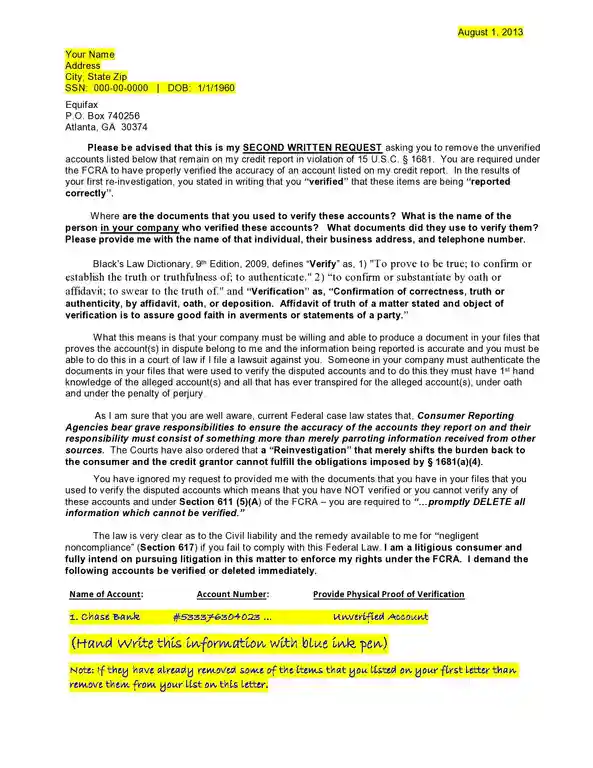

- Try Again, But Better: Send another dispute with even stronger proof that you’re right.

- Tell Your Side: Add a short note (no more than 100 words!) to your credit report explaining the mistake. Lenders will see this.

- Talk to the Company: Reach out to the company that reported the wrong information (that’s the bank, credit card company, etc.). They might fix it faster.

- Get Help: Groups like the Consumer Financial Protection Bureau (CFPB), and sometimes credit counselors or even lawyers, can help you.

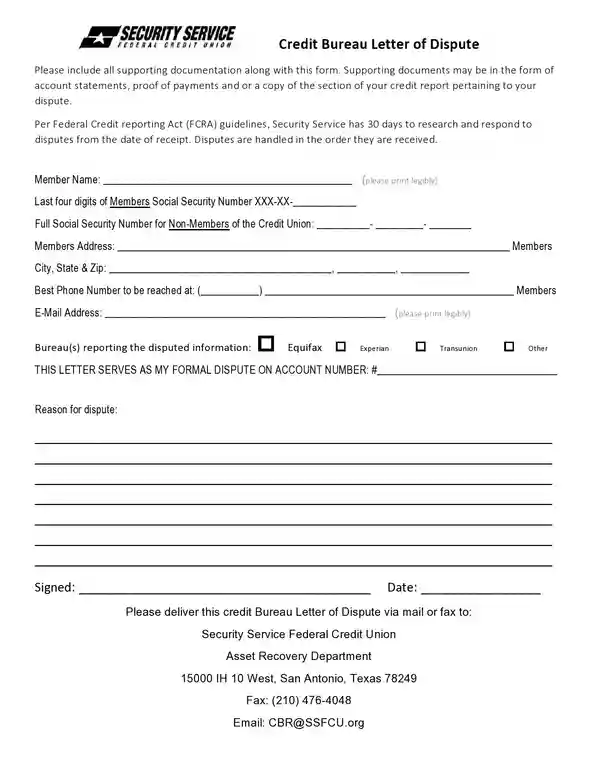

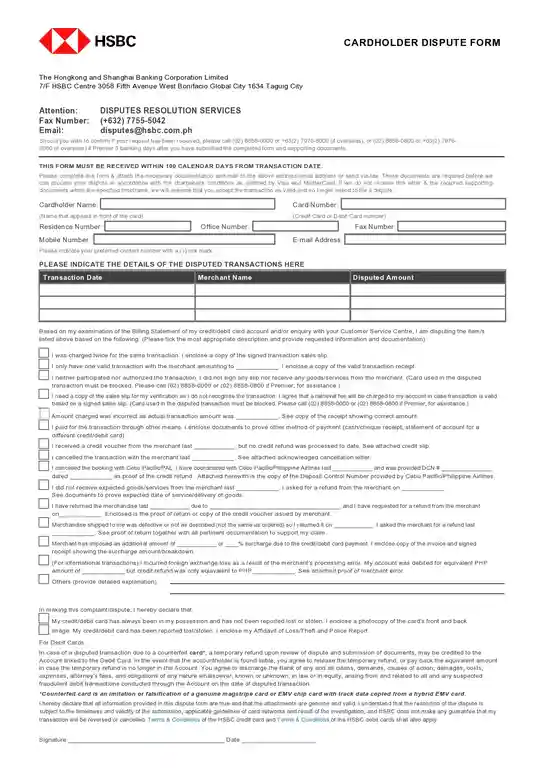

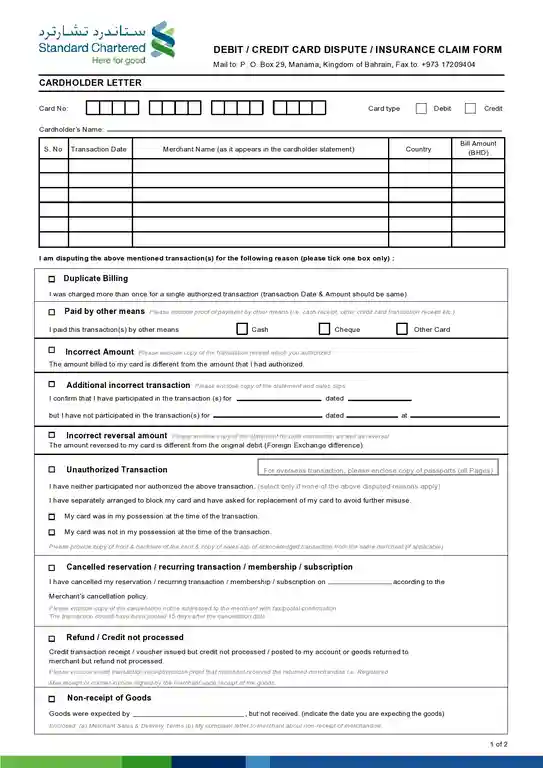

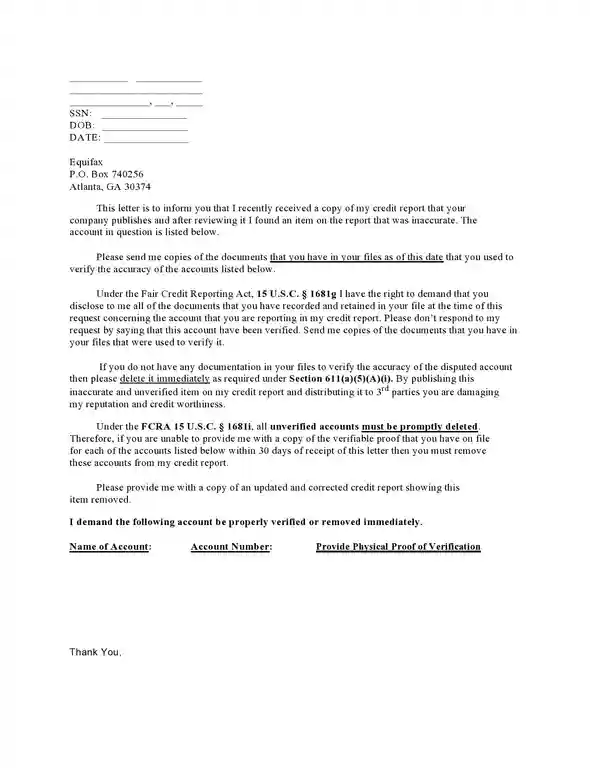

Credit Dispute Letter Template

Common Mistakes (And How to Avoid Them!)

Here are some mistakes people make when writing dispute letters:

- Being Unclear: Don’t just say something is wrong. Tell them exactly what the mistake is, the account number, and why it’s wrong.

- No Proof: Saying “this is wrong” isn’t enough. Show proof, like bills or letters.

- Forgetting the Company: The company that reported the wrong info might fix it quicker than the credit bureau. Talk to them!

- Getting Upset: It’s frustrating, but stick to the facts. Saying something is “unfair” won’t help – proof will!

- Not Following Up: If you don’t hear back in time, or they don’t fix it, keep asking!

How to Do It Right

- Be Super Specific: Say exactly what’s wrong (like “Wrong late payment date,” not just “This account is wrong.”)

- Include Proof: Send copies of bills, account closure letters, anything that backs you up!

- Contact Both: Tell the credit bureau and the company that made the mistake.

- Stay Calm & Professional: Focus on the facts and your rights. Don’t get angry.

- Keep Track: Save copies of everything, and remind yourself when to follow up (usually in 30-45 days).

- Get Help With Examples: The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) have sample dispute letters to help you!

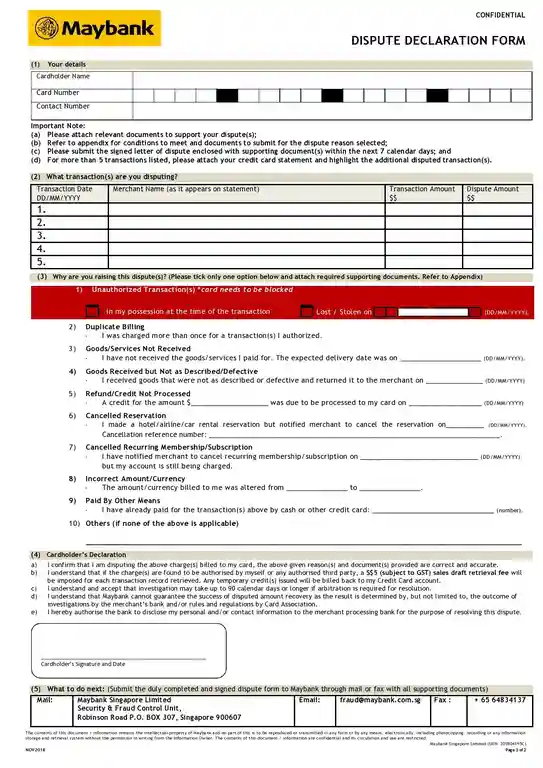

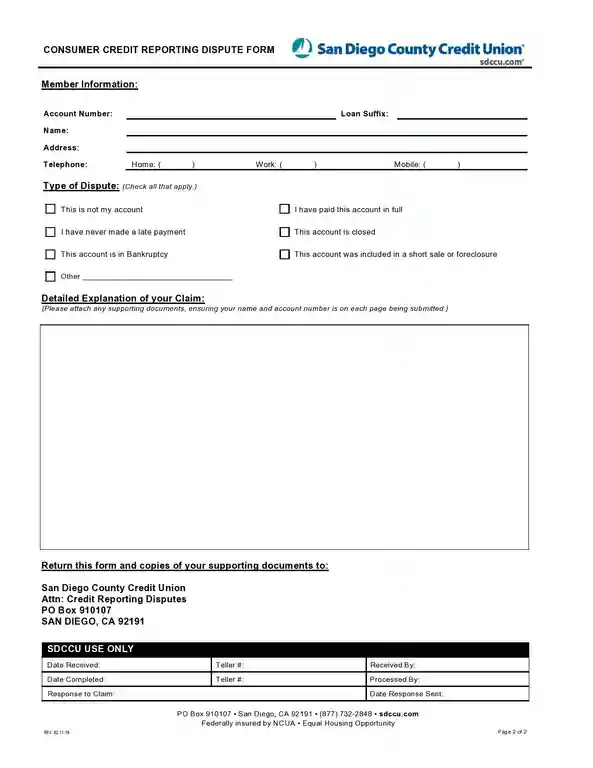

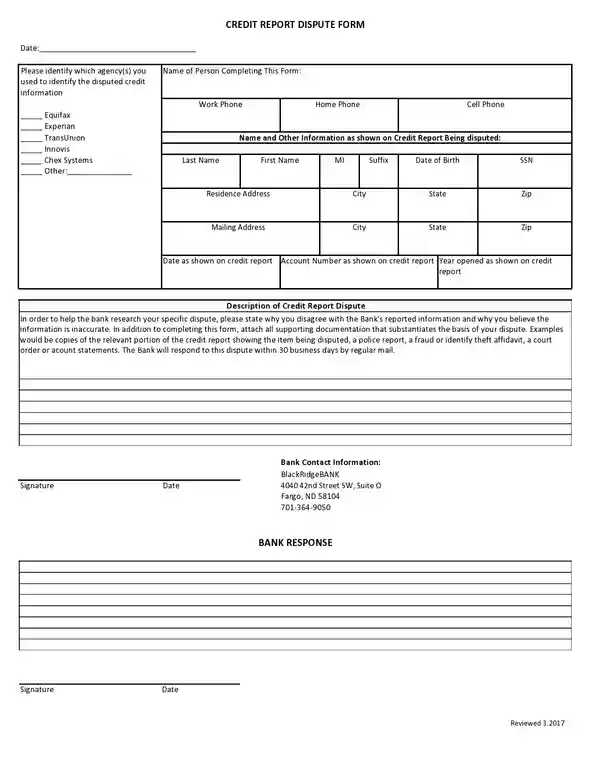

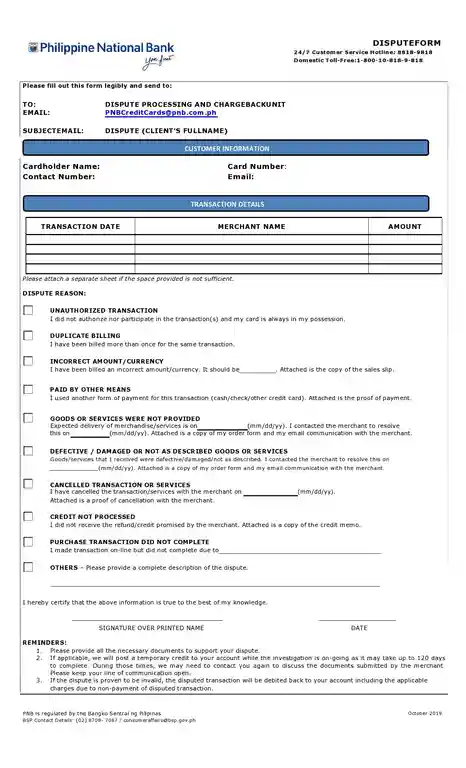

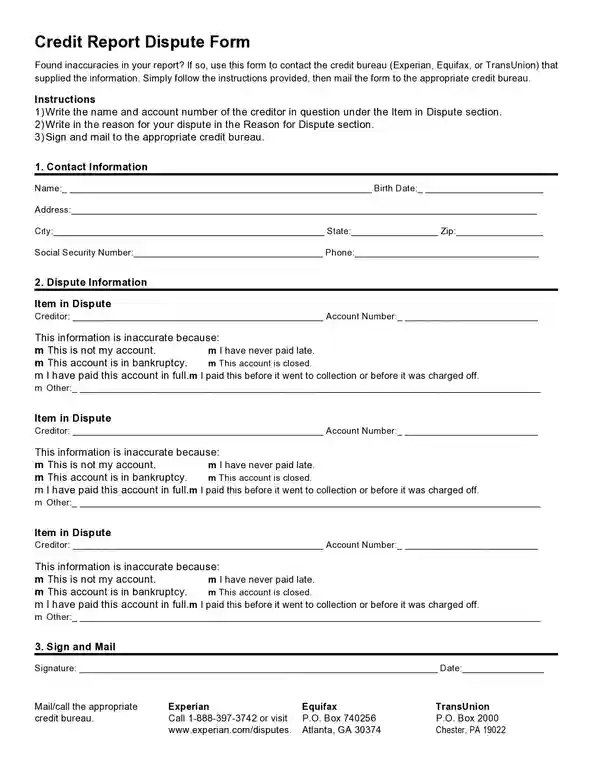

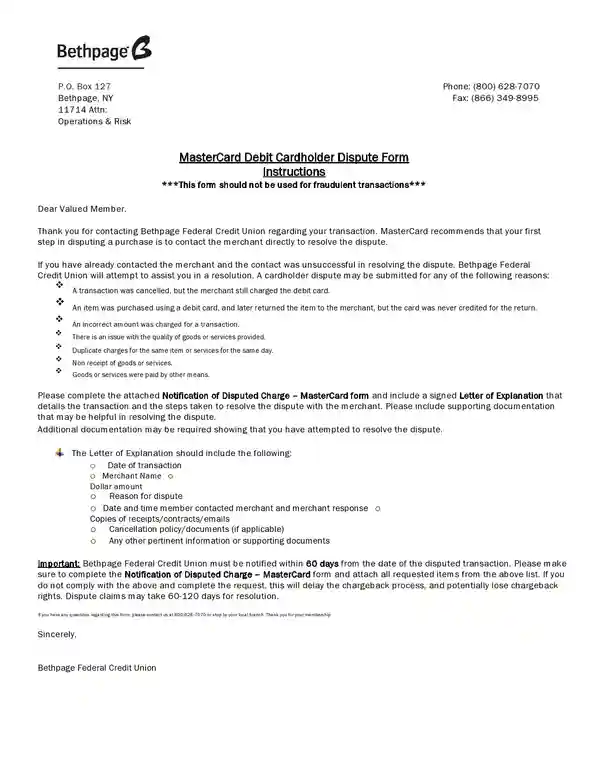

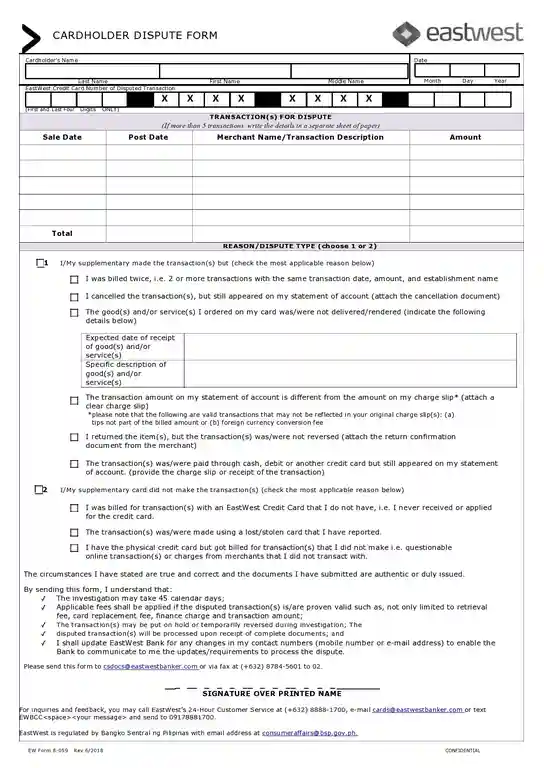

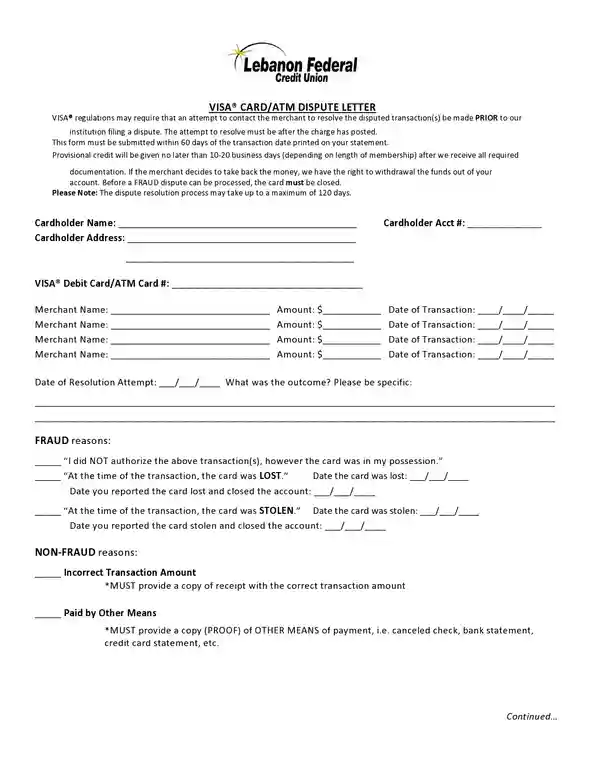

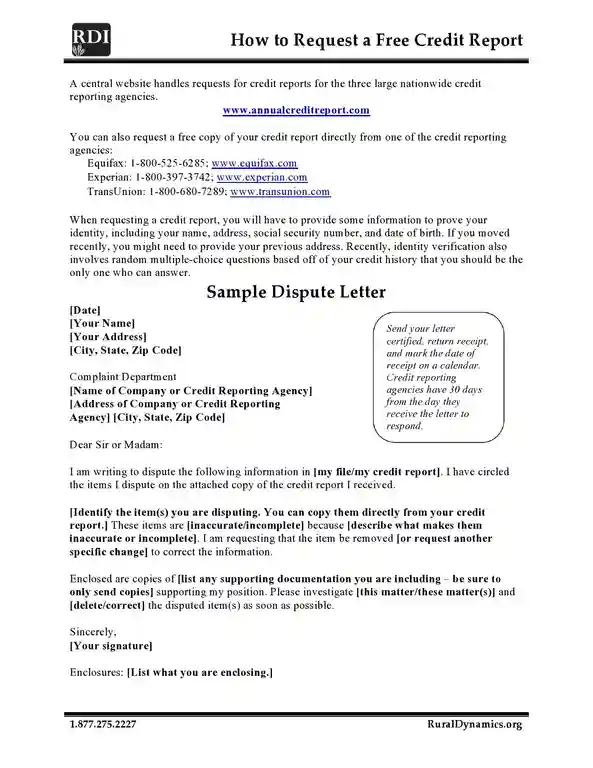

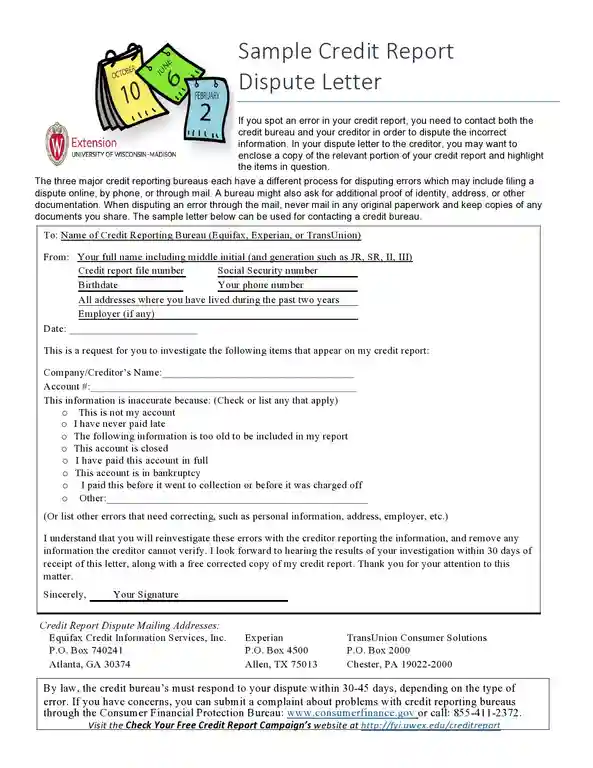

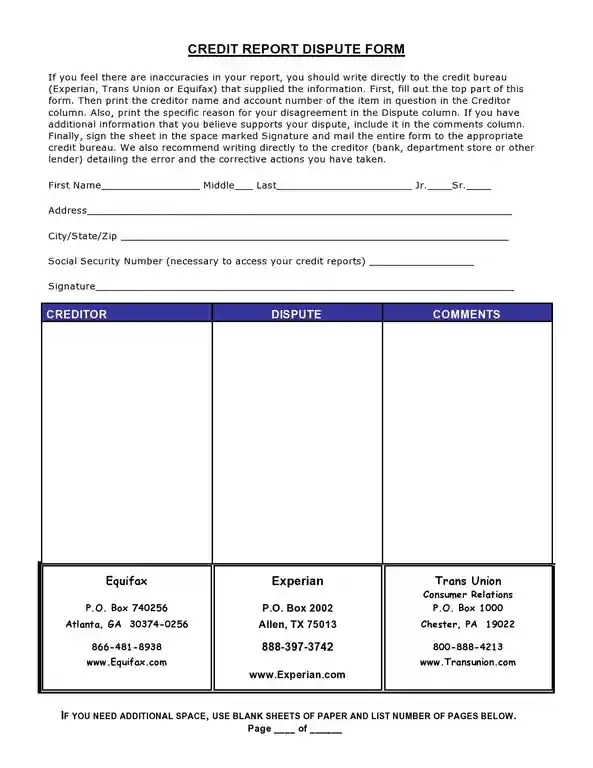

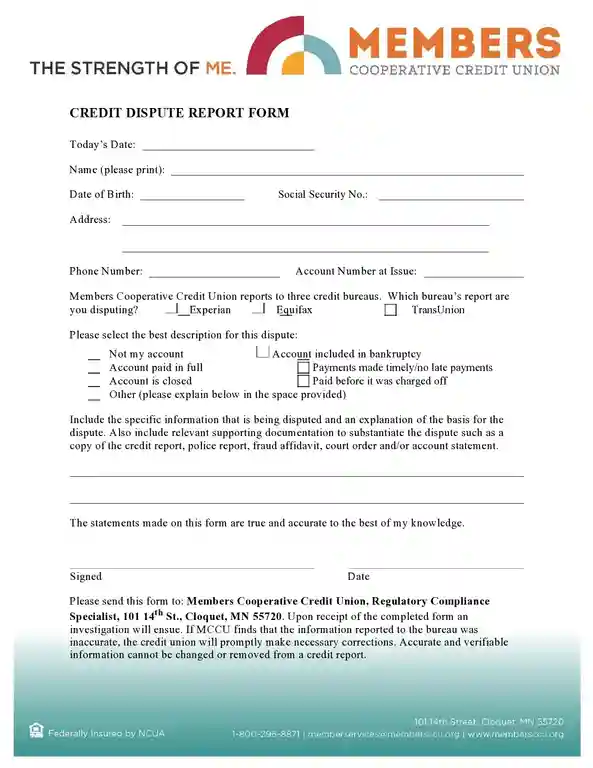

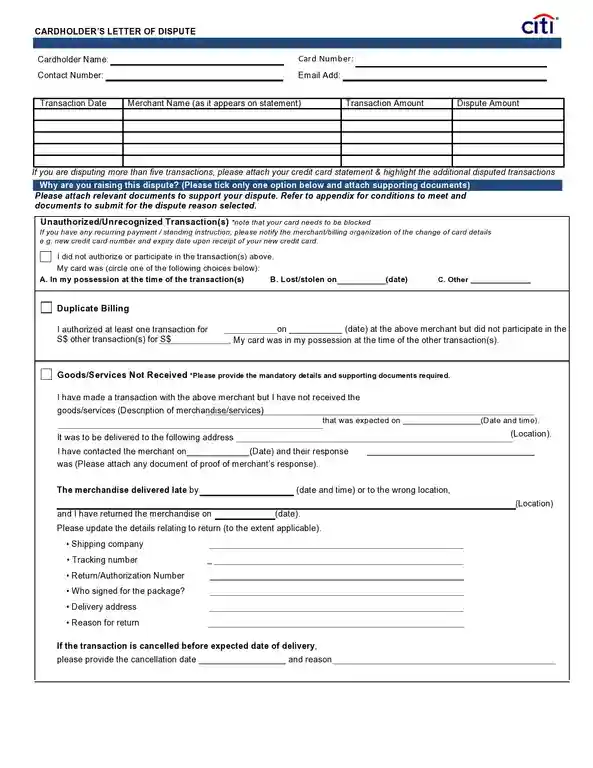

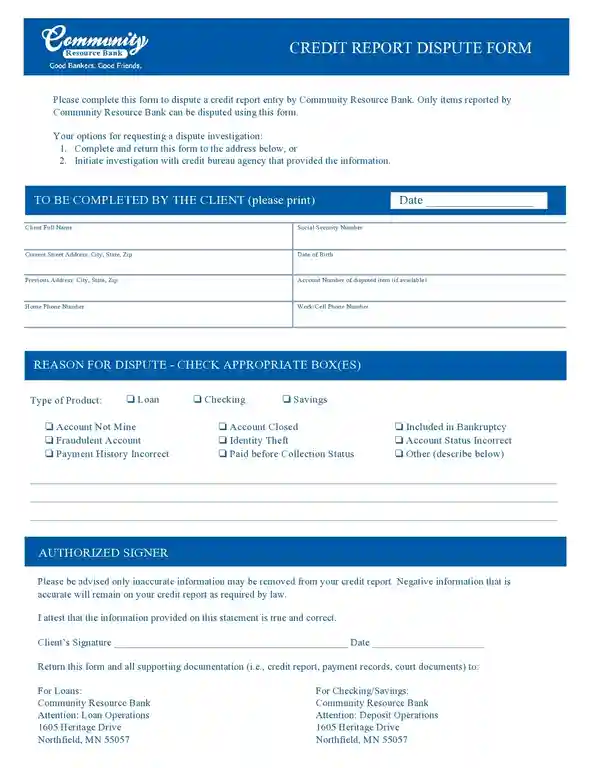

Credit Report Dispute Forms

The Best Way to Fix a Credit Report Mistake

Here’s how to to it step-by-step:

Step 1: Get Your Reports

- Your Free Reports: The law says you get a free report every year.

- Check Them Often: It’s good to get one report every few months to keep an eye on things.

Step 2: Be a Detective!

Compare Carefully: Look at the reports and your own records. Hunt for:

- Strange Accounts: Did you open them? Maybe they belong to someone else.

- Late Payments That Aren’t Yours: Did you pay on time, but the report says you didn’t?

- Wrong Amounts: Check if the amounts on the report match what you really owe.

- Closed Accounts That Look Open: This can hurt your score.

- Your Info is Wrong: Check your name, address, and Social Security number.

Step 3: Gather Your Clues

- Payment Proof: Find bills or statements that show you paid on time.

- Account Closed! Get letters showing accounts are really closed.

- Police Report: Important if someone stole your identity and made the mistake.

- Talk to the Company: Save emails or letters between you and the company that made the mistake.

Step 4: Tell Them About the Mistake

- Contact the Credit Bureaus: Tell each credit bureau about the mistake you found.

- Online Is Faster: All credit bureaus let you do this online, which might be quicker.

- Write a Letter: Make your letter clear and easy to read. Send copies (not originals!) of your clues. Use special mail to get a receipt.

- Important Stuff: Always include:

- Your name, address, and phone number

- Which mistake you are fixing and the account it’s on

- Why the information is wrong

- Copies of your clues

Step 5: Wait (Then Check Again!)

- They Have to Check: The law (it’s called the Fair Credit Reporting Act) says they have to look into your problem, usually in 30-45 days.

- What Could Happen

- Mistake Fixed! Your report will be changed.

- Need More Clues: The bureau might ask you for more proof – don’t worry, you can try again!

- They’re Not Sure: You can add a short note to your report to tell your side.

- Keep Trying! If it doesn’t work the first time, don’t give up! Get more clues, talk to the company, or ask a credit counselor for help.

Sending Your Letter

- Find the Right Place: Get the addresses for the big credit bureaus: Equifax, Experian, and TransUnion.

- Special Mail: Send your letter “certified.” This means you get a receipt so you know they got it!

- Try the Website: Sometimes you can fix the mistake online on the credit bureau’s website. This might be faster. Just make sure you can send them copies of your proof too.

When to Get Professional Help

There are times when seeking professional assistance is beneficial. Consider a reputable credit repair service if:

You have complex issues: Disputes involving identity theft, multiple errors, or difficult-to-prove inaccuracies.

You’re short on time: If you need errors fixed quickly and lack the time for the process.

You want ongoing support: Credit repair companies can provide monitoring and additional credit score optimization services.

Be wary of scams! The Federal Trade Commission (FTC) offers guidance on finding legitimate credit repair help.

Proactive Credit Monitoring

Proactive credit monitoring allows you to relax, knowing your financial reputation is protected

Fixing credit report errors is a huge win, but it’s important to stay vigilant. Regularly checking your credit helps you catch new mistakes quickly. Here’s how:

Free Reports: Get your free annual reports from AnnualCreditReport.com.

Paid Monitoring: For more frequent updates, consider a credit monitoring service. These often alert you to changes and offer additional identity protection features.

Credit Report Lingo Decoded

- Charge-off: A notation that an account is severely delinquent and the creditor considers it a loss (very negative for your score).

- Derogatory Mark: A negative item on your credit report, such as a late payment, collection, or charge-off.

- Furnisher: The company that reports information to credit bureaus (ex: banks, credit card companies). This is the party you might need to contact directly if the credit bureau cannot resolve your dispute.

- Hard Inquiry: When a lender checks your credit report as part of a loan application. This can cause a temporary, minor dip in your score.

- Statute of Limitations: The legal time limit on how long a debt can remain on your credit report (typically 7 years from the delinquency date).

Success Stories: See the Difference a Dispute Can Make

John disputed a closed account listed as open, and his score jumped 40 points!

Sarah removed an incorrect collection and finally got approved for her mortgage.

After disputing several errors, Mike’s credit report became accurate, and he qualified for his dream car loan.

FAQ: Your Credit Dispute Questions Answered

Does a credit dispute lower my credit score?

No, filing a credit dispute itself does not hurt your credit score. It’s simply a way to initiate a review of potentially inaccurate information. While the item is “under review” there might be a temporary note on your report, but this usually has minimal impact.

What if the bureau won’t change the error?

Don’t give up! If the credit bureau determines the information is correct based on what was reported to them, you have options:

Re-dispute: Submit another dispute with even stronger evidence supporting your claim.

Add a Statement: Add a brief explanation (100 words or less) to your credit report with your side of the story.

Contact the Furnisher: Reach out to the company that supplied the information (bank, credit card issuer, etc.) and try to resolve the issue directly.

Seek Help: Organizations like the Consumer Financial Protection Bureau (CFPB) or a credit counselor might offer further assistance.

Can I dispute something that’s correct but old?

Generally, yes, but there are limits. Negative information (like very late payments) automatically falls off your credit report after a set time (usually 7 years). However, if an old debt is wrongly listed as recent, or the date of a late payment is inaccurate, disputing it makes sense.

Protect Your Future!

Don’t let credit report errors hold you back from getting the loans you deserve! Learn from a credit dispute letter example to take control of your financial future. Fix those mistakes and pave the way to better interest rates and opportunities.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.