Trust distribution letter sample – When someone has a lot of things, like money or houses, they sometimes put these things in a “trust”. A trust is like a big safe box where they keep all these things until it’s time to give them to other people, like their family. When it’s time to give these things away, they write a letter to say who gets what. This letter is called a trust distribution letter. Let’s learn more about It.

Understanding the Trust Distribution Process

Trusts and distributing assets from them can be compared to a special game. Let’s dive into it to understand better:

How Trusts Operate:

- Setting Up the Game: A trust is set up by someone who has some valuable things like money, houses, or toys. They put these things in a special box called a trust. It’s like setting up a board game with all its pieces in the box.

- Rules of the Game: The trust has rules on who gets what and when. It’s like a game where the rulebook tells you how to play and how to win.

Roles and Responsibilities of a Trustee in Asset Distribution:

- Game Leader: The person in charge of sharing the things in the trust is called a trustee. They are like the game leader who makes sure everyone follows the rules and gets what they are supposed to get.

- Sharing Fairly: The trustee has to follow the rules of the trust to share the things in it. It’s like how the game leader makes sure everyone gets a turn and plays fair.

Legal Obligations Concerning Trust Distribution:

- Following the Big Rules: Besides the rules of the trust, there are big rules, called laws, that the trustee has to follow, too. It’s like how every game has to be played safely and fairly according to bigger rules.

- Getting Help: Sometimes, the rules and laws can be hard to understand. The trustee can talk to a lawyer to get help. It’s like asking a referee for help when the game rules are confusing.

Preparing to Draft the Trust Distribution Letter

Before you can write It, there are some steps to follow to prepare:

Gathering Necessary Information Regarding the Trust Assets and Beneficiaries:

- Make a List of Assets: First, make a list of all the things in the trust that will be given to others. It’s like making a list of all the toys that will be shared.

- Who Gets What: Write down who should get each item from the trust. It’s like deciding which friend gets to play with which toy.

Consulting with Legal Professionals to Understand the Implications and Correct Procedure:

- Talk to a Lawyer: Before writing the letter, it’s a good idea to talk to a lawyer. They can help explain the rules and how to write the letter correctly.

- Learn the Rules: Understand the rules you have to follow to share the things in the trust.

Ensuring Compliance with the Terms of the Trust and Legal Requirements:

- Follow the Trust Rules: Every trust has rules that need to be followed. It’s like how every game has rules to make sure it’s played fairly.

- Check the Laws: Some laws say how trusts should be handled. It’s like how there are rules for playing a game safely.

Key Components of a Trust Distribution Letter

Writing a trust distribution letter is like making a list before going to a store. Certain parts of the letter are really important to make sure everything goes to the right person.

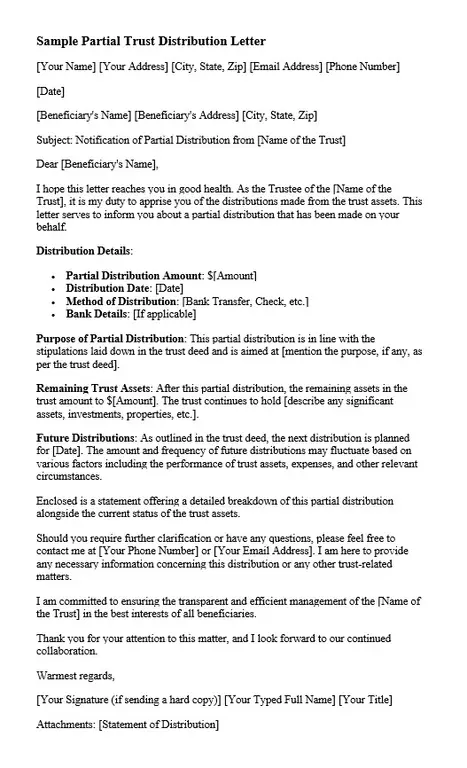

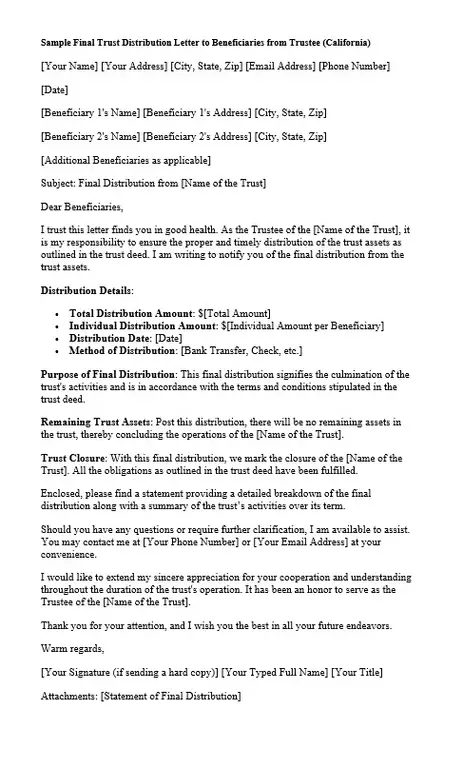

Heading and Addressing:

- Who is Sending the Letter: At the top of the letter, you write your name and address because you are the one sending the letter. It’s like writing a letter to Santa; you start with “From: [Your Name].”

- Who is Getting the Letter: Then, you write the name and address of the person you are sending the letter to. It’s like writing “To Santa, North Pole” on the envelope.

Trust Information:

- What is the Trust: Here, you write about the trust, like what it’s called and when it was made.

- Who is in Charge: You also tell who is in charge of the trust, usually, it’s the person writing the letter. It’s like saying who the leader of the team is.

Asset Distribution:

- List of Items: Now you make a list of all the things in the trust that are going to be given away, like toys or money. It’s like making a list of toys you are sharing with friends.

- Who Gets What: Next to each item, you write the name of the person who gets it. It’s like saying, “The soccer ball goes to Tim, and the toy car goes to Sara.”

Legal Disclaimers and Notices:

- Important Notices: Sometimes, there are important things that need to be said in the letter, like warnings or rules. It’s like saying, “Be careful; the toy car goes really fast!”

- Following the Rules: This part also says that everything in the letter follows the rules of the trust and the law. It’s like saying, “All the toys are shared fairly according to the rules.”

Writing Tips for Clarity and Compliance

Here are some tips to make the letter easy to understand and correct:

Using Clear, Straightforward Language:

- Simple Words: Use simple words that are easy to understand. It’s like saying, “Go ahead three spaces” instead of “Advance by a trio of spaces.”

- Short Sentences: Keep your sentences short and to the point. It’s like saying, “Roll the dice, move your piece.”

Ensuring All Legal Terms are Correctly Used and Explained:

- Use the Right Terms: Sometimes, you have to use special words that are important for the trust. Make sure you use them the right way.

- Explain the Terms: If you use a special word, explain what it means.

Organizing Information in a Logical, Easy-to-Follow Manner:

- Order: Put things in an order that makes sense. Talk about what the trust is, who gets what, and then any other important notices.

- Headings: Use headings to separate different parts of the letter.

Why is a Trust Distribution Letter Important?

A trust distribution letter plays a big role, just like a referee in a game. It helps make sure that everything is shared fairly and according to the rules. Here’s why it’s important:

Clear Instructions:

The letter gives clear instructions on who gets what from the trust.

Avoids Confusion:

With this letter, there might be clarity and disagreements.

Follows the Law:

The law says that trusts need to have a letter like this to share things.

Records Keeping:

The letter is a record of how the treasures in the trust were shared.

Helps Beneficiaries:

People who are getting something from the trust, called beneficiaries, will know what they are getting and why.

Shows Fairness:

The letter shows that everything is being shared fairly and that the person who made the trust wanted.

Legal Protection:

If someone is not happy with how things are shared, the letter can help show that everything was done the right way.

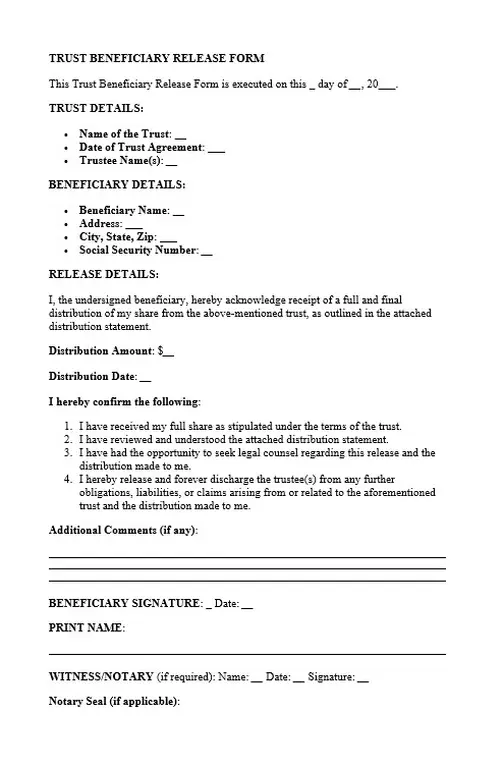

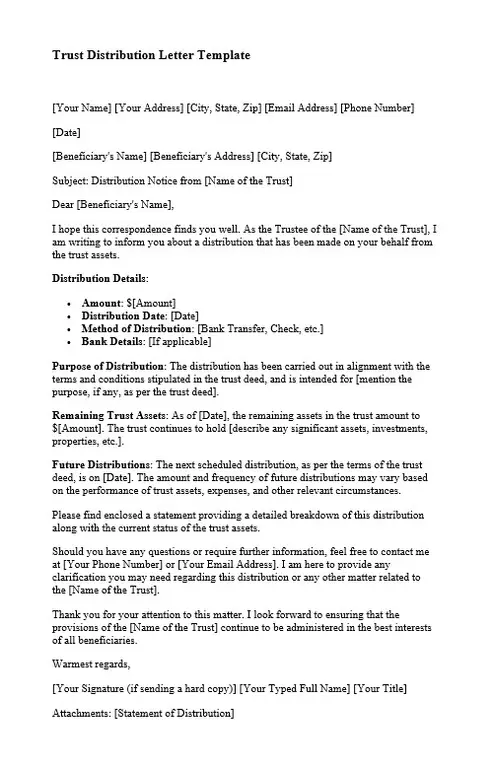

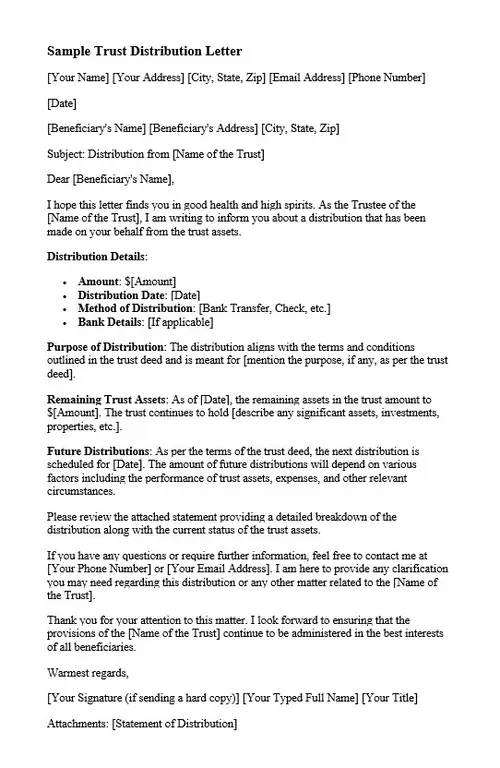

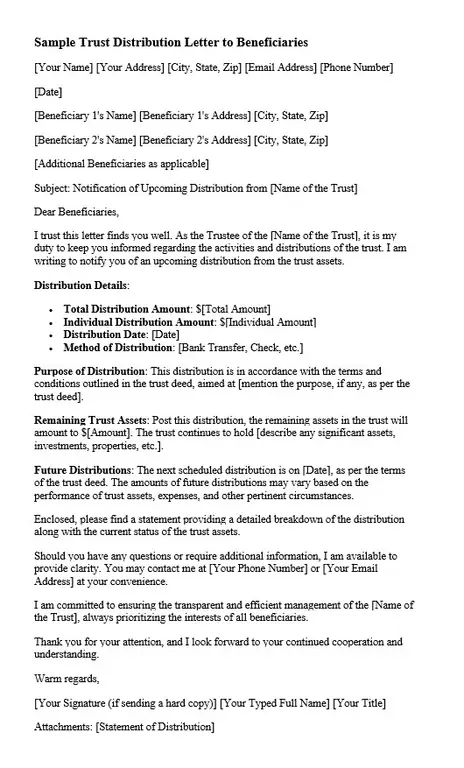

Trust Distribution Letter Sample

Here’s a simple example of what the trust distribution letter sample might look like. This example is made up, but it shows how to organize the letter.

Common Mistakes to Avoid

Here are some common mistakes and how to avoid them:

Inaccurate Asset Information:

- Wrong Details: Sometimes, the details about the things in the trust can be wrong. It’s like saying there are 10 soccer balls when there are only 8. Make sure to double-check all the details to get them right.

- Missing Items: Other times, some items might need to be remembered and mentioned in the letter. It’s like forgetting to mention the goal nets for the soccer game. Make a complete list and check it twice to make sure everything is present.

Overlooking Beneficiaries:

- Missing Names: It’s a big mistake to forget to mention someone who should get something from the trust. It’s like leaving a friend out of a team by accident. Make sure to have a complete list of everyone who should be mentioned in the letter.

- Wrong Addresses: Sometimes, the addresses or other details for the beneficiaries might need to be corrected. It’s like sending an invitation to the wrong house. Double-check all the details to make sure they are correct.

Not Adhering to Legal and Trust Stipulations:

- Not Following Rules: The trust and the law have special rules that need to be followed. It’s like not following the rules of a game. Make sure to understand and follow all the rules when writing the letter.

- Not Asking for Help: If something needs to be clarified, it’s a mistake not to ask for help. It’s like not asking the game rules if something needs to be clarified.

Reviewing and Sending the Trust Distribution Letter

Here are some steps to follow:

Having the Letter Reviewed by Legal Counsel:

- Check with a Lawyer: Before sending the letter, it’s a good idea to have a lawyer look at it. They can make sure all the rules are followed correctly. It’s like having a referee check the field before a game starts.

- Make Any Changes: If the lawyer finds anything that should be fixed, make sure to fix it. It’s like moving a soccer net to the right spot if it’s in the wrong place.

Ensuring All Necessary Parties Receive a Copy:

- Make a List: Make a list of everyone who needs to get the letter.

- Send the Letter: Send the letter to everyone on the list.

Keeping a Copy for Your Records and Following Up as Necessary:

- Keep a Copy: Always keep a copy of the letter for yourself. It’s like keeping a score sheet from a game so you know what happened.

- Follow-up: If there are any questions or if anything else needs to be done, make sure to follow up.

Sending out the trust distribution letter is a big step in sharing the things in the trust.

Writing a trust distribution letter sample is important. It’s like making a plan to share toys or treats at a party. It’s good to talk to a lawyer to make sure the letter is written the right way.

For more help, you can talk to a lawyer or look for books and websites about trusts and how to write a letter. It’s like finding a rule book for a new game.

FAQs

Who writes the Trust Distribution Letter?

The person in charge of the trust called the trustee, writes the letter. They are like the game leader who helps everyone play by the rules.

When is the Trust Distribution Letter sent?

The letter is sent when it’s time to share the treasures from the trust. It’s like announcing the start of a game.

Can I get help to write the Trust Distribution Letter?

Yes, you can talk to a lawyer who knows about trusts to help write the letter.

What happens if a mistake is made in the Trust Distribution Letter? If there’s a mistake, it might cause confusion or problems sharing the treasures.

How do I make sure everyone gets the letter? You can send the letter by mail or email and ask everyone to tell you when they get it.

What if someone is not happy with what they are getting from the trust? Sometimes, people might be unhappy with what they get. If this happens, it’s good to talk to a lawyer to understand what to do next.

Where can I find more help or information about Trust Distribution Letters?

You can talk to a lawyer, look for books about trusts, or search for information online.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.