Free Cash Flow Statement Template & Methods – Understanding the financial health of your business is crucial for its growth and sustainability. One key financial statement that provides this insight is the Cash Flow Statement. This document presents a detailed view of your business’s cash inflows and outflows over a specific period, covering three main areas: operations, investing, and financing.

The Cash Flow Statement is a critical tool for business planning, decision-making, and financial management. It helps you understand how your business generates and spends cash, enabling you to identify opportunities for expansion and investment. Furthermore, it aids in maintaining proper cash outflow and inflow, crucial for the accuracy of the statement.

This article will guide you through the intricacies of the Cash Flow Statement, including its creation, the methods used (accrual and cash-based systems), and its role in business expansion and investment decisions. We will also provide templates and real-life case studies for better understanding and application. Whether you’re a small business owner, an investor, or an individual seeking to manage personal finances, this comprehensive guide to Cash Flow Statements will prove invaluable.

What is the Cash Flow Statement

A Cash Flow Statement or CFS is one of the main financial statements that will provide you with the average data for all the cash inflow received by the company and the cash outflow, which the company pays for the investments and operations. Two methods and two forms of accounting are used to make a CFS, including the accrual and cash-based systems.

How To Create A Cash Flow Statement

Creating a cash flow statement involves three main steps, each corresponding to one of the three sections of the statement: operating activities, investing activities, and financing activities.

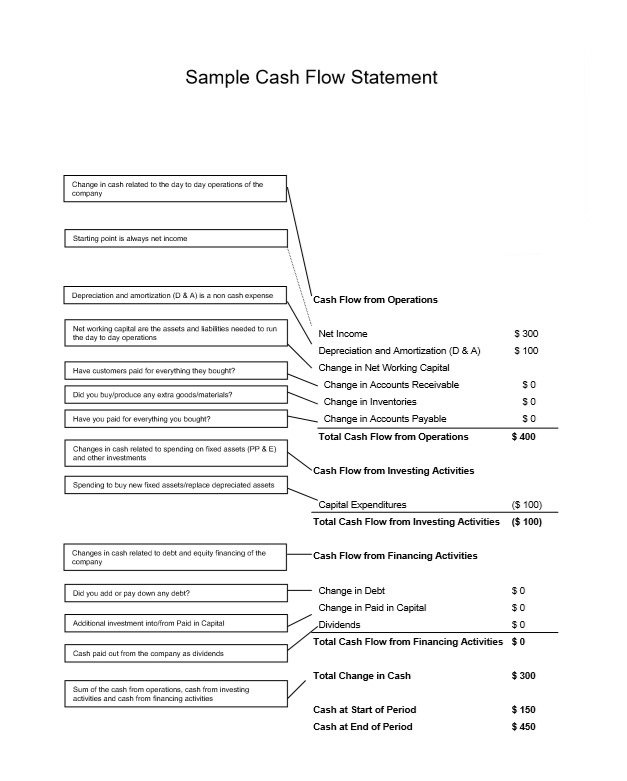

There are three components of the cash flow statement template.

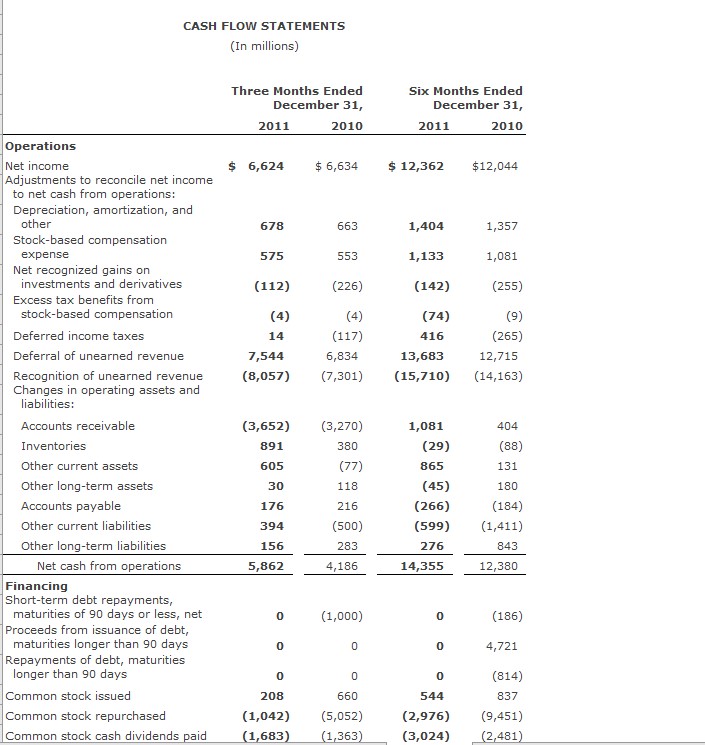

- Cash Flow from Operations

The first component is the cash flow from the operational business activities. This component will measure the cash inflows and outflows from the core. This component will also show you the amount of cash generated from the company’s products and services. Not only that, but this component also shows the changes occur in the inventory, depreciation, accounts receivables, accounts payables, and cash.

- Cash Flow from Investing

The second component is from the investment. Things which are related to investments such as equipment and assets belong to this component. In this component, when the cash is used to buy new assets such as equipment, buildings or marketable securities, the cash changes from investment to a cash-out item. Meanwhile, when the company divests from an asset, the transaction will change into a cash-in item.

- Cash Flow from Financing

The last component in the cash flow statement is from the financing. Loans, debts, and dividends belong to this component. The transaction in this component is counted as a cash-in item as soon as the capital is raised.

Cash Flow Statement Methods

When creating a cash flow statement, companies can choose between two primary methods: the accrual method and the cash-based method. Both methods have benefits and drawbacks, and the choice between them often depends on the specific needs and circumstances of the industry.

Accrual Method

The accrual analysis method recognizes gains and fees when made or incurred, regardless of when the money trade occurs.

This method delivers a more comprehensive view of a company’s financial condition, containing all financial activities, not just those involving immediate cash transactions.

However, it can also make it more difficult, as there can be a significant time gap between when income is identified and when the money is accepted.

Cash-Based Method

On the different hand, the cash-based method of accounting records trades when cash reverses indicators.

This process can deliver a clearer view of a company’s cash flow at any given moment, as it just has transactions resulting in an immediate inflow or outflow of cash.

However, it may not reflect a company’s long-term financial health accurately, as it doesn’t account for commitments or future payments.

Smaller businesses or those with simpler financial structures prefer the cash-based method due to its simplicity and focus on cash flow. Larger businesses or those with more complex financial structures might opt for the accrual, as it delivers a better comprehensive view of the company’s financial health.

It’s important to note that once a company chooses a method, it should stick with it for consistency in financial reporting. Switching between methods can lead to clarity and make it easier to track financial trends over time.

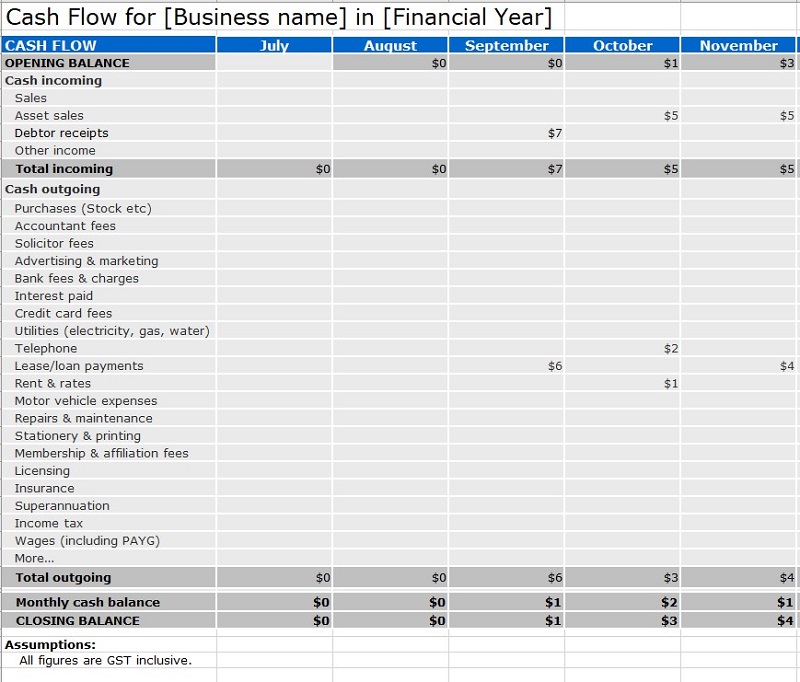

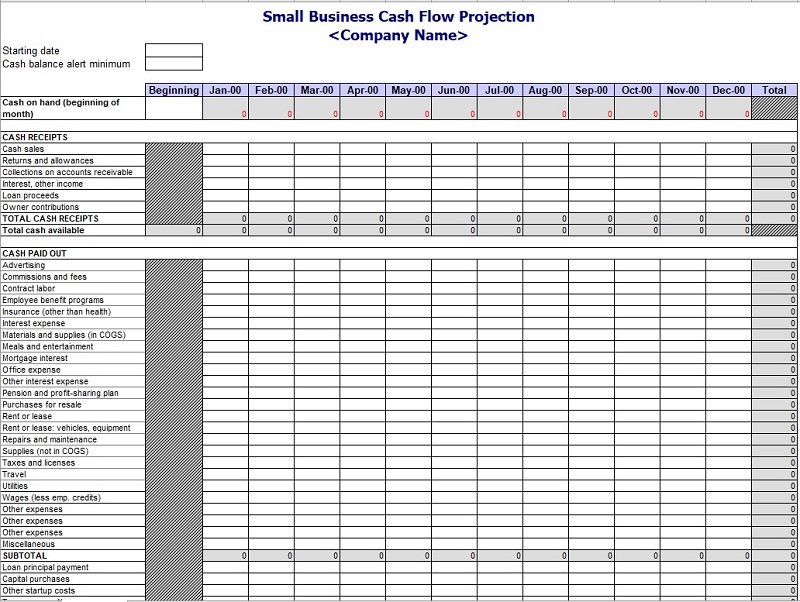

Small Business Cash Flow Statement

This financial record tracks the cash flow in and out over a typical time. It helps business owners comprehend their processes, where their money arrives, and how it is paid. It is vital for financial planning, budgeting, and providing the business has enough money to cover costs.

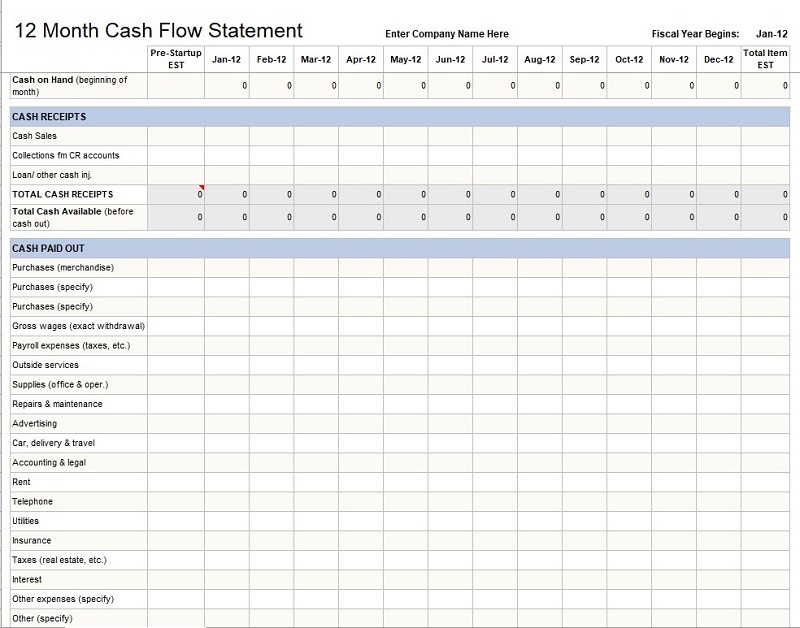

Example of Cash Flow Forecast

It predicts a company’s financial situation based on anticipated payments and receivables. It is employed to estimate the funds that will drift into and out of the company during a future time. For example, a cash flow projection might include projected sales revenues, estimated operating costs, and expected capital costs.

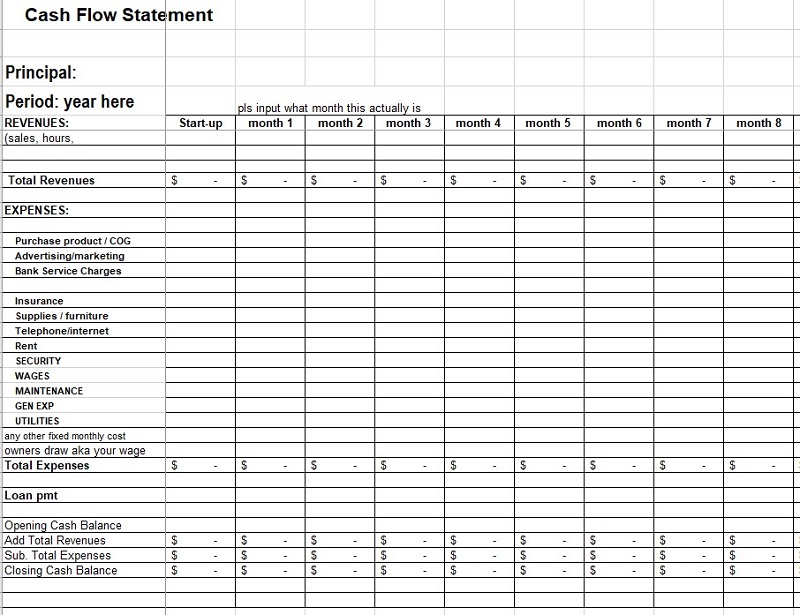

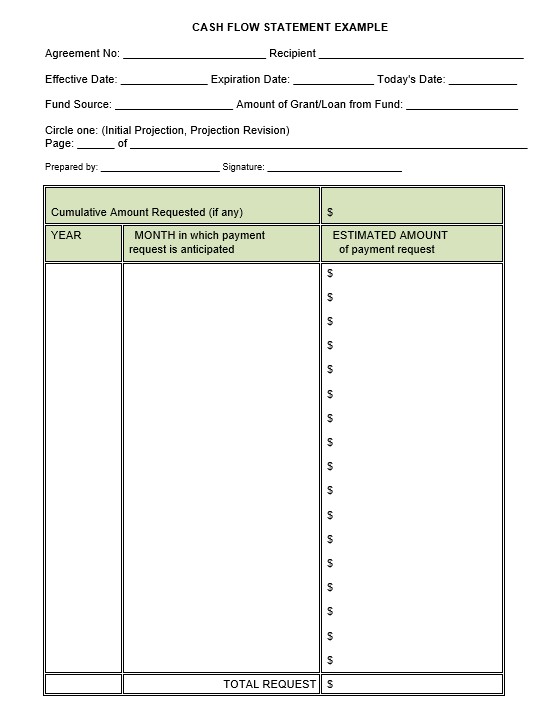

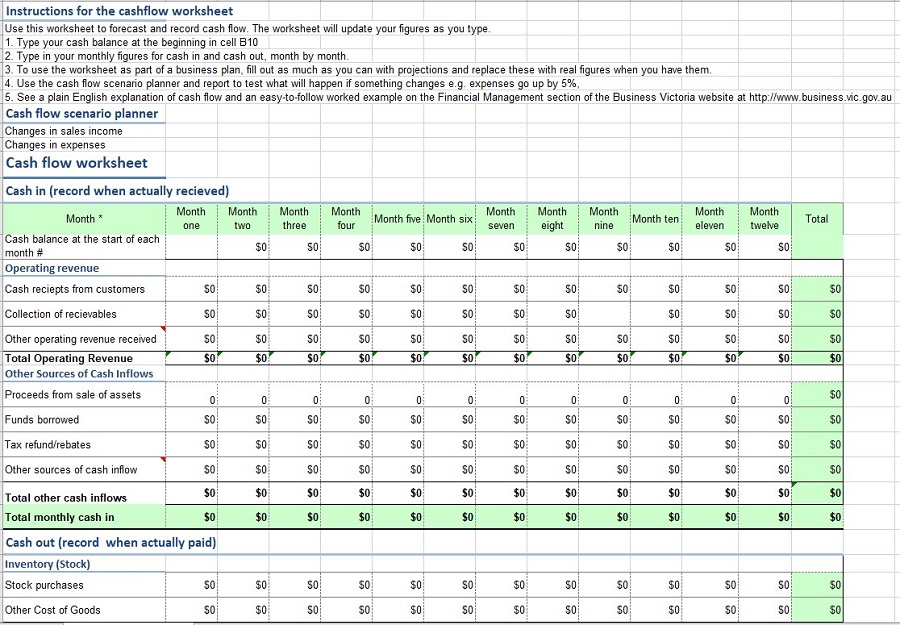

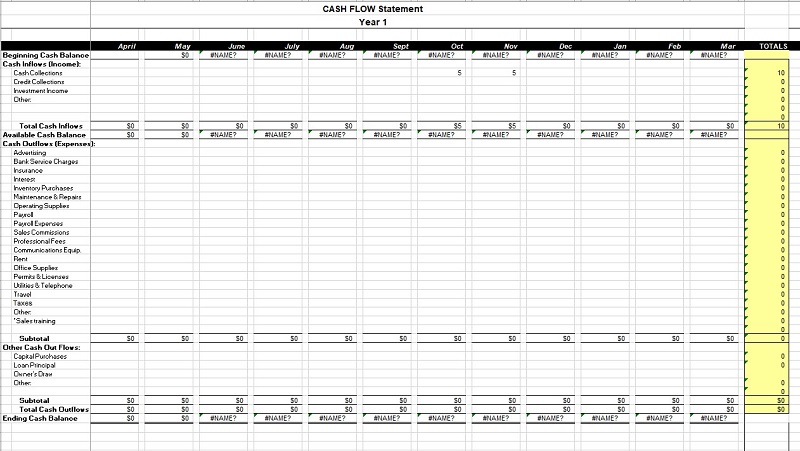

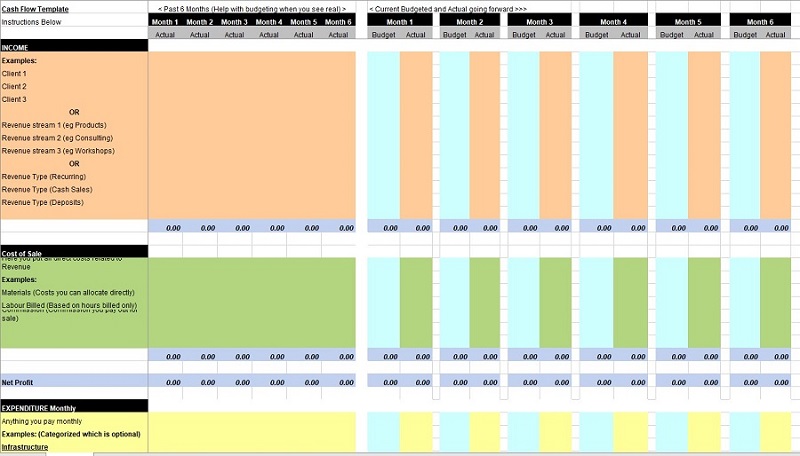

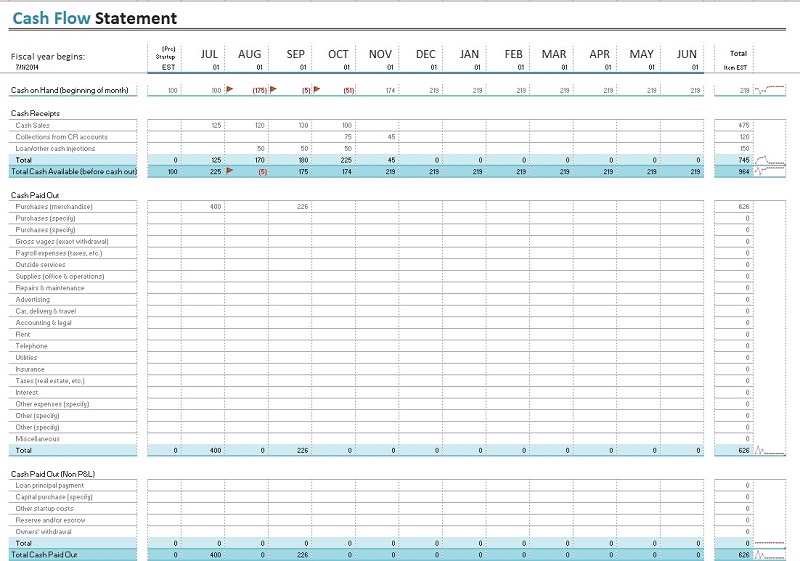

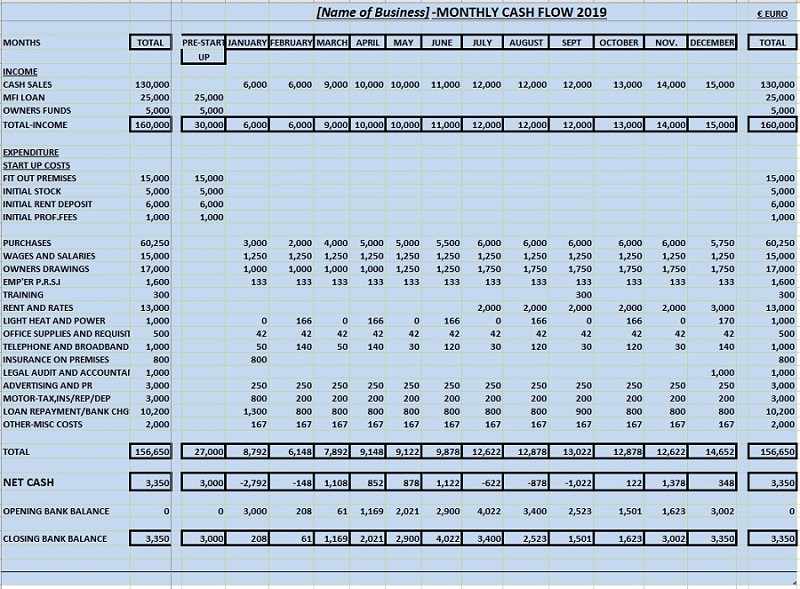

Monthly Cash Flow Statement Template

It is a pre-formatted copy that supports companies in tracking their cash in and out every month. It generally has sections for money from running actions, investing, and financing. This template can be customized to suit a company’s requirements and is good for monitoring cash flow and resolving possible financial problems early.

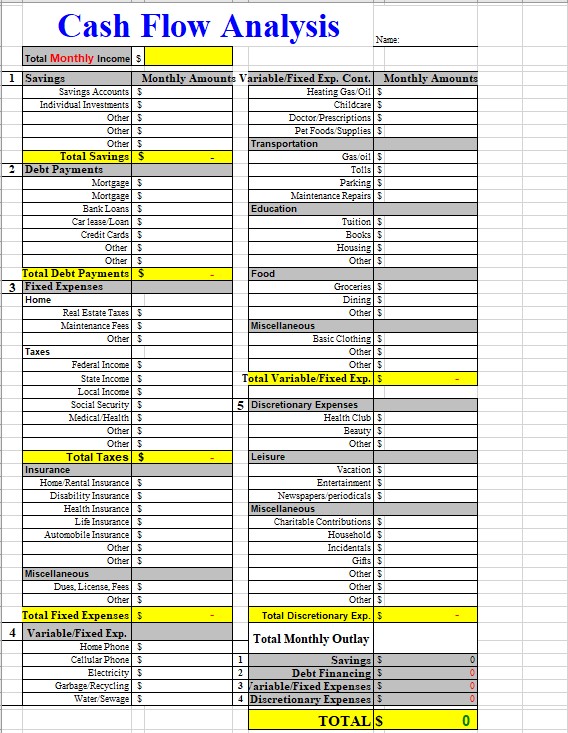

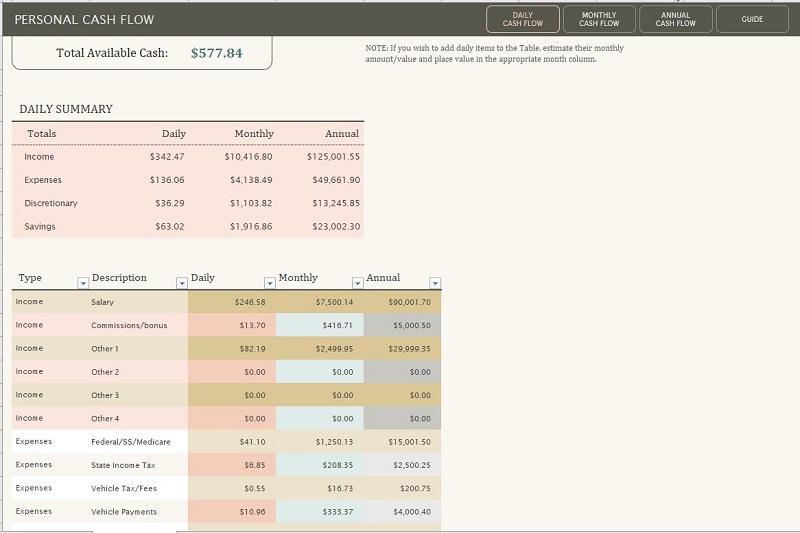

Personal Cash Flow Statement

It is a record that individuals use to track their revenue and costs over a specific time. It assists individuals in understanding where their cash is arriving from and where it is being spent. It is vital for personal financial planning and budgeting, helping individuals manage their finances effectively and achieve their goals.

Using Cash Flow Statement Templates

Cash flow statement templates can simplify creating a cash flow statement, saving time and ensuring accuracy. Here’s a guide on how to use them:

- Finding Templates

Cash flow statement templates are readily available online. Websites like Microsoft Office, Google Docs, and various financial education websites offer free templates. Choose a template that fits your business needs and is easy to understand and use.

- Understanding the Template

Before filling in the template, take some time to understand its structure. Most templates are divided into three sections:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

Each section has different line items that represent various cash inflows and outflows.

- Customizing the Template

While templates provide a general structure, you may need to customize them to fit your business. Add or remove line items as necessary to accurately represent your company’s cash flows. Remember to keep the overall structure intact to maintain the statement’s integrity.

- Filling in the template

Once you’ve customized the template, start filling in the data. Be sure to use accurate figures from your financial records. Consult with a financial advisor or accountant if you need clarification.

- Reviewing the Statement

After filling in the template, review the statement to ensure accuracy. Check the calculations and ensure the total cash inflow and outflow match your financial records.

- Updating the Statement

A cash flow statement should be updated regularly, typically every quarter or year. Regular updates ensure the statement accurately reflects your company’s current financial status.

Cash flow statement templates are valuable for creating accurate and professional cash flow statements. They simplify the process, ensuring you get all crucial information.

Challenges and Potential Risks

Like any financial tool, they come with their own set of challenges and potential risks. Here are some of the most common ones:

- Accuracy of Information: The accuracy depends on the information used to create it. If the underlying data is incorrect or incomplete, It will not provide a true picture of a company’s cash flows.

- Timing of Cash Flows: These only capture cash inflows and outflows during a specific period. They do not account for that occurring outside of this period. It can lead to a distorted look at a company’s money position if significant cash flows occur just after the end of the period.

- Non-Cash Transactions: These do not account for non-cash transactions like depreciation or stock-based payment. These transactions can significantly impact a company’s financial position but are not contemplated in the cash flow statement.

- Predicting Future Cash Flows: These can provide valuable insights into a company’s past and present, but they are not a reliable predictor of future cash flows. It is because various factors, containing differences in market conditions, business strategy, and unforeseen events, can influence future cash flows.

- Overemphasis on Cash Flow: These measure a company’s financial health. It is not the only step. Overemphasizing cash flow at the cost of other financial metrics, such as profitability or return on investment, can lead to a skewed understanding of a company’s financial position.

By being aware of these challenges and potential risks, companies can take steps to mitigate them and ensure that their cash flow statements provide a reliable and accurate picture of their financial health.

Case Studies of Effective Cash Flow Management

Understanding the theory behind cash flow management is one thing, but seeing it in action can provide valuable insights. Here are a few real-life examples of businesses that have effectively managed their cash flow:

- Tech Startup:

A tech startup faced cash flow issues due to high operational costs and slow customer payments.

To manage this, they implemented a strict invoicing and follow-up system to speed up customer payments.

They also negotiated longer payment terms with their suppliers, giving them more time to collect from their customers before paying their bills. It improved their cash flow and allowed them to continue growing their business.

- Retail Business:

A retail business was experiencing seasonal fluctuations in cash flow, with high sales during the holiday season but slow sales during the rest of the year.

To manage this, they developed a detailed cash flow forecast to anticipate these fluctuations.

They also diversified their product range to attract customers year-round, smoothing their cash flow.

- Manufacturing Company:

A manufacturing company had a large amount of cash tied up in inventory.

They implemented a just-in-time inventory system to improve their cash flow, reducing the amount of cash tied up in unsold goods.

They also negotiated better terms with their suppliers, reducing the cash needed for purchases.

These case studies illustrate the importance of proactive cash flow management. By implementing effective strategies and regularly monitoring their cash flow, these businesses were able to improve their financial health and support their growth.

Cash Flow Statements in Investment Decisions

The cash flow statement is a critical financial document that can significantly influence investment decisions. Here’s how:

- Identifying Investment Opportunities

A cash flow statement can help businesses identify potential investment opportunities. For instance, a consistent boost in cash flow from working actions might show a healthy company model, suggesting that the business could benefit from further investment.

- Evaluating Financial Health

Investors often look at the statement to consider a company’s financial health. A company that develops powerful cash flow will likely be financially stable, making it a potentially safe investment.

- Understanding Cash Flow Trends

Companies and investors can learn about a business’s financial stability by studying trends. For example, a company increasing it over several periods may be considered a growing business, making it an attractive investment opportunity.

- Making Informed Investment Decisions

It provides a detailed report about a company’s cash inflows and outflows, which can be utilized to create knowledgeable asset judgments. For example, a company with strong cash flow from processes but significant cash outflows for investing movements might be investing heavily in its growth, potentially indicating a good long-term investment.

- Comparing Companies

Investors can use statements to reach companies within the same industry. A company with a stronger cash flow than its competitors could be a more attractive investment.

The cash flow statement recreates a vital part of investment findings. It delivers a useful understanding of a business’s financial health, allowing businesses and investors to create knowledgeable decisions.

Cash Flow Statement in Business Expansion

A cash flow statement is a financial document that thoroughly analyzes how a business receives and utilizes money. Role of Cash Flow Statement in Business Expansion:

- A strong, positive cash flow shows that a company generates additional money than it uses. This surplus cash can be reinvested into the business for growth and expansion.

- Expansion usually needs a significant upfront acquisition, and a business must ensure it has enough money to protect these costs without jeopardizing its operational stability.

- By examining it, a business can determine if it has enough cash from its operating activities to cover expansion costs.

- The cash flow statement can also help a business time its expansion. For example, a business might see that its cash flow from working activities tends to be higher in certain quarters. It may then time its expansion to coincide with these periods of higher cash inflow.

Real-world Example: Starbucks, the global coffeehouse chain, has used its strong cash flow to fund its aggressive global expansion. By generating a healthy cash flow from its existing stores, Starbucks has been able to invest in opening new stores worldwide without taking on excessive debt.

Other Factors to Consider: While a strong cash flow can indicate a good position for expansion, it’s not the only factor to consider. Businesses must also consider market conditions, competition, and overall business strategy.

The cash flow statement is a crucial tool for businesses considering expansion. It clearly shows a business’s ability to develop money and fund growth, supporting companies in making notified, strategic decisions regarding when and how to expand.

FAQS

Why is my cash flow from operating activities negative?

A negative cash flow from operating activities could indicate that your business is spending more money on its operations than it’s making. This could be due to high operating expenses, low sales revenue, or a combination. Identifying the cause and taking steps to improve operational efficiency is important.

How can I improve my cash flow from operating activities? You can improve your cash flow from operating activities by increasing sales revenue, reducing operating expenses, or improving your collection process for accounts receivable. Regularly reviewing and managing your inventory can also help to free up cash.

Is it bad if my cash flow from investing activities is positive?

A positive cash flow from investing activities is not necessarily bad. It could mean that your business is selling off assets or making profits from investments. However, if this is a regular occurrence, it might indicate that your business is not investing enough in its future growth.

What does it mean if my cash flow from financing activities is negative?

A negative cash flow from financing activities could mean your business is paying off debt, repurchasing shares, or distributing dividends to shareholders. While these activities can reduce cash reserves, they can also be signs of a financially healthy business.

How often should I update my cash flow statement?

The frequency of updating your cash flow statement depends on the size and nature of your business. However, updating your cash flow statement monthly is generally recommended to keep track of your financial position and make informed business decisions.

How can I use my cash flow statement to make better business decisions?

A cash flow statement provides valuable insights into your business’s financial health. By analyzing your cash flow statement, you can identify trends, plan for future cash needs, make informed investment decisions, and evaluate the effectiveness of your financial management strategies.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.