In today’s Kiddie Guide to Investment, we would like to talk about the private placement memorandum example. For those of you who are a stranger to the term, you should not be embarrassed because it is perfectly normal for you to think like that. You are, after all, a ‘kiddie’ in the world of investment, and it is wont for you to not understand about it.

Fortunately for you, we have this handy guide that will tell you a bit about what a private placement memorandum is and how people use it to their benefit.

Without further ado, let us begin first with a brief exposition of how investment works:

What are the things that you can find in a PPM?

Few. The things you want to emphasize are:

Introduction:

- The cover page or the appetizer.

- Gives a snapshot of your company’s main details.

- Lists the basic terms of the offer and your company’s mission, values, and vision.

- It may also include required legal details.

Summary of Offering Terms:

- The main course of the PPM.

- It’s a quick look at what the investor would want to know.

- It’s like a term sheet and can also tell about the company’s capital before and after the offer.

- It lists important terms like voting rights, liquidation preferences, and more.

Risk Factors:

- Lists possible challenges like competition risks or dependency on key staff.

Company & Management Description:

- Tells about the company’s history, performance, goals, products, and more.

- Also, shares details about the company’s leadership and their backgrounds.

Use of Proceeds:

- Explain how the company will use the money it gets from the offer.

- It helps investors see where their money is going.

Description of Securities:

- Talks about the type of securities offered and their terms.

- Highlights things like dividend distribution and share classes.

Subscription Procedures:

- The step-by-step method.

- Gives instructions on how to invest in the offer.

- Explains the mechanics of joining the offer.

Appendices or Exhibits:

- Provides extra details to help investors decide.

- Includes things like financial statements, licenses, contracts, and more.

All of those are the things that you will usually find in an ordinary PPM. Still, I suggest you want your private placement memorandum template to be more convincing.

In that case, you can also add several documents that can strengthen your standings, like financial statements, business licenses, or any other helpful documents.

The how to’s of investment

To see it in its simplest form, investing is like loaning money to an individual or a company and expecting that money to be returned within the allocated time. Not only will the money be returned, but you also expect to make a bit of profit from your investment Simple.

At its core, it is pretty simple. The world, however, despises simple things. Now, investments are so complex it drives people away. People think that investing their money in stock markets is a hard thing to do, so they shy away from it. With all the rules surrounding investing, it is normal for people to be afraid of investing in stock markets. Add to the list that there are a lot of investment types out there, which makes investing your money in something so abstract a scary thing to do.

We are not here to talk about the kinds of investments, though

Because we want to talk about the private placement memorandum example, not the other kind, while a memorandum of this kind counts as a type of investment, this is a simpler concept that commoners can easily learn. To understand more about this memorandum, you need to understand that there are two ways of selling your stocks to the public:

The first method is through an IPO or an initial public offering. This is the most common way of offering your stocks to external investors. In this way, you basically throw yourself into the stock market and allow the masses to buy your stocks through that market. An IPO is usually the first thing that a company will do when they want to foray into stock markets and to be able to conduct an initial public offering, you need to register your company to the market.

The second method is using a private placement memorandum, which is today’s major topic. Contrary to IPO, you use a PPM if you do not want to expose your stock to the masses. The basics are the same; you still try to find an external investor for your business, but instead of opening it to the public, you offer your stock to a select few people that you think will invest in your business.

The investors may or may not accept your offer, depending on how they think your business will go. A PPM is often used by companies who are yet to be eligible to compete in an open market or by companies who do not like exposing themselves to the public.

The difference between the two lies in the chance of potential investment amount. While you can earn a lot of investors through IPO, those investing in stock markets rarely invest in high numbers, meaning you will need to tend to many investors at once while earning a trickle of equity from them.

The PPM method will net you a whole lot of equity (depending on the amount being invested, but it is often higher than using IPO), but there is a risk of rejection.

A PPM sounds risky when you have read the above paragraph, but in reality, the two offering methods bear the same risk. A public offering going right will not land you any investors, while a bad PPM can bring potential investors away from you. It is all about how you bring your company in front of potential investors.

Is it really necessary to make a PPM?

No, not really. Unless you are planning to offer your stock to an investment company, there is no need for you to make a PPM. A PPM, however, is very useful to avoid any repercussions if your business is not doing any good.

Take, for example, you are offering your stock to a best friend who is willing to invest in your company. As long as you two trust each other not to go back on the deal, you do not need to make a PPM because your friend will trust your word. Your friend will then be bound as a ‘co-owner’ of your business because they have a stock of your business in their hands. You are not legally bound to pay the investment back, but you would not dare betray the trust that your best friend has given to you, right?

On the other hand, if you are planning to offer your stock to an investment company, you DEFINITELY need to make a PPM. A PPM is like an offering letter that will tell them (the investment company) about your business. If you manage to convince them, then the equity will start coming, and you can make more business decisions.

A PPM can only be conceived by investment banks on behalf of a company. If you write it on your own, the PPM will lack integrity, and an investment company will reject it.

What are the legal implications of not having a PPM when required?

What happens if a company doesn’t use it when they should? Let’s find out.

Trouble with the Law:

- A PPM has rules that companies need to follow. If they don’t, they might get in trouble with the people who make these rules.

- When you don’t follow the rules at school, you might get a time-out.

Money Problems:

- If a company doesn’t use a PPM and something goes wrong, people might want their money back.

- It’s like if you promised your friend a toy but didn’t give it, they might get upset.

Trust Issues:

- If a company doesn’t use a PPM, people might not trust them anymore.

- Just like if someone breaks a promise, you might not believe them next time.

Bad Name:

- Other companies might not want to work with a company that doesn’t follow the rules.

- It’s like when someone cheats in a game, others might not want to play with them again.

Big Fines:

- The people who check the rules might make the company pay money if they don’t use a PPM. This is called a fine.

- It’s like when you break something at home, and you might need to pay for it or fix it.

Closing Down:

- In some cases, if a company doesn’t follow the big rules, they might have to stop working.

- It’s like if you keep breaking the rules at school, you might not be allowed to come back.

The company needs a PPM, and if they don’t use it, they can get in big trouble.

Different types of PPMs for different industries

There are different tools for different tasks, and there are different PPMs for different types of businesses. Let’s explore this!

Agriculture PPM:

- For businesses that grow food or raise animals.

- Think of farms with cows, chickens, or fields of corn and wheat.

Biotech PPM:

- For companies that use science to make new medicines or health tools.

- Imagine scientists in labs making new things to help people feel better.

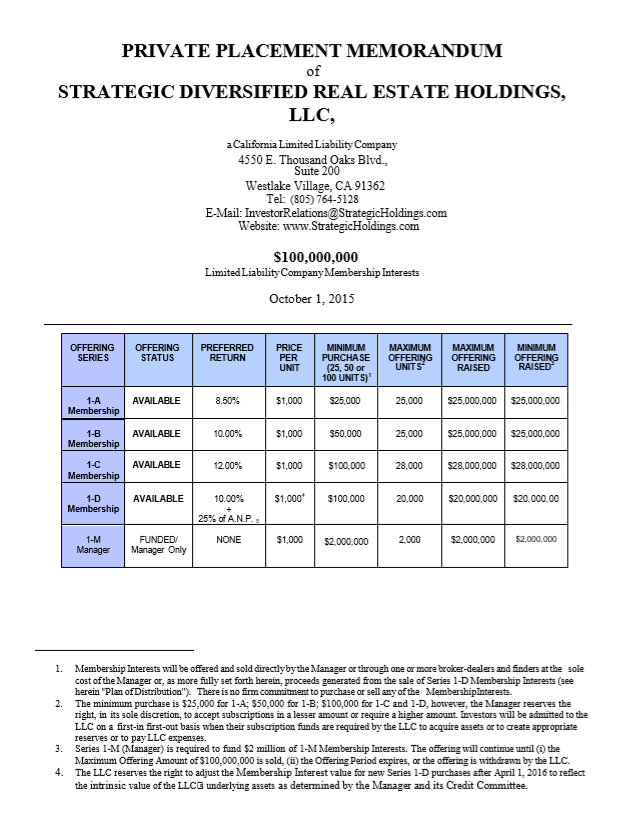

Real Estate PPM:

- For businesses that build houses, apartments, or big buildings.

- Picture builders making tall skyscrapers or cozy homes.

Hedge Fund PPM:

- For special groups that manage a lot of money for people.

- Think of them as piggy banks where many people put their money to grow.

Marketing PPM:

- For companies that tell people about new things to buy or use.

- Imagine folks making fun ads on TV or colorful posters.

Confidential PPM:

- Some businesses have secrets they don’t want to share.

- This PPM keeps those secrets safe while still sharing some info.

Private Placement Memorandum Template Free:

- This is a basic PPM that companies can use without paying money.

- Think of it as a starter kit for companies.

Every business is unique. They do different jobs and need different tools. That’s why there are many types of PPMs. Each one is made to help a certain kind of business do its job the best way. Just like you might use a spoon for soup and a fork for salad, businesses use the right PPM for their job.

When Should You Use a Private Placement Memorandum Example?

There are times when a company should use a sample or example, PPM.

Starting a New Business:

- If you’re starting a new company and need money to make it grow, you might show a PPM to people who want to give you money.

Big Changes in the Company:

- If your company is planning to do something big and different, you might need more money.

- A PPM can help you explain your new plans to people.

Keeping Things Clear:

- A PPM sample can help make sure everyone understands the same thing.

Legal Reasons:

- Sometimes, the rules say that you need to have a PPM if you want to ask many people for money.

Learning:

- If this is your first time making a PPM, looking at a sample can help you learn how to do it.

Making a Strong Impression:

- If you want people to trust you and give you money, showing them a well-made PPM can help.

- It shows them you’re serious and have a good plan.

If a company thinks people might have questions or want to know more, it’s a good time to use a PPM sample.

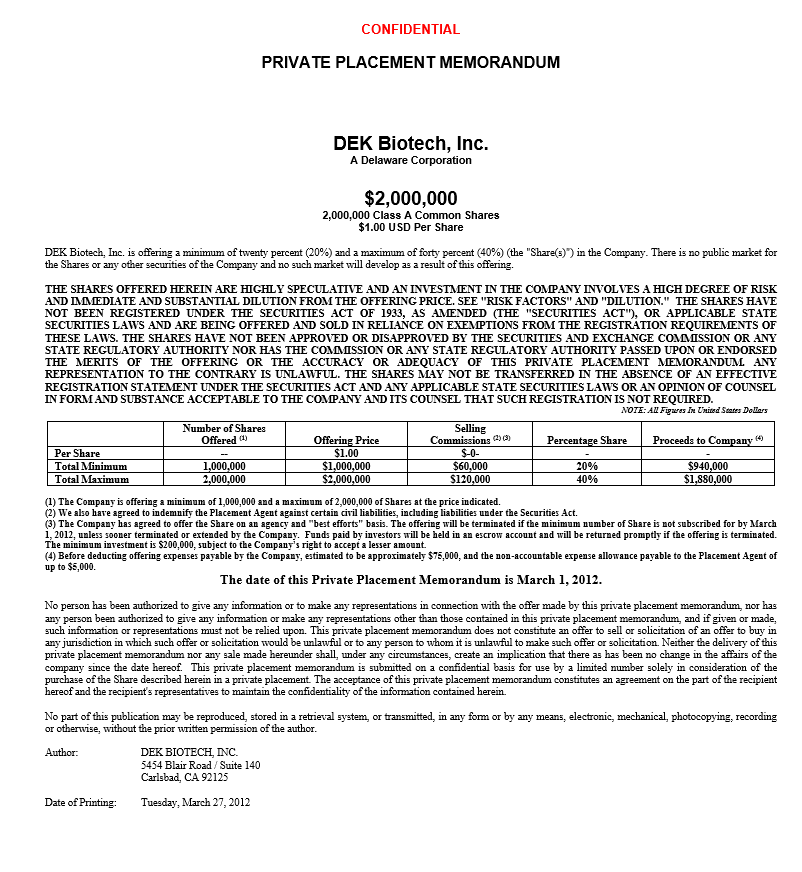

Private Placement Memorandum Example

Agriculture Private Placement Memorandum

Biotech Private Placement Memorandum

Confidential Private Placement Memorandum

Confidential Private Placement Memorandum

Hedge Fund Private Placement Memorandum

Marketing Private Placement Memorandum

Private Placement Memorandum Requirements

Private Placement Memorandum Template Free

Real Estate Private Placement Memorandum

How Does a PPM Differ from Other Investment Documents?

Do you know what a PPM is? Let’s learn about it differently from other money papers.

What’s it for?

- A PPM is like a special letter.

- Other money papers might tell everyone about a company’s past work.

Who reads it?

- A PPM is for a small group of people who have lots of money to invest.

- Some money papers are for everyone to read.

What’s inside?

- A PPM talks about the company, what it plans to do with the money, and what might go wrong.

- Other money papers might only talk about the good things a company did.

Rules:

- PPMs have some rules, but fewer than other money papers because they are private.

- Papers for everyone have many rules to follow.

Shape and Info:

- Companies can decide how a PPM looks and what to write in it as long as they tell the truth.

- Other money papers have to look a certain way because of the rules.

Who knows about it?

- PPMs are secret. Only a few people see them.

- Some money papers are for everyone to see.

It’s different from other money papers because of who reads it and what’s inside. It’s a way for companies to get help in growing.

A PPM can only be conceived by investment banks on behalf of a company. If you write it on your own, the PPM will lack integrity and it would be rejected by an investment company.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.