Break-even analysis is a fundamental financial instrument for businesses to choose the point at which their incomes equal their prices. This essential juncture, the break-even point, is a key indicator of a business’s financial health and sustainability.

The Importance of Break-Even Analysis in Business

Here’s a deeper look at why it is so important in business:

- Financial Planning: It is a fundamental part of financial planning. It allows companies to choose the lowest deal they require to cover their prices. This data is vital for budgeting and forecasting, helping businesses plan their finances effectively.

- Pricing Strategy: It plays a key role in setting pricing plans. Companies can set prices that cover their costs and ensure profitability by comprehending the prices and sales volume needed to break even. It allows for defining the price elasticity and the effect of price changes on the break-even point.

- Cost Control: It aids in price management by determining fixed and varying prices. This knowledge allows businesses to strategize on how to control these costs. For instance, they might find ways to lower variable costs or negotiate lower fixed costs.

- Investment Decisions: The payback period derived from the break-even analysis can influence acquisition decisions. If the payback period is shorter, it might indicate that the investment is risky or not worthwhile. Conversely, a short payback period might suggest a good investment.

- Product Viability: It can help assess the viability of a product or service. If the break-even point is too high, the product or service might not be profitable, leading to reconsidering the product launch or modifying the product strategy.

- Risk Assessment: It can also help businesses assess risk. By understanding how changes in price or costs affect the break-even point, companies can better prepare for uncertainties. It allows companies to simulate various methods and understand their impact on the break-even point.

- Performance Measurement: It is also a tool for performance measurement. Companies can measure their performance and adjust their operations or strategies by comparing actual sales with the break-even point.

The Process of Break-Even Analysis

Embarking on a break-even analysis involves a series of well-defined steps. Here’s an in-depth, step-by-step guide to streamline the process:

Spotlight on Fixed Costs

The journey begins with identifying all your fixed costs.

Highlighting Variable Costs

The next stage involves pinpointing your variable costs. These costs correlate instantly with the importance of interests produced or assistance rendered.

Establishing the Sales Price

How you vend your product or assistance. It’s imperative to set a realistic sales price that covers your costs and ensures profitability.

Computing the Contribution Margin

Estimated as the selling price minus the varying price per unit, signifies how much each unit contributes towards covering fixed costs and subsequently generating profit.

Determining Point

The point is ascertained by splitting the fixed costs by the contribution margin. The result means the units you must sell to protect your prices. Selling beyond this number ushers in profit.

Interpreting the Results

It’s time to analyze the results. Assess whether it is achievable with your current resources and market needs. Consider plans to decrease costs or elevate the selling price if it appears unattainable.

Maintaining and Updating Your Break-Even Analysis

Industry needs affect your costs, sales, and deals volume. Hence, it’s crucial to regularly monitor and update your break-even analysis to ensure its accuracy and relevance.

Advantages of Using Break-Even Templates

They offer a range of advantages that can enhance efficiency, accuracy, and strategic decision-making. Here’s a detailed look at the benefits of using break-even templates:

Efficiency

Break-even templates come with pre-set formulas that automatically calculate the break-even point based on the inputted data. It saves time and effort, allowing businesses to focus more on analyzing the results and making strategic decisions.

Accuracy

With pre-set formulas, the risk of calculation errors is significantly reduced. It ensures the accuracy of the break-even analysis, leading to more reliable results and informed decisions.

Consistency

Using a standardized break-even template ensures consistency in conducting the analysis. It particularly benefits businesses needing break-even analysis for multiple products or services.

Ease of Use

Break-even templates are typically user-friendly, requiring minimal training. It makes them accessible to all team members, not just those with financial expertise.

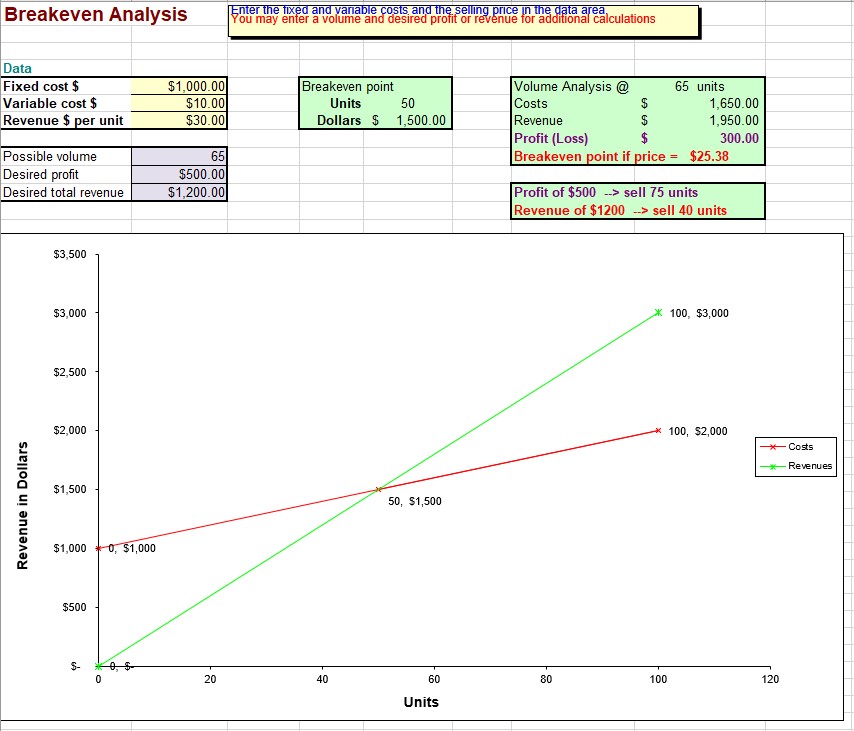

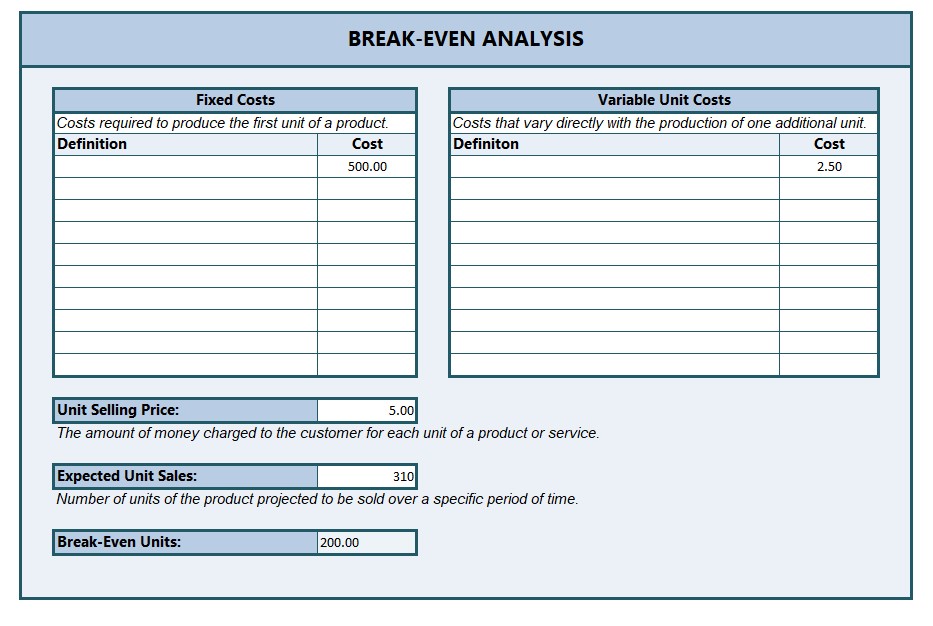

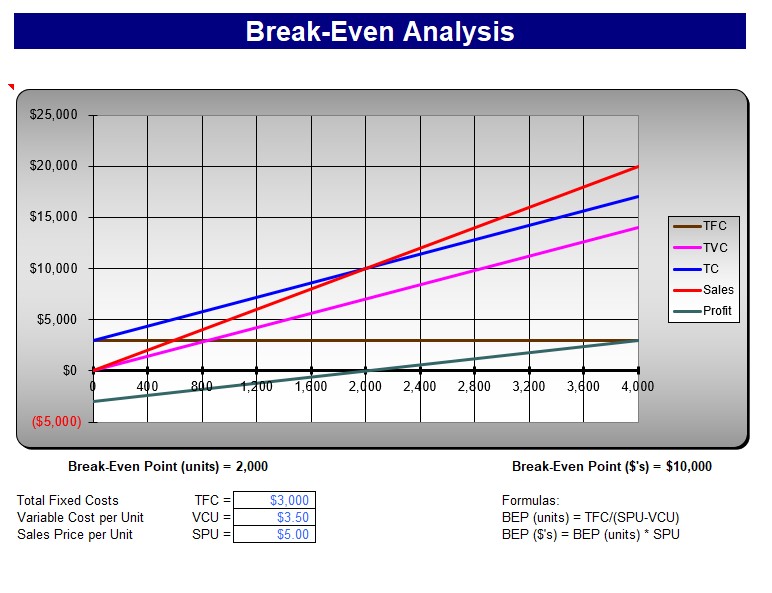

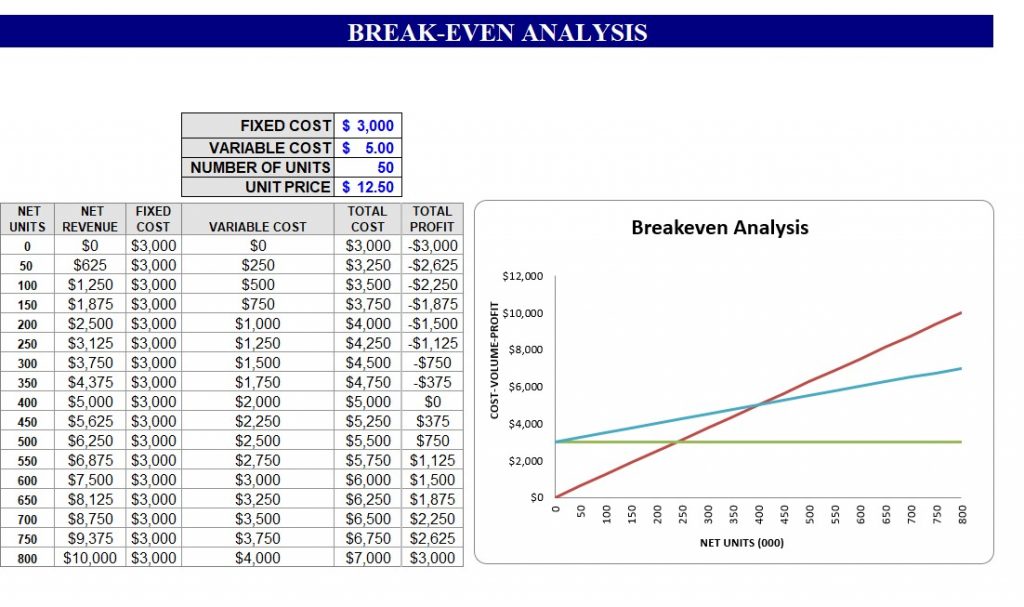

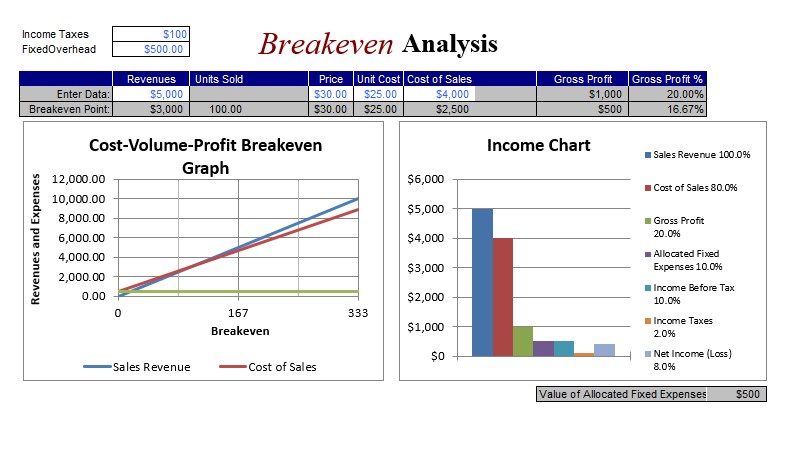

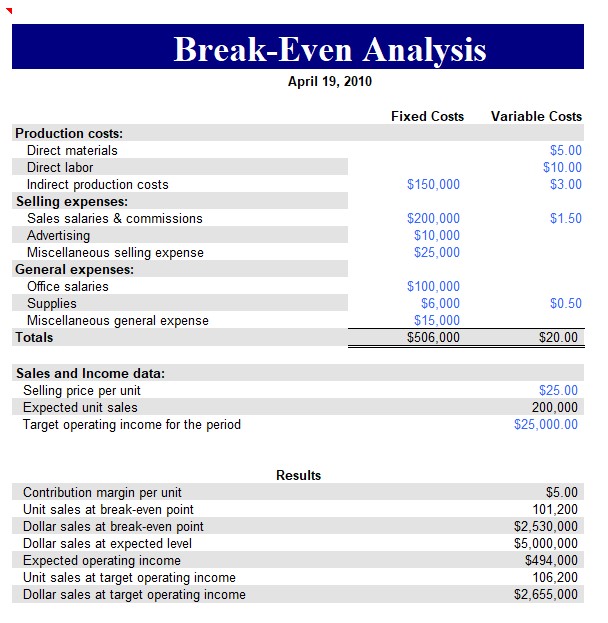

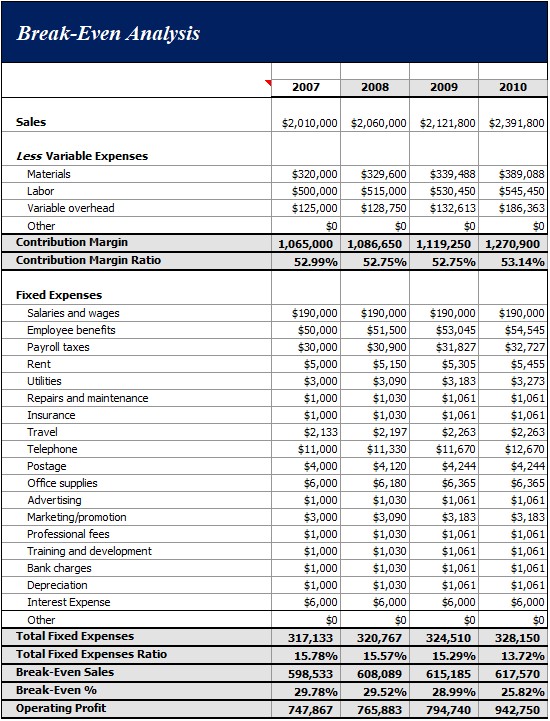

Visual Representation

Many break-even templates include features that allow for a visual representation of the break-even point, such as charts or graphs. It can enhance understanding of the break-even analysis and facilitate communication.

Customizability

Break-even templates are often customizable, allowing businesses to modify them to suit their needs. It can include adding fields, changing the layout, or adjusting the formulas.

Scalability

Break-even templates are scalable, making them suitable for businesses of all sizes. Whether you’re a small business owner doing a simple break-even analysis or a large corporation conducting a complex multi-product analysis, a break-even template can meet your needs.

Cost-Effective

Many break-even templates are available for free or at a low cost. It makes them a cost-effective solution for businesses looking to conduct a break-even analysis without investing in expensive software.

Types of Break-Even Templates

Break-even templates come in various formats, each with its unique features and benefits:

Break-Even Templates Excel

Excel templates are highly versatile and dynamic. They come with pre-set formulas that automatically calculate the break-even point based on the inputted data. They also offer charting capabilities for a visual representation of the break-even analysis.

Break-Even Templates Word

Word templates are ideal for creating detailed break-even analysis reports. They allow for a more narrative and descriptive presentation of the break-even analysis, making them suitable for business plans or reports.

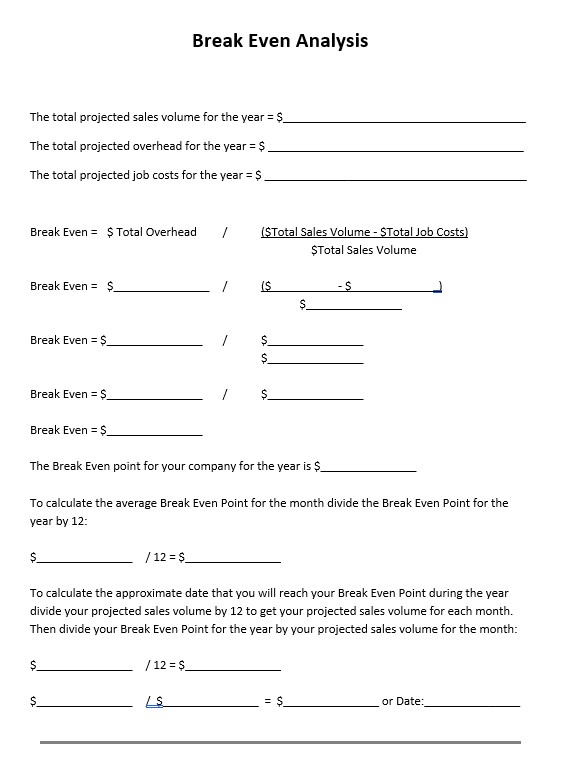

Break-Even Templates PDF

PDF templates are perfect for printing or sharing purposes. They often include fillable fields for inputting data, making them convenient for businesses that prefer working with PDF documents.

How to Choose the Right Break-Even Template

Here’s a detailed guide on how to choose the right break-even template:

Understand Your Business Needs

The first step in choosing the right template is understanding your business needs. Are you conducting a simple break-even analysis for a single product, or must you analyze multiple products or services? The complexity of your analysis will select the type you need.

Consider the Template Format

It comes in various formats, including Excel, Word, and PDF. Each format has its advantages. Excel templates, for instance, are great for calculations and charting, Word templates are ideal for creating detailed reports, and PDF templates are perfect for sharing or printing.

Check for Pre-set Formulas

A good break-even template should come with pre-set formulas that automatically calculate the break-even point based on the inputted data. It not only saves time but also reduces the risk of calculation errors.

Look for Customizability

The ability to customize the template to suit your specific needs is another important factor to consider. Can you add or remove fields? Can you adjust the formulas or change the layout? A customizable template is more likely to meet your specific needs.

Evaluate the Visual Features

Many break-even templates include visual features such as charts or graphs representing the break-even point. These features can enhance understanding of the break-even analysis and facilitate communication of the results.

Consider the Ease of Use

It should be user-friendly and manageable, even for those without financial expertise. It should have a clear layout and instructions for inputting data.

Check Reviews and Ratings

If downloading a break-even template from an online source, check the reviews and ratings. These can provide insights into the template’s effectiveness and reliability.

Tips for Using Break-Even Templates Effectively

Here are some tips to help you make the most of your break-even templates:

- Ensure Accurate Data Input: The accuracy depends on the accuracy of your data. Confirm that you input accurate and up-to-date data into the template. It includes your fixed costs, variable costs, and sales price.

- Regularly Update the Template: Business conditions can change, affecting your costs, sales price, and sales volume. Therefore, it’s important to regularly update your template with the latest data to ensure that your analysis remains accurate and relevant.

- Customize the Template: It is typically customizable. This feature will modify the template to suit your specific needs. It can include adding fields, changing the layout, or adjusting the formulas.

- Use the Visual Features: It include visual features such as charts or graphs. Use these features to enhance your understanding of the break-even analysis and to communicate the results more effectively.

- Check Your Calculations: It comes with pre-set formulas. Checking your calculations is still important. It can help you catch any errors and ensure the accuracy of your analysis.

- Use the template Consistently: To ensure consistency in your analysis, use the same template each time you conduct the analysis. It can help you compare results over time and track changes in your break-even point.

- Share the Template with Your Team: If multiple people are involved in the break-even analysis, share the template with them. It can ensure everyone is on the same page and using the same methodology.

Common Mistakes to Avoid When Using Break-Even Templates

Avoiding common mistakes is crucial. Here are some pitfalls to watch out for:

- Inaccurate Data Input: The accuracy of your break-even analysis hinges on the accuracy of your data. Always double-check your figures before inputting them into the template.

- Failure to Update Regularly: Business conditions can change, affecting your costs, sales price, and sales volume. Regularly update your break-even template with the latest data to ensure your analysis remains relevant.

- Overlooking Customization: Break-even templates are often customizable. Failing to tailor the template to suit your needs can lead to an analysis that doesn’t accurately reflect your business situation.

- Ignoring Visual Features: Many break-even templates include visual features like charts or graphs. Neglecting these features can lead to missed opportunities for enhanced understanding and communication of the results.

- Relying Solely on the Template: While break-even templates are a great tool, they should differ from a thorough understanding of break-even analysis principles. Ensure you understand the underlying concepts and use the template to aid the process, not as a substitute for financial knowledge.

- Not Sharing the Template with Your Team: If multiple people in your team are involved in the break-even analysis, ensure everyone can access the template. It ensures consistency in the methodology and helps keep everyone on the same page.

By avoiding common mistakes, you can maximize the benefits of your break-even template and conduct a more effective and accurate break-even analysis.

Break-Even Analysis for Restaurants

Here’s a condensed guide on how to conduct it:

- Grasp the Concept: The point is where earnings match prices. Beyond this, every meal sold generates earnings.

- Identify Fixed Costs: These remain constant yet of deals volume, like rent, salaried worker wages, and insurance.

- Spot Variable Costs: These prices fluctuate with deal volume, containing food and beverage costs, hourly labor, and utilities.

- Determine Average Sales Price: This can be challenging due to varying menu prices. A standard procedure is to estimate the average check size per customer.

- Estimate Break-Even Point: You can count the point after choosing fixed and varying prices and the moderate deal price. It tells you how many meals or buyers you require to cover prices.

- Leverage for Decision Making: Understanding points aids in producing notified determinations about menu pricing, cost control, and selling techniques. Consider raising prices or attracting more customers if your break-even point exceeds your current customer count.

Conclusion

Break-even analysis provides valuable insights into financial planning, pricing strategies, cost control, investment decisions, product viability, risk assessment, and performance measurement.

Companies must identify fixed and variable costs, establish the sales price, compute the contribution margin, choose the break-even point, and interpret the results. Regular maintenance and updates of the analysis are essential to keep it accurate and relevant.

Using break-even templates offers several advantages, including increased efficiency, accuracy, consistency, ease of use, visual representation, customizability, scalability, and cost-effectiveness. These templates come in various formats, such as Excel, Word, and PDF, each with benefits.

Choosing the right template involves understanding business needs, considering the format and features, checking for pre-set formulas, evaluating customizability, and reviewing ratings and reviews.

Businesses should ensure accurate data input, regularly update the template, customize it to suit their needs, utilize visual features, double-check calculations, use the template consistently, and share it with the team.

However, there are common mistakes to avoid when using break-even templates, including inaccurate data input, failure to update regularly, overlooking customization, ignoring visual features, relying solely on the template without understanding the underlying concepts, and not sharing the template with the team. This analysis can help restaurants decide on menu pricing, cost control, and sales techniques.

Break-even analysis and templates provide valuable financial insights and aid businesses in making strategic decisions to enhance profitability and sustainability.