Ever wondered who makes sure you get your paycheck on time? That’s the job description for a payroll administrator. They make sure everyone gets paid correctly and on time. This job is very important for keeping workers happy and the company running smoothly.

What is a Payroll Administrator?

A payroll administrator is someone who makes sure that everyone at a company gets paid the right amount of money at the right time. They handle all the steps needed to give out paychecks.

Payroll Administrator Benefits

Being a payroll administrator has many benefits. Here are some reasons why this job is good:

- Job security: Every company needs a payroll administrator, so there are always job opportunities.

- Good salary: Payroll administrators often earn a good income.

- Learning opportunities: This job allows you to learn about finance, accounting, and human resources.

- Career growth: There are many chances to move up and take on more responsibilities.

- Helping others: You make sure that your coworkers get paid correctly, which makes them happy.

Overall, being a payroll administrator is a rewarding and important job.

What Does a Payroll Administrator Do?

A payroll administrator has many important jobs. They make sure everyone gets paid the right amount and on time. Here are some of their tasks:

- Manage the payroll process: They handle all steps in paying employees.

- Calculate salaries: They figure out how much each worker should get.

- Ensure timely paychecks: They make sure paychecks are given out on the right day.

- Keep records: They track hours worked, overtime, and any tax deductions.

Skills Required for a Payroll Administrator

To be a good payroll administrator, you need several important skills:

- Attention to detail: You must be careful to avoid mistakes.

- Time management: You need to be good at meeting deadlines.

- Communication skills: You should be able to explain payroll details clearly to employees.

Qualifications Needed for a Payroll Administrator Role

Most payroll administrators have special training and education:

- Degree in accounting or HR management: This helps them understand the job.

- Payroll certifications: These show they have special knowledge and skills.

- Knowledge of payroll systems and laws: This helps them manage complex tasks.

Primary Responsibilities of a Payroll Administrator

A payroll administrator has many important jobs to do. Here are the main ones:

- Prepare payroll reports: They create reports showing how much money was paid out.

- Keep employee records: They track how many hours each person works and other important details.

- Handle tax filings: They make sure the right taxes are taken out and sent to the government.

- Follow company policies and laws: They ensure all payroll activities follow the rules set by the company and the government.

Ensuring Accurate Payroll Processing

Making sure the payroll is correct is very important. Here’s how payroll administrators do it:

- Use payroll software: They use special computer programs to help them.

- Check and double-check data: They look at the numbers more than once to make sure they are right.

- Do regular audits: They review the payroll regularly to find and fix any mistakes.

Common Software Used by Payroll Administrators

Payroll administrators use special computer programs to help them do their jobs. These programs make the work easier and faster. Here are some popular ones:

- QuickBooks: This is a very common software that helps with payroll and other accounting tasks.

- ADP: This software is used by many companies to manage payroll. It helps with things like calculating paychecks and handling taxes.

- Sage: This is another popular program that helps payroll administrators do their work. It helps keep everything organized and correct.

These tools help automate the payroll process, which means they do a lot of the work by themselves. This makes the job easier and helps avoid mistakes.

Challenges Faced by Payroll Administrators

Being a payroll administrator can be tough. Here are some of the challenges they face:

- Payroll errors: Sometimes, mistakes happen with paychecks. It’s up to the payroll administrator to fix these errors.

- Payroll Compliance issues: They must make sure the company follows all payroll laws. If the laws change, they need to know and follow the new rules.

- Heavy workload: There is often a lot of work to do. They must manage their time well to get everything done.

Handling Payroll Discrepancies

When there are problems with payroll, the payroll administrator has to fix them quickly. Here’s what they do:

- Dispute resolution: If an employee has a problem with their paycheck distribution, the payroll administrator helps solve it.

- Error correction: They fix any mistakes in the payroll.

- Answering employee queries: They answer questions from employees about their pay.

- Making adjustments: If there are mistakes, they make changes to ensure the employee gets the right amount of money.

Role in Compliance and Regulations

Payroll administrators have an important job to do. They make sure the company follows all the rules about paying workers. Here’s how they do it:

- Follow labor laws: They make sure the company obeys laws about work hours and pay.

- Handle tax regulations: They take care of taxes and make sure the right amount is taken out of paychecks.

- Do compliance checks: They regularly check to make sure everything is done correctly. This helps avoid legal problems.

This part of their job is very important. It helps protect the company from getting into trouble.

Career Advancement in Payroll Administration

There are many ways to grow in a payroll career. Here’s how payroll administrators can advance:

- Seek professional development: They can take courses and attend workshops to learn new skills.

- Gain experience: With time and experience, they become better at their job.

- Move into leadership roles: Experienced payroll administrators can become team leaders or managers.

- Take on more responsibilities: They can handle bigger projects and more complex tasks.

By doing these things, payroll administrators can grow in their careers and take on more important roles.

Payroll Administrator Salary

A payroll administrator can earn a good salary. How much they make can depend on their experience, where they work, and the size of the company. Here’s a look at what payroll administrators can earn:

- Average Salary: According to Indeed, the average salary for a payroll administrator in the United States is about $54,769 per year.

- Entry-Level Salary: New payroll administrators might start at around $40,000 per year.

- Experienced Salary: With more experience, payroll administrators can earn up to $60,000 or more per year.

- Top Salaries: In some big companies or locations, payroll administrators can earn over $70,000 per year.

Here are some references to learn more about payroll administrator salaries:

- Indeed

- Glassdoor

- ZipRecruiter

- Salary.com

These sources give detailed information on how much payroll administrators can make in different places and with different levels of experience.

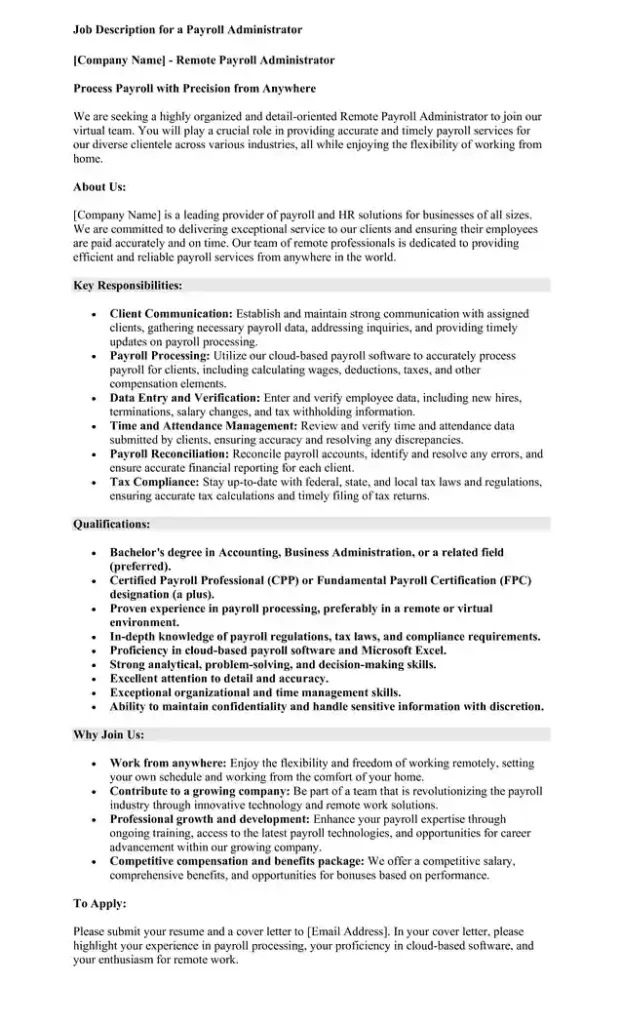

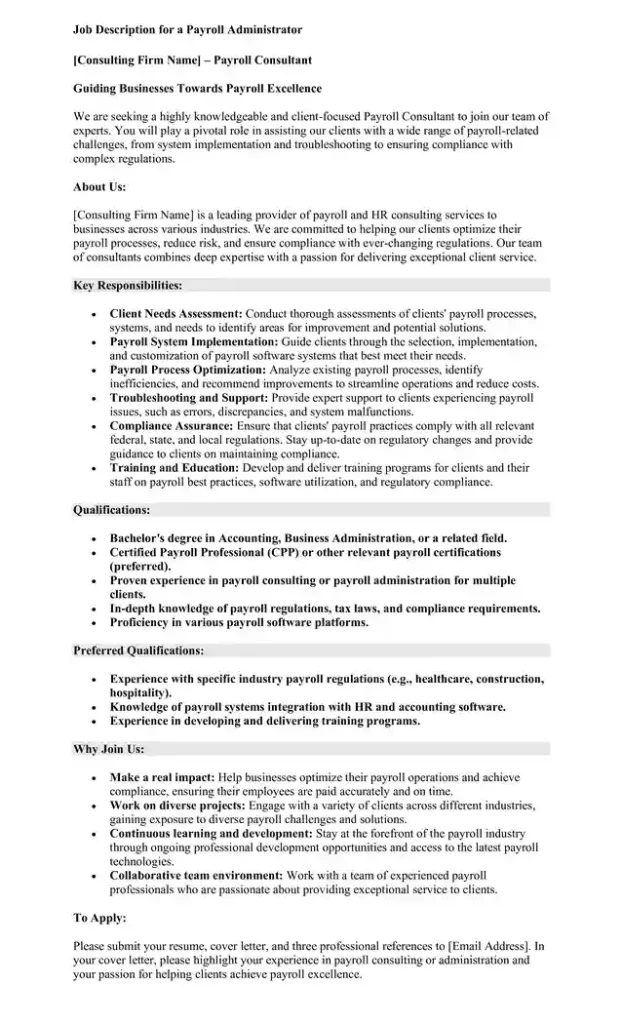

Sample Job Description for a Payroll Administrator

FAQs about Payroll Administrator Job Description

How do payroll administrators handle discrepancies?

They resolve disputes, correct errors, answer employee questions, and make necessary adjustments.

What is the role of a payroll administrator in compliance and regulations?

They ensure the company follows labor laws and tax regulations and conduct compliance checks.

How can a payroll administrator advance in their career?

They can seek professional development, gain experience, move into leadership roles, and take on more responsibilities.

In conclusion, The job description for a payroll administrator is very important. They make sure everyone gets paid the right amount and on time. They handle many tasks and make sure the company follows the rules. Their work helps keep everyone happy and working well. Ready to start a career as a payroll administrator? Learn more and get started today!”

Alexander is a skilled HR expert who writes clear and compelling job descriptions. He has spent over 15 years in the HR field, helping companies find and keep the best employees. With a degree in Human Resources Management from the University of Chicago, he has the knowledge to back up his experience.