Mortgage pre-approval letter example – Buying a house is a big step. Before you start looking for houses, it’s good to know how much money a bank can lend you. This is where a Mortgage Pre-Approval Letter comes in handy. Let’s dig into what it is and why it’s important!

A Mortgage Pre-Approval Letter is like a note from the bank. It says, “Hey, we’ve checked out your money situation, and we’re willing to lend you this much money to buy a house!” It’s like having a friend say they will lend you some money to buy a cool bike, but in this case, it’s a bank, and it’s for a house.

When you have a mortgage pre-approval letter example, it’s easier to shop for houses. You know how much you can spend, and the people selling houses know you’re serious. It’s like going to a toy store with your allowance in your pocket, and everyone knows you’re ready to buy something cool.

Getting a mortgage pre-approval is a smart move. It helps you, the bank, and the people selling houses all get on the same page. It’s like having a ticket to a show, so everyone knows you belong there. Now, let’s dig deeper into how this pre-approval letter works and why it’s a key piece of the home-buying!

What is the Mortgage Pre-Approval Letter?

Buying a house is like going on a big adventure, and getting a mortgage pre-approval is one of the first steps on this exciting journey. Let’s dig into what mortgage pre-approval really means:

A Special Promise:

- A mortgage pre-approval is a promise from a lender (the money-giving buddy) that they are willing to lend you a certain amount of money to buy a house. It’s like having a friend say they’ll lend you their sled for a snow race!

A Peek at Your Money:

- To get this promise, the lender takes a peek at your money, your job, and your credit score (that’s a number that tells how good you are with money). It’s like having a friend check you have enough candies before they lend you their toy.

Not a Final Yes:

- Remember, a mortgage pre-approval isn’t a final yes. It’s a big step, but you’ll still need to get final approval once you find a house you love. It’s like passing a big test but still having a final exam.

A Price Range:

- The pre-approval tells you the price range of houses you can look at. It’s like knowing how expensive of a toy you can choose from the store.

An Expiry Date:

- The pre-approval letter has an expiry date. You’ll need to use it before it expires, or you’ll have to get a new one. It’s like having a movie ticket for a special showtime!

A Helping Hand:

- Having a mortgage pre-approval is like having a helping hand guiding you on your house-hunting adventure. It helps you, the sellers, and everyone else know you’re ready and able to buy a house.

The Process to Obtain a Mortgage Pre-Approval

Getting a mortgage pre-approval letter is like getting a special key that helps you on your journey to owning a home. Here’s how you can get your key:

Gather Your Documents:

- First, you need to collect all the papers that tell you about your money. This includes your pay stubs, tax returns, and bank statements. It’s like packing your bag before a big adventure!

Choose a Lender:

- Next, find a lender (the person who will give you the loan). Look for someone who is helpful and has good terms. It’s like finding a good buddy for a team game!

Fill Out an Application:

- Now, fill out a loan application with the lender. This is where you tell them about your money and the house you want to buy. It’s like signing up to play in a game!

Credit Check:

- The lender will look at your credit score to see if you’re good at paying back money. It’s like a game score that shows how well you’ve played so far!

Review and Discussion:

- Talk with the lender about the loan options. It’s like planning a game strategy with a coach!

Receive Your Pre-Approval Letter:

- Hooray! If everything looks good, the lender will give you a mortgage pre-approval letter. This letter is like a golden ticket that says you’re ready to go house hunting!

Keep Your Finances Steady:

- After you get the letter, keep your money situation the same. Don’t make big purchases or change jobs. It’s like keeping your game skills sharp while you’re on the lookout for the perfect house!

Importance of Mortgage Pre-Approval in the Home Buying Process

Getting a mortgage pre-approval is like having a treasure map when you’re on a quest to buy a home. Let’s explore why it’s so important:

Shows You’re Serious:

- When you have a mortgage pre-approval letter, sellers know you’re not just window shopping. You’re a serious buyer, ready to find your new home. It’s like having a VIP badge at a big event!

Know Your Budget:

- With a pre-approval, you know exactly how much you can spend. It’s like knowing how much gold you have in your treasure chest before you go on a shopping spree!

Saves Time:

- You won’t waste time looking at houses you can’t afford.

Stronger Offer:

- Sellers are more likely to accept your offer if you have a pre-approval. It’s like having a stronger sword in a battle for a treasure!

Speeds Up the Process:

- Having a pre-approval speeds up the buying process since a big part of the loan work is done. It’s like having a fast horse in a long race, helping you reach the finish line quicker!

Less Stress:

- With pre-approval, you have less to worry about as you know what you can afford and that you have a lender supporting you. It’s like having a trusty shield in a tough battle!

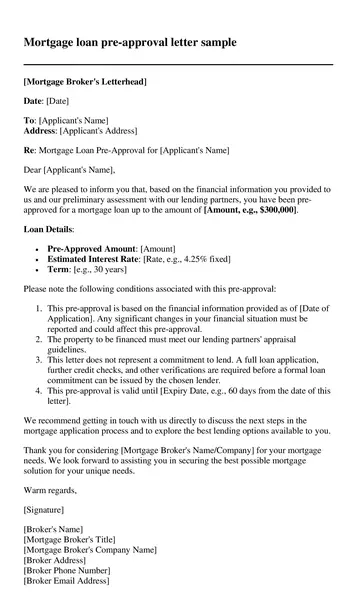

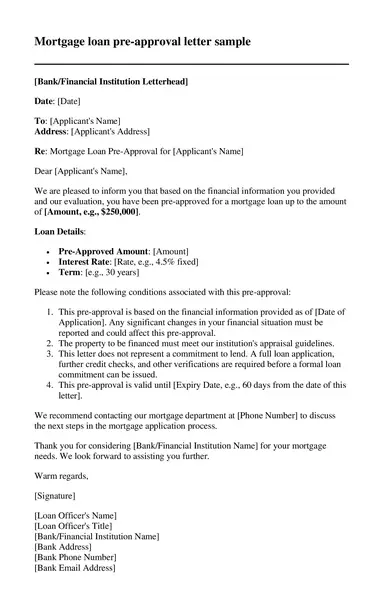

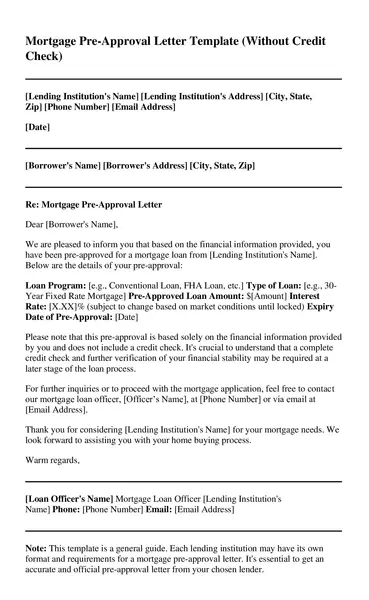

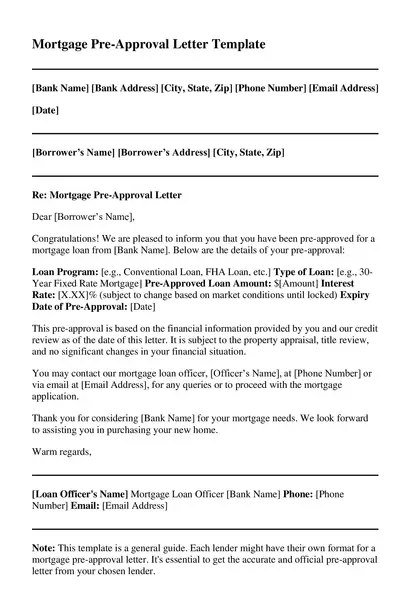

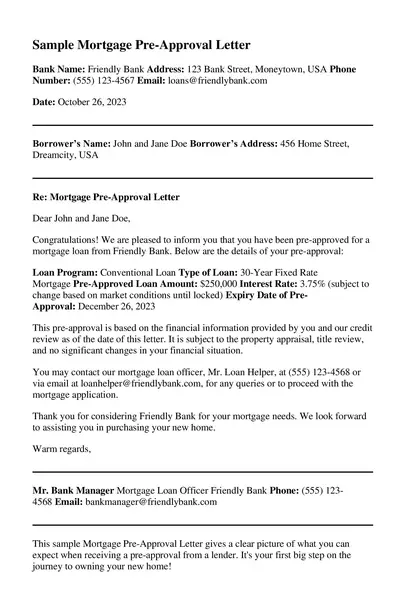

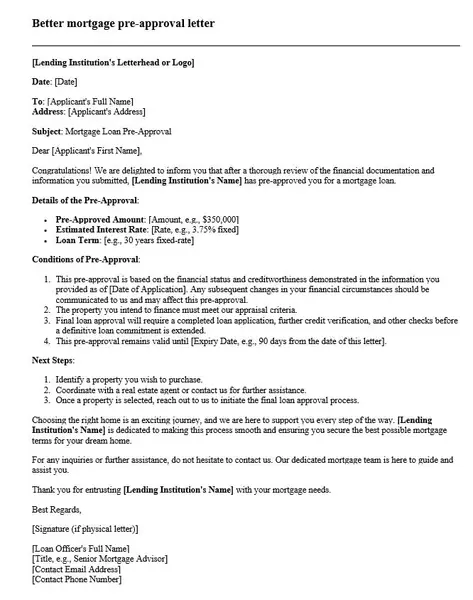

Key Components of a Mortgage Pre-Approval Letter

When you’re ready to buy a house, getting a mortgage pre-approval letter is your first step. Let’s learn about what’s in this letter!

Loan Program Specifics

- There are many ways to get a loan for a house. Some common ones are conventional, jumbo, FHA, VA, and USDA loans. Each one has its own rules. It’s like choosing a game to play, and each game has its rules. This part of the letter tells you which game you’re playing!

Type of Loan

- Now, loans can be of two main types. A fixed-rate loan means your payment remains the exact every month. An adjustable-rate mortgage (ARM) means your payment can change. It’s like choosing between a steady, slow turtle or a speedy, changing hare!

Loan Term Duration

- The loan term pays back the loan. It could be 30 years, 15 years, or another number. It’s like planning a long car trip, and the term is you’ll be on the road!

Amount of Loan and Maximum Purchase Price

- This part tells the total price of the house you can afford. Imagine you’re buying a big toy, and this tells you the cost tag of the toy you can select!

Qualified Interest Rate

- A lower rate means you pay less extra money over time. This part of the letter tells you your rate.

Validity of the Offer – Expiration Date of the Letter

- The letter will only last for a while. It has an expiration date, telling you when it’s good.

Mortgage Pre-Approval Letter Example

Mortgage pre-approval letter without credit check

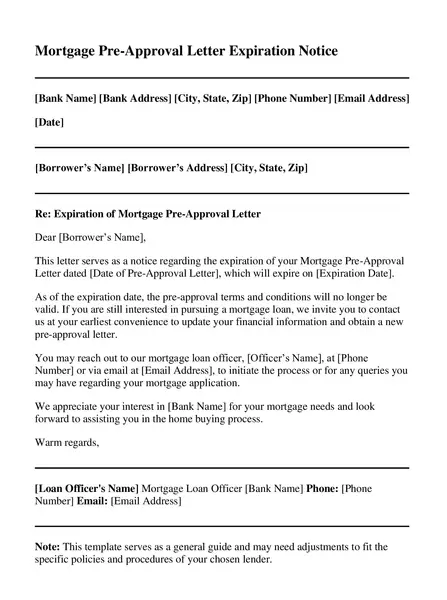

Mortgage pre-approval letter expiration

Better mortgage pre approval letter

Common Mistakes and How to Avoid Them

Sometimes, mistakes happen. When dealing with a mortgage pre-approval letter, here are some common mistakes and how to dodge them:

Incorrect or Outdated Financial Information

- Make sure all the money details you give are correct and recent.

Lack of Clarity in the Details Provided

- Be clear and detailed when you give your information. It’s like explaining the rules of a game so everyone can play fairly.

Not Checking the Expiration Date of the Pre-Approval Letter

- Remember to check when your letter will expire. It’s like checking the “use by” date on a carton of milk!

Making the Most of Your Mortgage Pre-Approval Letter

You got your mortgage pre-approval letter. Now let’s make the most of it:

Negotiating with Sellers

- With this letter, sellers know you’re serious. You can talk with them to lower the price. It’s like having a golden ticket in a game!

Speeding Up the Home-Buying Process

- Having this letter makes things go faster because sellers won’t have to wait to see if you can get a loan. It’s like having a fast pass at an amusement park!

Building a Strong Relationship with Your Lender

Stay in touch with the person who gave you the loan. Ask questions and learn from them.

Conditions for Loan Denial After Pre-Approval

Getting a mortgage pre-approval is like getting a high-five from a lender, telling you you’re on the right track to buy a home. But sometimes, things change, and that high-five can turn into a “wait-a-minute” hand signal. Let’s explore some reasons why this might happen:

Change of Employer:

If you change jobs after getting pre-approved, the lender might want to take another look. It’s like changing your costume after getting a thumbs-up for the first one. The lender wants to make sure your new job is as good money-wise as the old one!

Change of Your Credit Score Negatively:

Your credit score is like your report card for how you handle money. If it goes down, the lender might worry and take back their high-five. They want to see you’re still good with money before lending you some.

The House Fails to Meet Mortgage Requirements:

Sometimes, the house you pick needs to pass the lender’s test. It’s like picking a toy that’s broken or missing pieces. The lender wants to make sure the house is worth the money they’re lending.

Adding More Lines of Credit:

If you open new credit cards or loans, the lender might get nervous. It’s like seeing you grab more toys when your arms are already full. They worry you won’t be able to handle paying back all the money.

When Your Bank Balance Suddenly Reduces:

If a lot of money leaves your bank suddenly, the lender might pause. It’s like seeing you spend all your candy money before the big candy sale. They want to make sure you still have enough money to handle a home loan.

Mortgage Pre-Approval Letter Expiration

A mortgage pre-approval letter is not a forever promise. It has an expiration date. Here’s what you need to know:

Expiration Date:

- Your Mortgage Pre-Approval Letter will show an expiration date. This is the date until which the offer to lend you money is good. It’s usually 60 to 90 days from when the letter is written.

Why It Expires:

- The lender says, “We’ll lend you this money,” based on your money story at that time. If too much time passes, your money story might change. The lender wants to make sure everything is still the same before they lend you money.

What to Do if It Expires:

- If your letter expires before you find a house, don’t worry. You can ask the lender for a new letter. They’ll check your money story again to make sure everything has stayed the same.

Keeping Your Money Story the Same:

- Try to keep your money story the same while you’re house hunting. Don’t make big money moves like buying a car or opening new credit cards. It helps make sure your lender will still lend you money.

Talk to Your Lender:

- If your letter might expire soon, talk to your lender.

FAQs

What is the difference between pre-qualification and pre-approval?

Pre-qualification is like a wink from the lender saying you might be able to borrow money. They take a quick look at your money story. But pre-approval is like a handshake. The lender takes a closer look at your finances and tells you exactly how much you can borrow. It’s a stronger promise!

How long does it take to get a mortgage pre-approval?

Getting a mortgage pre-approval can take anywhere from a few hours to a few days. It’s like waiting for your turn to ride the big roller coaster. Sometimes, the line is short, and sometimes, it’s long, depending on how busy the lender is and how quickly you give them the info they need.

What should I do if my mortgage pre-approval expires?

If your pre-approval expires, it’s like your golden ticket turned back into a regular ticket. You’ll need to talk to the lender and get a new pre-approval. It’s like getting a new ticket for a show when the old one is for a past date.

How can I ensure a smooth mortgage pre-approval process?

To have a smooth pre-approval process, gather all your money papers, choose a good lender, and respond to their questions quickly. It’s like being ready with your ticket, your ID, and your snack money when you go to a big event. Being prepared makes everything go smoothly!

Conclusion

Buying a house is a big, fun step. But before you go, get a mortgage pre-approval letter example. It’s like having a map for a treasure hunt! It tells you how much money you can spend on a house.

This letter is like a big hi-five from the bank. It tells everyone you have money to buy a house. Sellers will be happy to see you. They know you are ready to buy.

So, if you dream of a new home, get your mortgage pre-approval letter first. It’s like packing a snack and a flashlight for a trip. This letter will guide you, show you which houses you can buy, and help you move fast when you find your dream home. Talk to a bank, tell them about your money, and get your letter. With it, you’re not just dreaming; you’re ready to buy a house!

The big world of buying a house is waiting. With a mortgage pre-approval letter, you’re ready for this cool journey. So, get your letter, and start looking for your new home. Happy house hunting!

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.