Are public records dragging down your credit score? You’re not alone. Many people discover errors or outdated information on their reports that unfairly impact their financial lives. But here’s the awesome news: you have the power to fight back!

A public record removal letter template is like a magic eraser for your credit report. It’s a simple letter you write to ask the credit reporting companies to fix those mistakes. This guide will show you everything you need to know about public records, how they mess with your credit, and most importantly, give you a free template to write your own letter. Get ready to take charge of your credit score and watch it soar!

What Are Public Records?

Think of public records as official notes about things that happened with your money or legal stuff. They can be good (like paying off your mortgage) or bad (like a bankruptcy). Here are some of the common ones that can mess with your credit score:

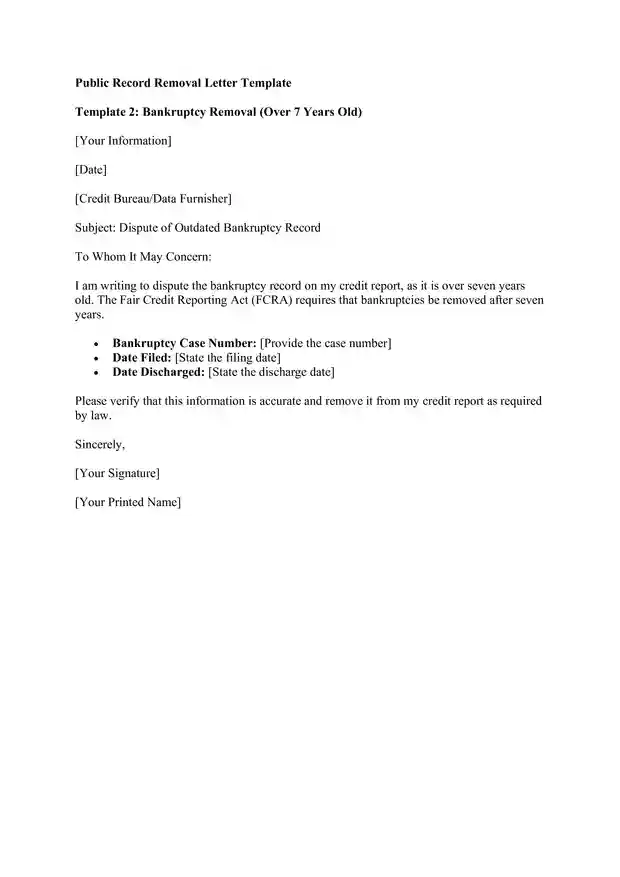

- Bankruptcy: This happens when you can’t pay your debts and it stays on your report for 7-10 years.

- Foreclosure: If the bank took back your house because you couldn’t pay, that’s a foreclosure.

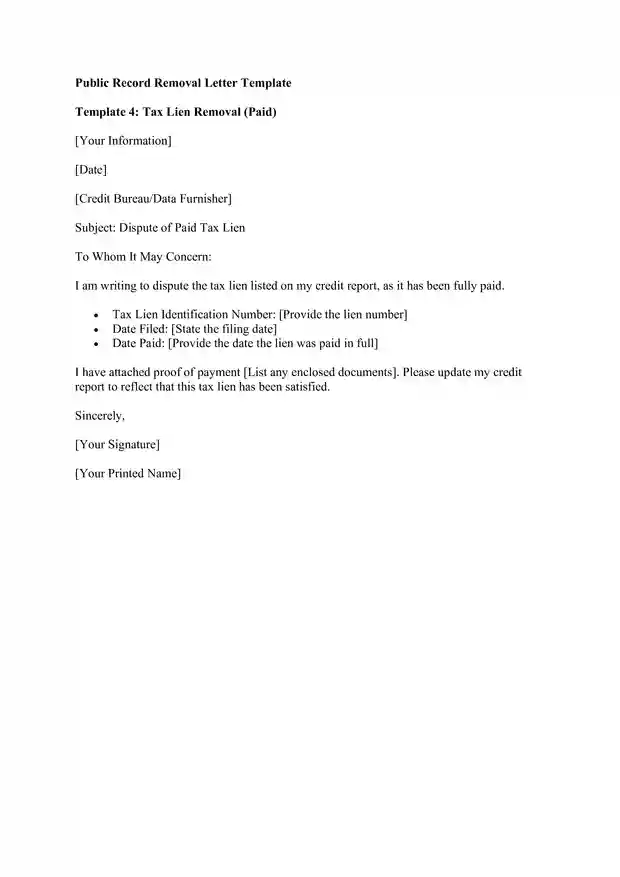

- Tax Liens: If you owe the government money for taxes, that’s a tax lien.

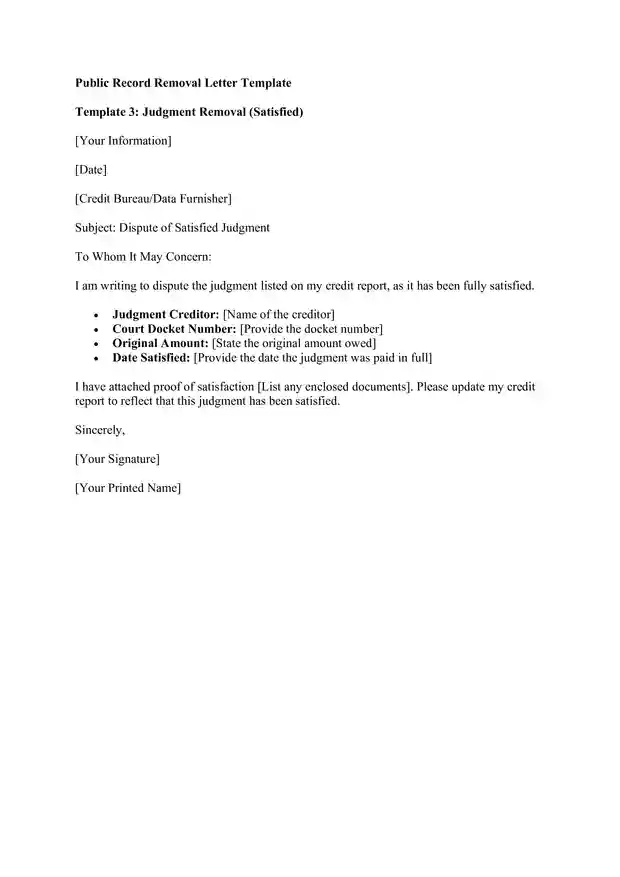

- Court Judgments: If you lost a court case and owe money, that’s a judgment.

Why Should You Care About Your Credit Report?

Your credit report is like a report card, but for grown-ups. It shows how well you handle money – paying bills on time, borrowing responsibly, and not getting into too much debt. And just like a good report card, a good credit report opens doors to awesome things:

- Borrowing Made Easy: Want a car or need a loan for college? A good credit report helps you get approved faster and at lower interest rates (meaning you save money).

- Save Money on Insurance: Insurance companies check your credit score too! A good score often means lower payments for your car, house, and even life insurance. Who doesn’t love saving money?

- Score Your Dream Apartment: When you’re looking for a place to live, landlords want to know you’ll pay your rent on time. A good credit report makes you look like a reliable tenant.

- Land the Perfect Job: Some bosses check credit reports too, especially for jobs where you handle money. A clean credit history shows you’re responsible and can help you get the job you want.

What If Your Credit Report Has Mistakes?

Mistakes on your credit report are like getting a bad grade when you actually deserve an A+. It’s not fair, and it can cause some problems:

- Paying More for Things: Even if you can get a loan, you’ll probably pay more in interest. It’s like paying extra just because someone made a mistake!

- Rejection Letters: You might get turned down for loans or credit cards. It’s like being told “no” when you know you deserve a “yes.”

- Harder to Find a Place to Live: Landlords might not want to rent to you if your credit report is wrong.

- Missed Job Opportunities: Some jobs might say no to you based on your credit.

But don’t worry, the law is on your side! The Fair Credit Reporting Act (FCRA) says you have the right to tell the credit reporting companies if they got something wrong, and they have to fix it!

How Did Those Mistakes Get There?

Credit reporting agencies (like Experian, Equifax, and TransUnion) collect tons of info from different places:

- Courts: They check to see if you’ve had legal trouble with money.

- Debt Collectors: They tell the credit companies if you haven’t paid a bill.

- Government: They report if you owe taxes.

- Creditors: Banks, credit card companies, and stores report how you handle your accounts.

Sometimes they mess up, mixing up your information with someone else, leaving old stuff on your report, reporting things that aren’t true, or even making typos.

Dispute vs. Removal: What’s the Difference?

- Dispute: This is like raising your hand in class and saying, “Hey, that’s not right!” You’re telling the credit company to check their facts.

- Removal: This is like getting the teacher to erase the wrong answer from your report card. If the credit company finds out they were wrong, they have to take the bad stuff off your report.

Writing Your Public Record Removal Letter: Your Credit Score Superhero

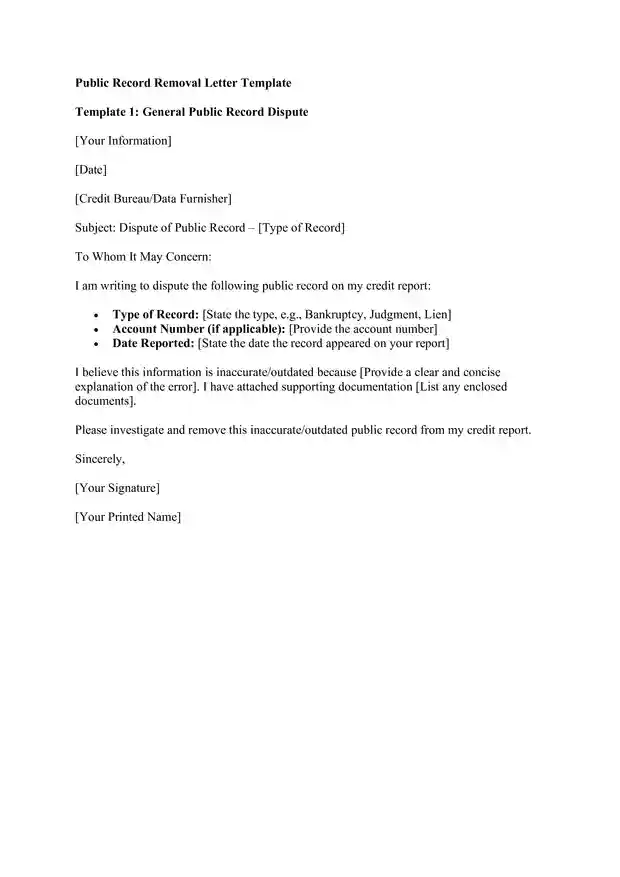

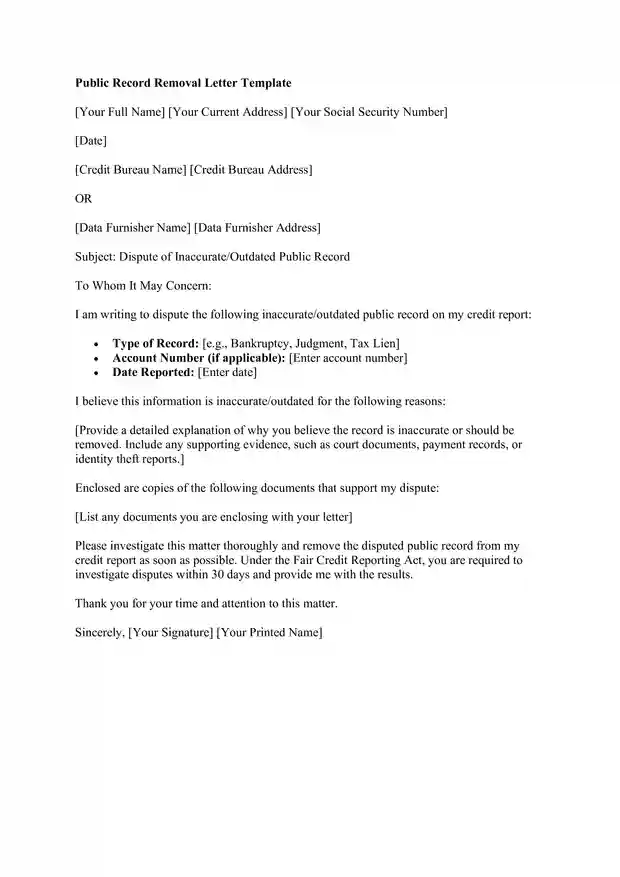

This isn’t just any letter – it’s your chance to be a superhero for your credit score! Here’s what your letter needs to do:

- Gather Your Information: Include your full name, current address, and Social Security number.

- Identify the Incorrect Public Record: Be specific! Say what the record is (bankruptcy, judgment, etc.), the date it was reported, and any account numbers.

- Explain Why It’s Wrong: Is it inaccurate? Outdated? Not yours? Explain the error in detail.

- Prove Your Case: Include any papers or proof you have that show the info is wrong. This could be court documents, payment records, or anything else that supports your claim.

- Make Your Request: Tell the credit reporting company that you want them to investigate and remove the incorrect record.

You can find lots of templates online, but don’t just copy and paste. Make sure the letter fits your specific situation. Then, send it off to the credit companies like a superhero swooping in to save the day!

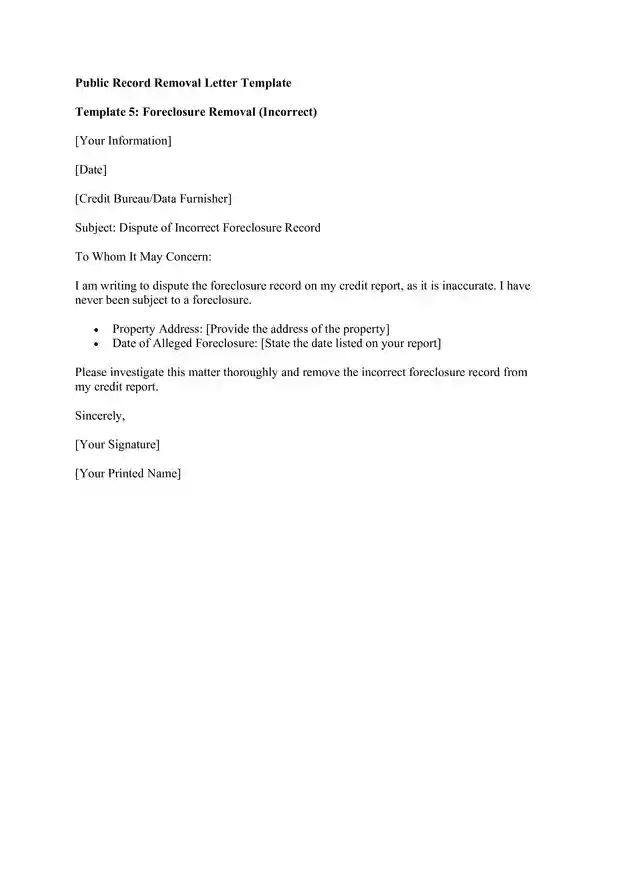

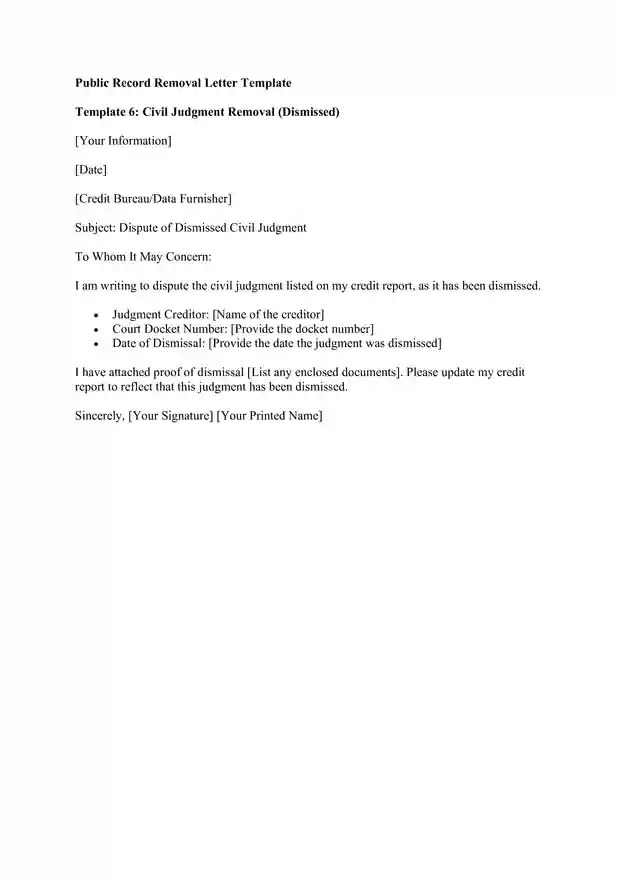

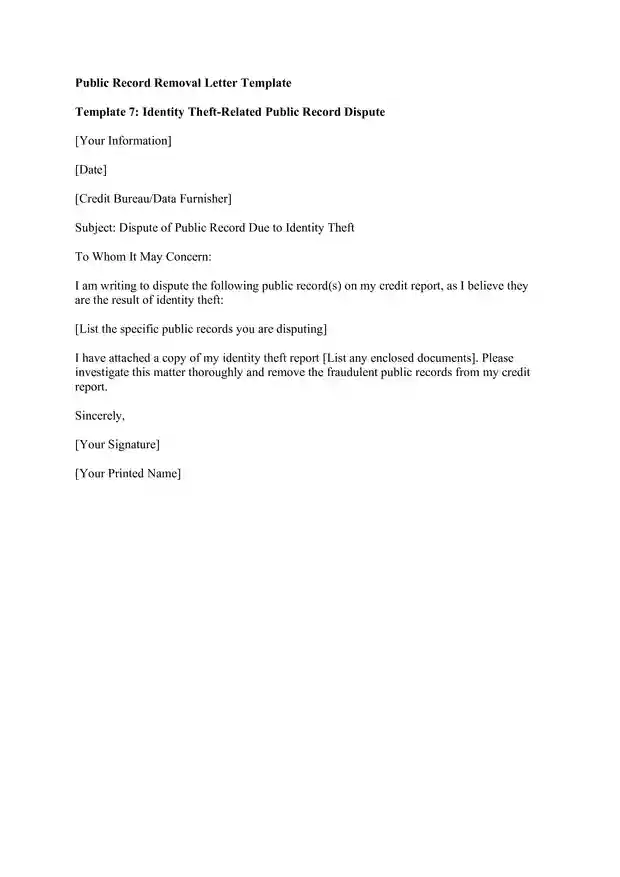

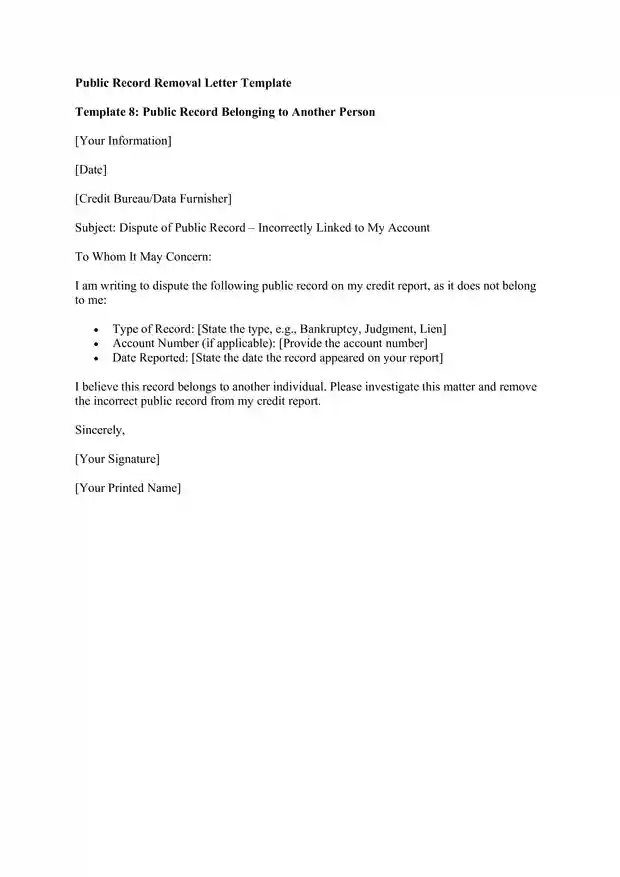

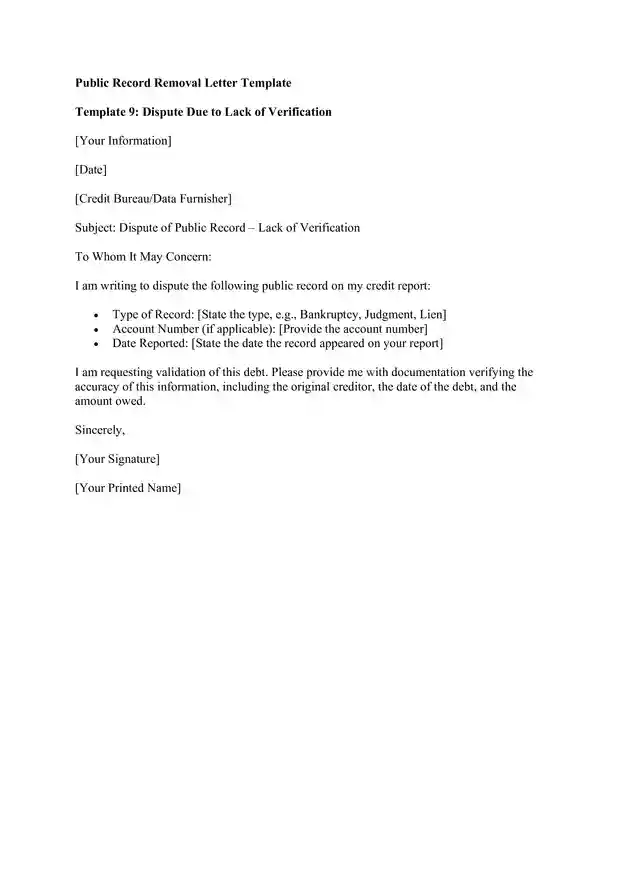

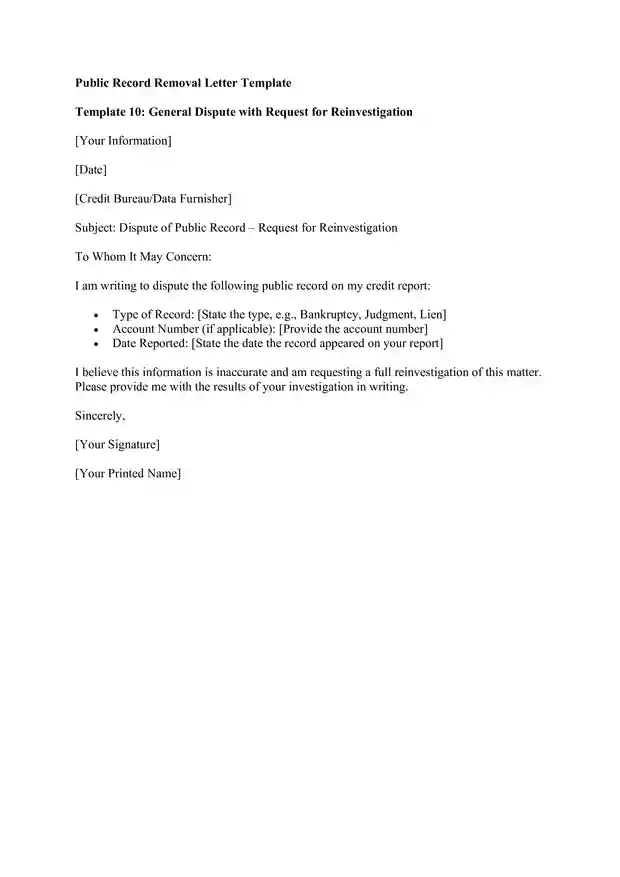

Public Record Removal Letter Template

Sending Your Letter and Staying on Top of It

Now that your letter is ready, it’s time to send it out and keep track of things:

- Send Copies: Send one to each of the three credit reporting companies (Experian, Equifax, and TransUnion). Also, send one to the company that gave them the wrong information (this is called the “data furnisher“).

- Certified Mail is Best: This way, you get a receipt proving they got your letter.

- Be Organized: Keep a notebook to track when you sent the letters and any answers you get back.

- Don’t Give Up! It might take a while to get things fixed, but keep checking in.

- Ask for More Help: If you don’t get an answer or the problem isn’t fixed, you can contact the Consumer Financial Protection Bureau (CFPB). They can help you make a complaint.

How Long Does It Take to Remove a Public Record?

It depends on how complicated the mistake is. Simple typos might get fixed in a few weeks, but bigger problems could take months. The credit bureaus have 30 days to look into your dispute, but sometimes it takes longer. Be patient, and don’t give up!

The Laws Related to Public Record Removal

The FCRA is the law for your credit report. Here’s what it does for you:

- Right to Fight Back: If you find something wrong on your credit report, like a public record that doesn’t belong there, you have the right to tell the credit reporting businesses to fix it.

- Investigation Time: The credit companies must look into your dispute within 30 days (usually) and tell you what they find out.

- Erase Mistakes: If the data is wrong, the credit companies must remove it from your account.

- Old News is No News: Most negative information, even if it’s true, can’t wait on your report permanently. For example, bankruptcy usually goes away after 7-10 years.

It’s like having a referee on your side while playing a game. The FCRA ensures that credit reporting businesses observe the laws and feast you legally.

Negotiating with Creditors: The “Pay for Delete” Strategy

Sometimes, you might have an old debt dragging down your score. You can negotiate with the creditor to remove it from your report. This is called “pay for delete.” It’s like making a deal: you pay off the debt, and they agree to take it off your report.

If you’re thinking about this, check out our Pay for Delete Letter Template guide. It can help you write a letter to negotiate with your creditors.

Need More Help?

If you need a hand, some people can help:

- Government Agencies: The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) have tons of info and can assist if you require to create a complaint.

- Legal Aid: If you need a lawyer but can’t afford one, legal aid organizations can help.

- Credit Repair Companies: Be careful with these; some can help you fix your credit.

Conclusion

Your credit report is more than just a bunch of numbers – it’s a key to your financial future. It can open doors to opportunities like buying a car, renting an apartment, or landing your dream job. Don’t let errors or outdated dispute public records hold you back!

You can fix mistakes and improve your credit score with a well-written public record removal letter and a little persistence. A better credit score means a brighter financial future—lower interest rates, more financial freedom, and the ability to achieve your goals.

So what are you waiting for? Take control of your credit report today and unlock a world of possibilities!

Daniel Wilson Is a Seasoned communications professional and letter-writing expert. With over a decade of experience in corporate and non-profit sectors, Has developed a deep understanding of the power of effective communication.

Specializes in creating versatile letter templates that can be tailored to any situation. In this blog, Daniel shares a passion for the art of letter writing, offering practical tips, customizable templates, and inspiring ideas to help you communicate with clarity, confidence, and impact.