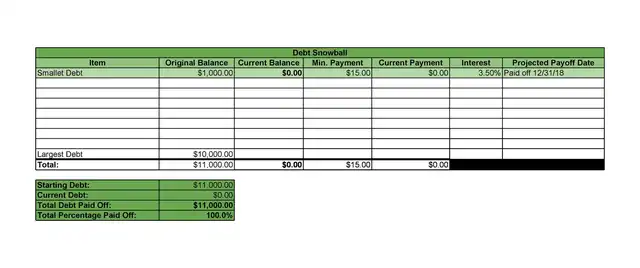

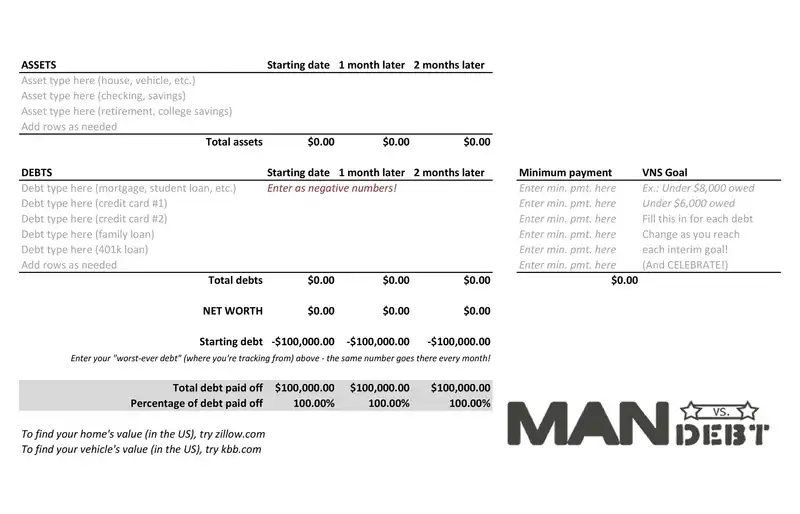

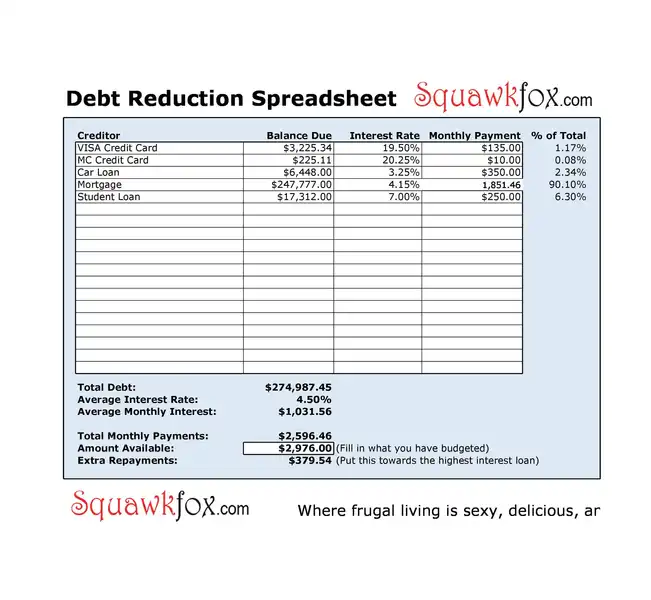

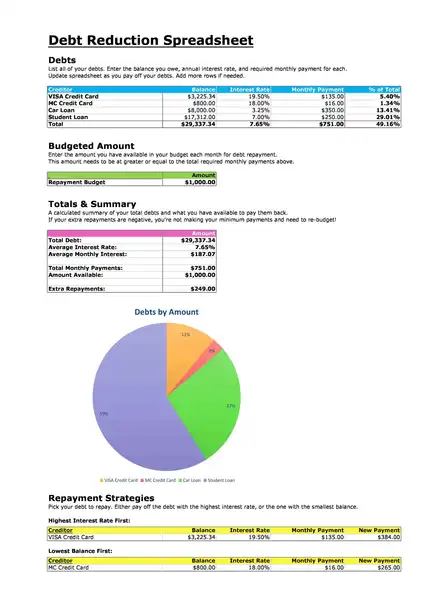

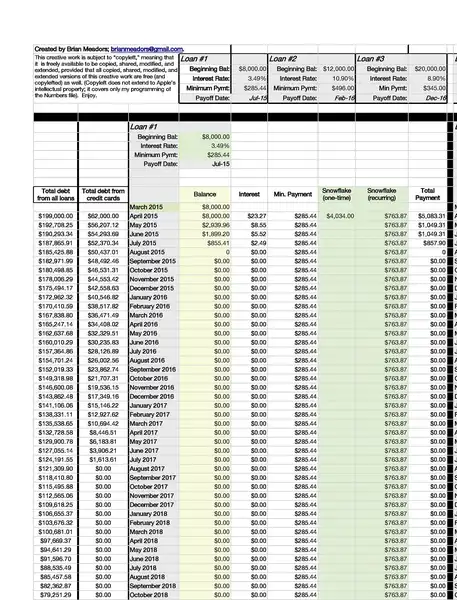

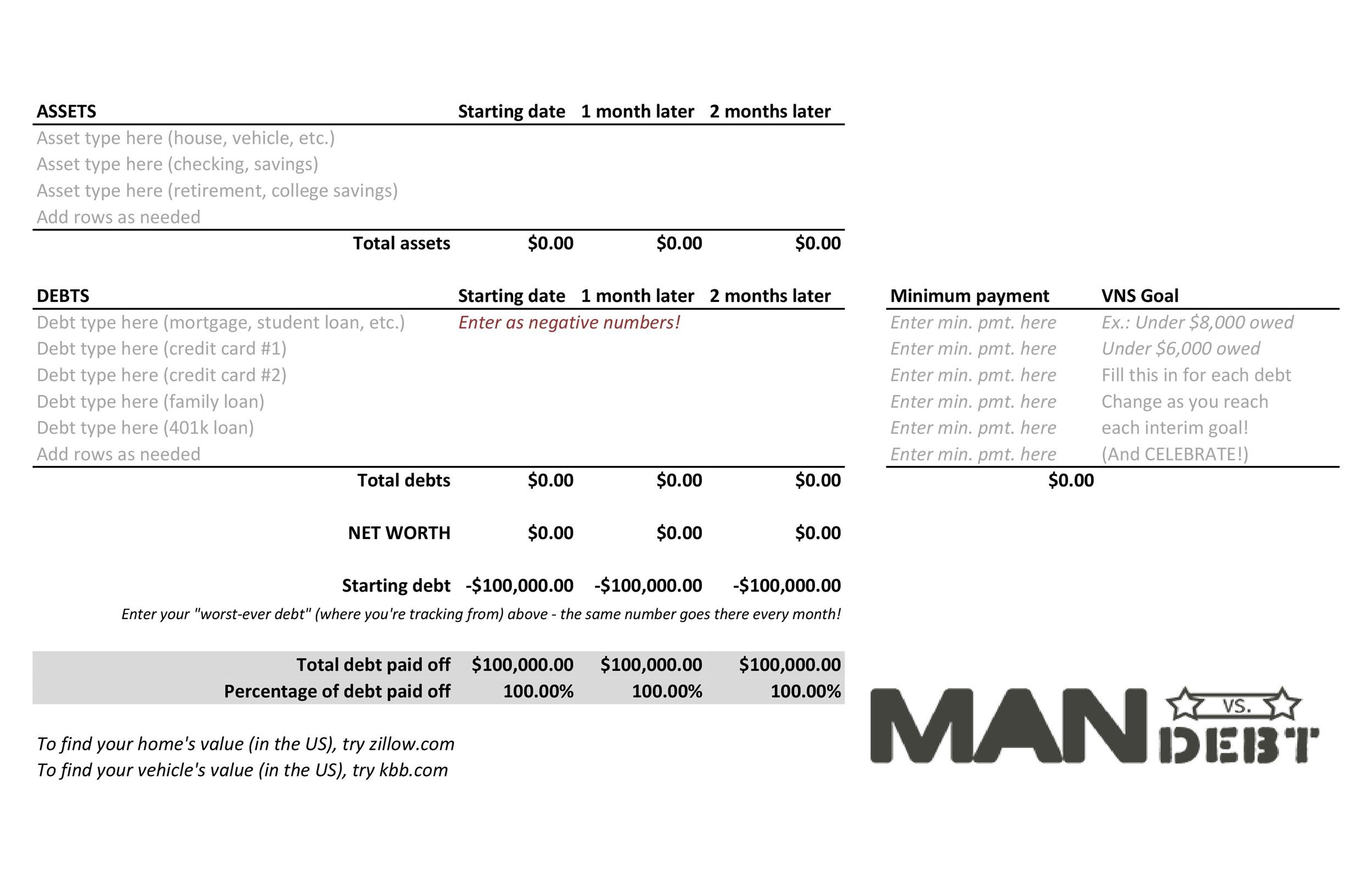

To track the payments you made, you can use debt snowball templates or the debt payoff spreadsheet. You can use this form to list and add all debts to get the total. Then you can plan how much you will set aside monthly for your debts. To see the progress of your debt, you can use this debt reduction calculator.

It offers advantages, including psychological motivation, simplicity, improved financial habits, debt reduction, and financial freedom. However, it’s important to note that while the method can result in quick wins, it may also lead to higher long-term costs due to the potential for larger debts with higher interest rates accruing more interest over time.

Strategies can be employed by combining the debt snowball and avalanche or negotiating rates. Tools like debt snowball templates, calculators, and worksheets can also be utilized to organize, track, and visualize your debt repayment progress, making the journey to evolving debt-free more manageable and less overwhelming.

Debt Snowball Method

This technique prioritizes clearing debts from most minor to largest, irrespective of interest rates.

Critical Steps in the Debt Snowball Method

- Record Your Debts: Itemize all your deficits, banning from least to biggest. This index serves as your debt repayment roadmap.

- Make Lowest Payments: Provide you make the lowest prices on all your monthly obligations to bypass late fees or penalties.

- Concentrate on the Least Debt: Give any extra cash towards spending off the least debt on your inventory.

- Roll-Over Fees: Once the least debt is removed, proceed that cash into the charge for the next least debt, creating a ‘snowball impact’.

- Repeat Until Debt-Free: Continue this procedure until all obligations are settled, revving and achieving a rate over time.

Benefits of the Debt Snowball Method

The benefits:

- Psychological Explanation: Achieving quick, fast wins by concentrating on the least debt delivers a powerful motivator.

- Simplicity: Concentrating on one debt at a moment facilitates repayment and completes the task more effortlessly.

- Improved Financial Habits: Regularly creating payments and seeing debts decrease promotes accountable spending and saving practices.

- Debt Reduction: It impacts rules to effect debt decrease over time.

- Financial Freedom: The ultimate purpose is to reach monetary independence by systematically eliminating debts.

It offers psychological reasons, promotes better financial habits, and paves the way towards financial freedom.

Debt Snowball Templates

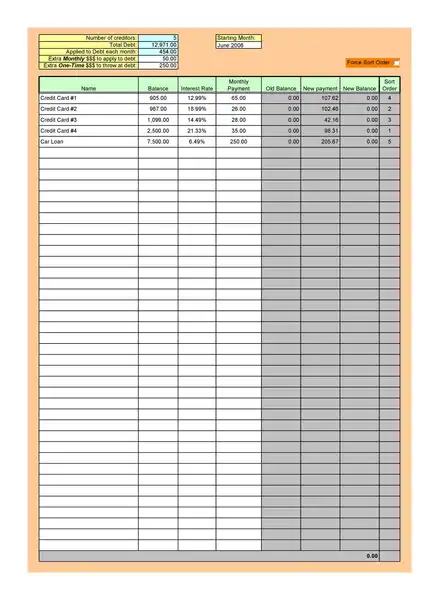

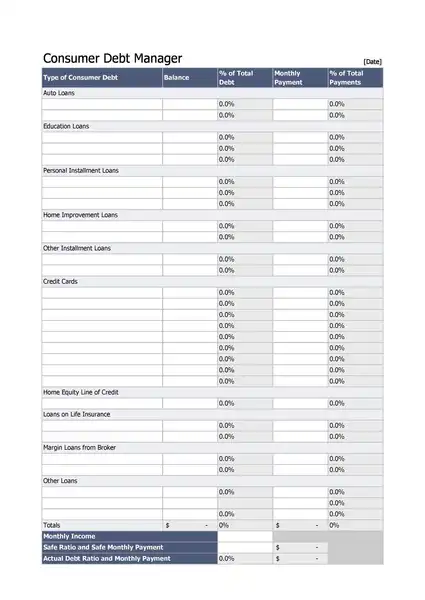

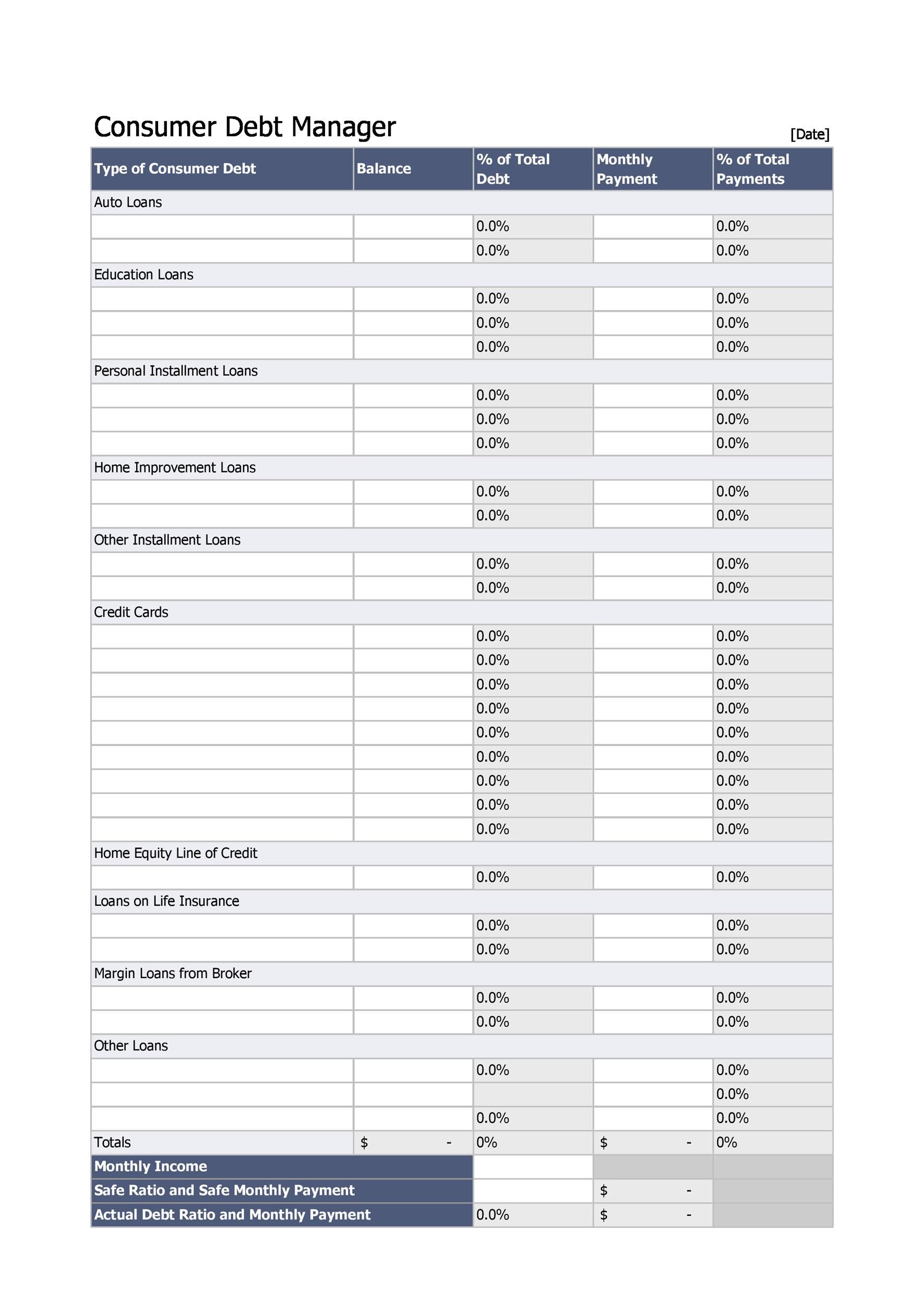

It is a practical tool designed to facilitate the implementation of the debt snowball method. These templates offer a structured format to organize, track, and visualize your debt repayment progress. Let’s explore the benefits of using debt snowball templates in more detail.

Organization and Clarity

One of the primary benefits is the organization it provides. The template lets you record all your debts in one area, from the least to the largest, delivering a clear overview of your financial obligations. This clarity can be invaluable in understanding your debt situation and formulating a plan to tackle it.

Tracking Progress

It also serves as a progress tracker. You can update the template to reflect these changes as you complete payments and reduce your debts. It lets you notice how considerably you’ve paid off and still owe and how your costs impact your overall debt balance. This graphical model of your improvement can be incredibly motivating and help you stay committed to your debt repayment plan.

Motivation and Accountability

It can constantly remind you of your obligation reimbursement plans. Seeing your debts listed out and watching the balances decrease over time can deliver a sense of achievement and encourage you to keep going. Additionally, the template can hold you accountable. It serves as a tangible record of your commitment to spending off your debts, which can motivate you to stick to your plan.

Ease of Use

Most debt snowball templates are user-friendly and easy to use. They often come in formats like Excel or Google Sheets, allowing automatic calculations and easy updates. This ease of use means you can spend less time managing your template and focusing more on paying off your debts.

How to Use Debt Snowball Templates: A Step-by-Step Guide

It can simplify your repayment process and keep you on course towards achieving your financial objectives. Here’s a simplified guide on how to effectively use these templates.

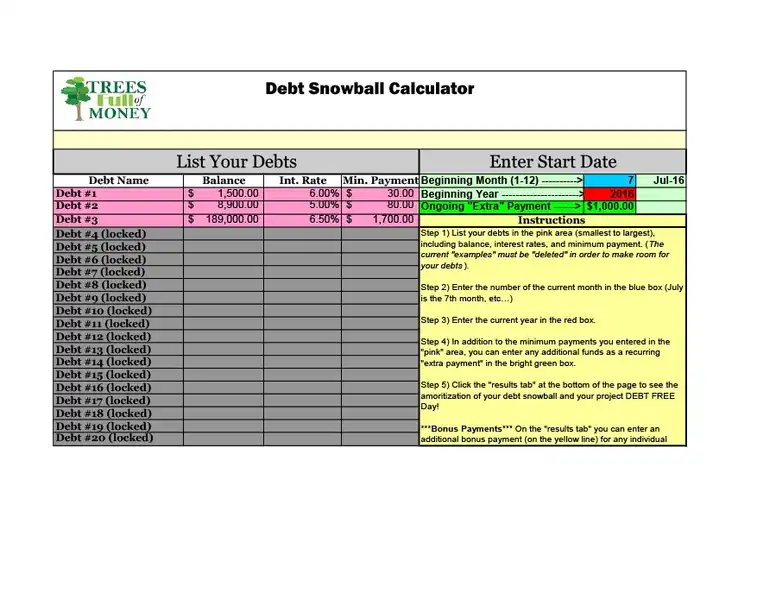

- Step 1: Select an Appropriate Template. Begin by selecting a template that aligns with your needs. Numerous templates are available online, both free and paid, ranging from basic spreadsheets to more advanced ones with features like graphs and automatic calculations. Opt for a user-friendly template that aligns with your personal preferences.

- Step 2: Enumerate Your Debts. After selecting your template, list all your debts. The strategy details obligations from minor to significant, irrespective of the interest rate. Include all pertinent details for each debt, such as the creditor’s name, total payment owed, lowest monthly fee, and reasonable rate.

- Step 3: Strategize Your Payments Once your debts are listed, determine your affordable monthly payment towards your debts. This amount should exceed the total of your minimum payments. The surplus will be directed towards clearing your smallest debt.

- Step 4: Regularly Update the Template Update your template as you create monthly payments. Document your expenses and adjust the remaining credits of your debts. This practice provides a transparent view of your progress and serves as a motivation booster.

- Step 5: Implement Roll Over Payments Upon clearing a debt, don’t pocket the extra money. Instead, roll it over to the next debt on your list. It is the ‘snowball effect’ – as each debt is cleared, your extra payment increases, accelerating the repayment of subsequent debts.

- Step 6: Repeat Until Debt-Free Persist with this process until all your debts are cleared. The key to the debt snowball method is consistency. Stick with it; your obligations will diminish over time and eventually vanish.

Negotiating Interest Rates

Lower interest rates mean less money paid over the life of the debt, which can accelerate your debt repayment process. Here’s how you can approach this:

Understanding Your Position

Before you start negotiating, it’s essential to understand your position. You can deal if you’ve been a loyal customer, made your payments on time, and have a good credit score. Financial institutions value reliable customers and may be willing to lower your interest rate to keep your business.

Research and Preparation

Do some research to see what interest rates other institutions offer. If you find better rates elsewhere, you can use this as a bargaining chip in your negotiations. Also, prepare your argument. Explain why you deserve a lower rate, and be ready to provide evidence to support your claims.

Contact Your Financial Institution

Once you’re prepared, contact your financial institution. Be polite but firm. Explain that you’re working on paying off your debts and that a lower interest rate would help you achieve this goal faster. If you’ve found better rates elsewhere, mention this and ask if they can match or beat those rates.

Consider Balance Transfers

If your financial institution isn’t willing to negotiate, consider transferring your balance to a different institution that offers a lower rate. Be aware that balance transfers often come with fees, so ensure the lower interest rate outweighs any costs.

Revisit Regularly

Interest rates are not set in stone. Make it a habit to revisit your rates regularly and renegotiate if necessary. Your financial situation and credit score can improve over time, putting you in a better position to negotiate.

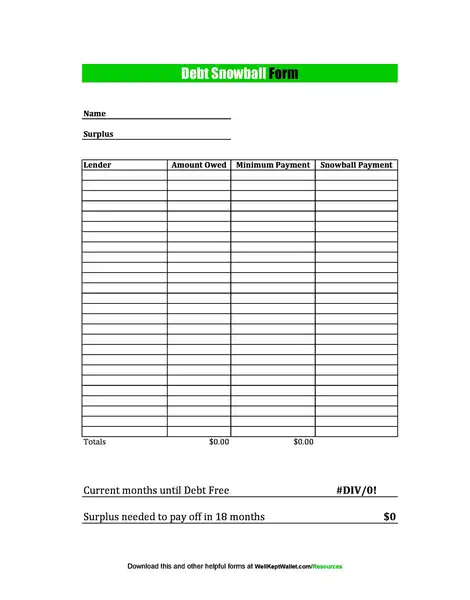

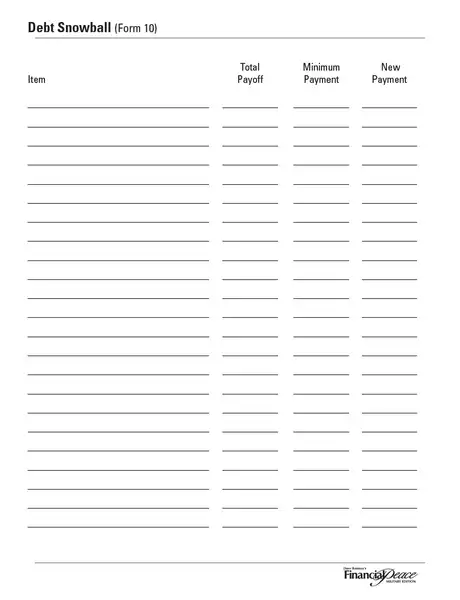

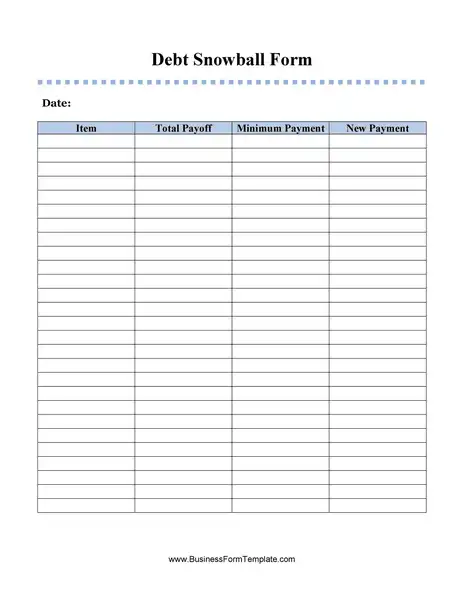

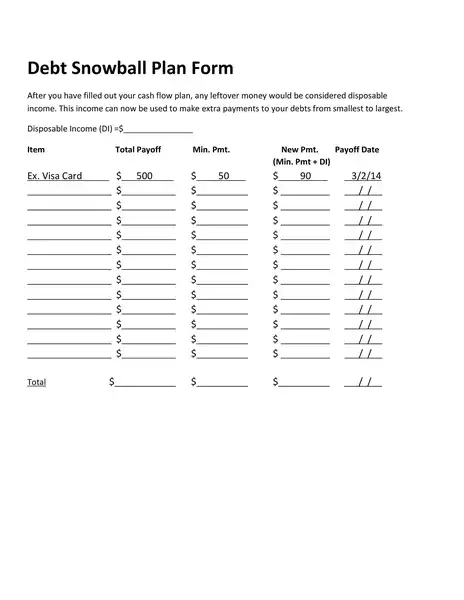

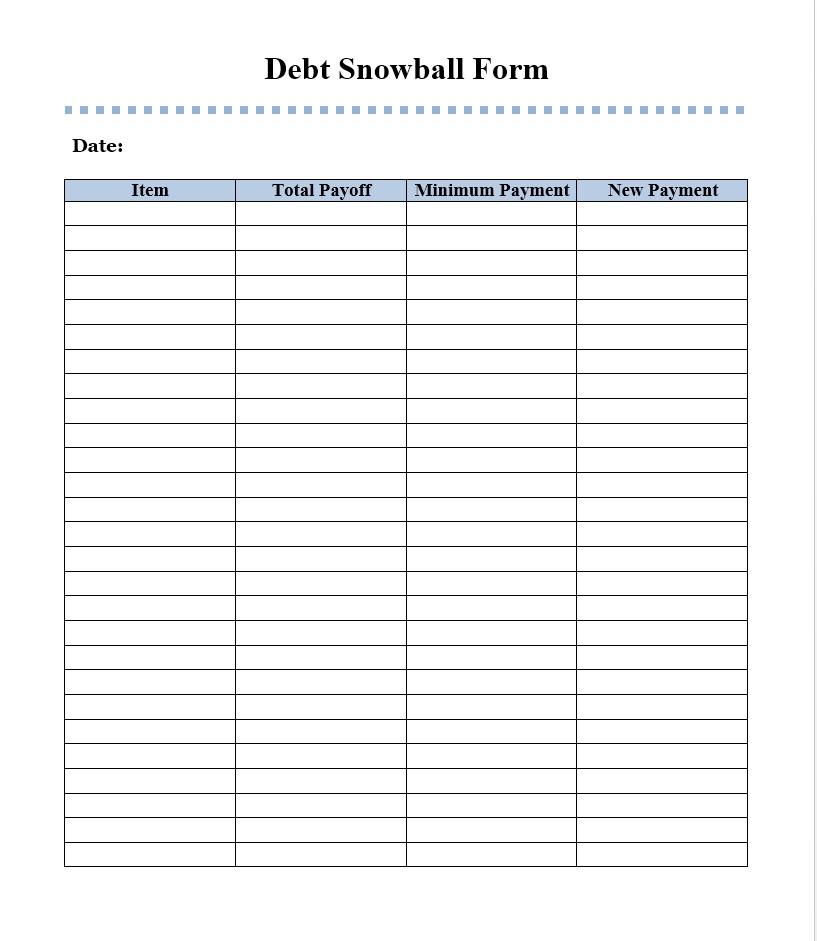

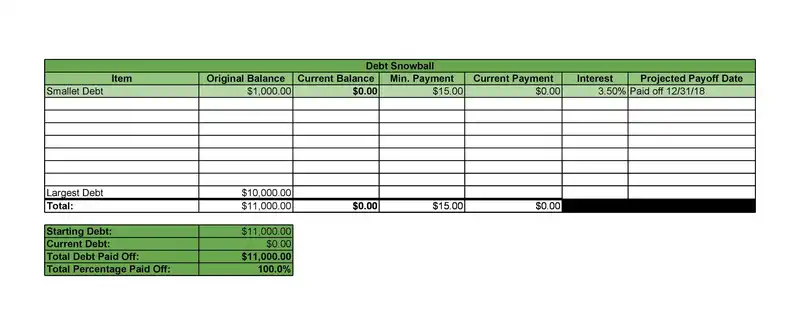

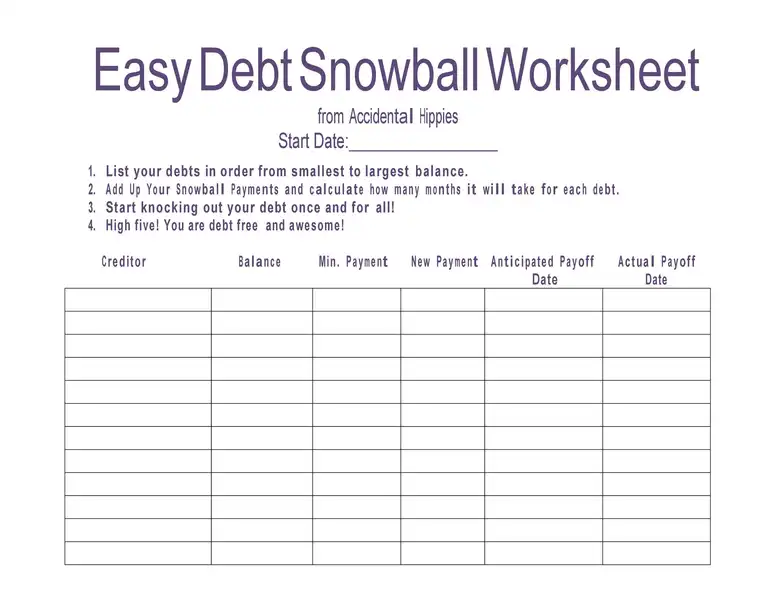

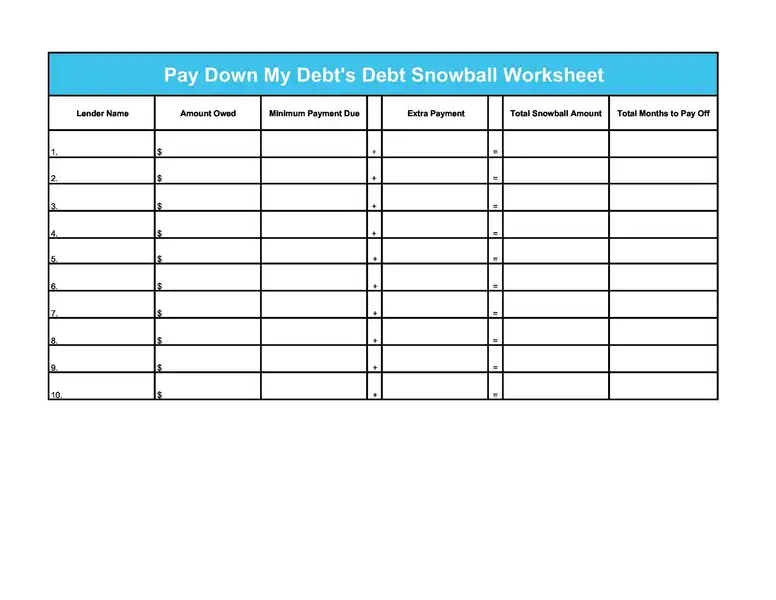

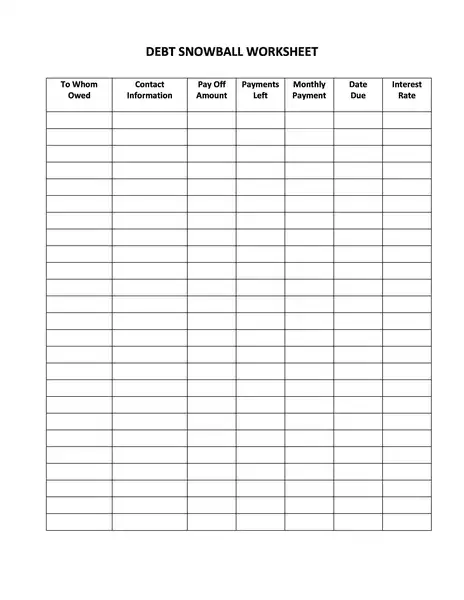

Debt Snowball Form

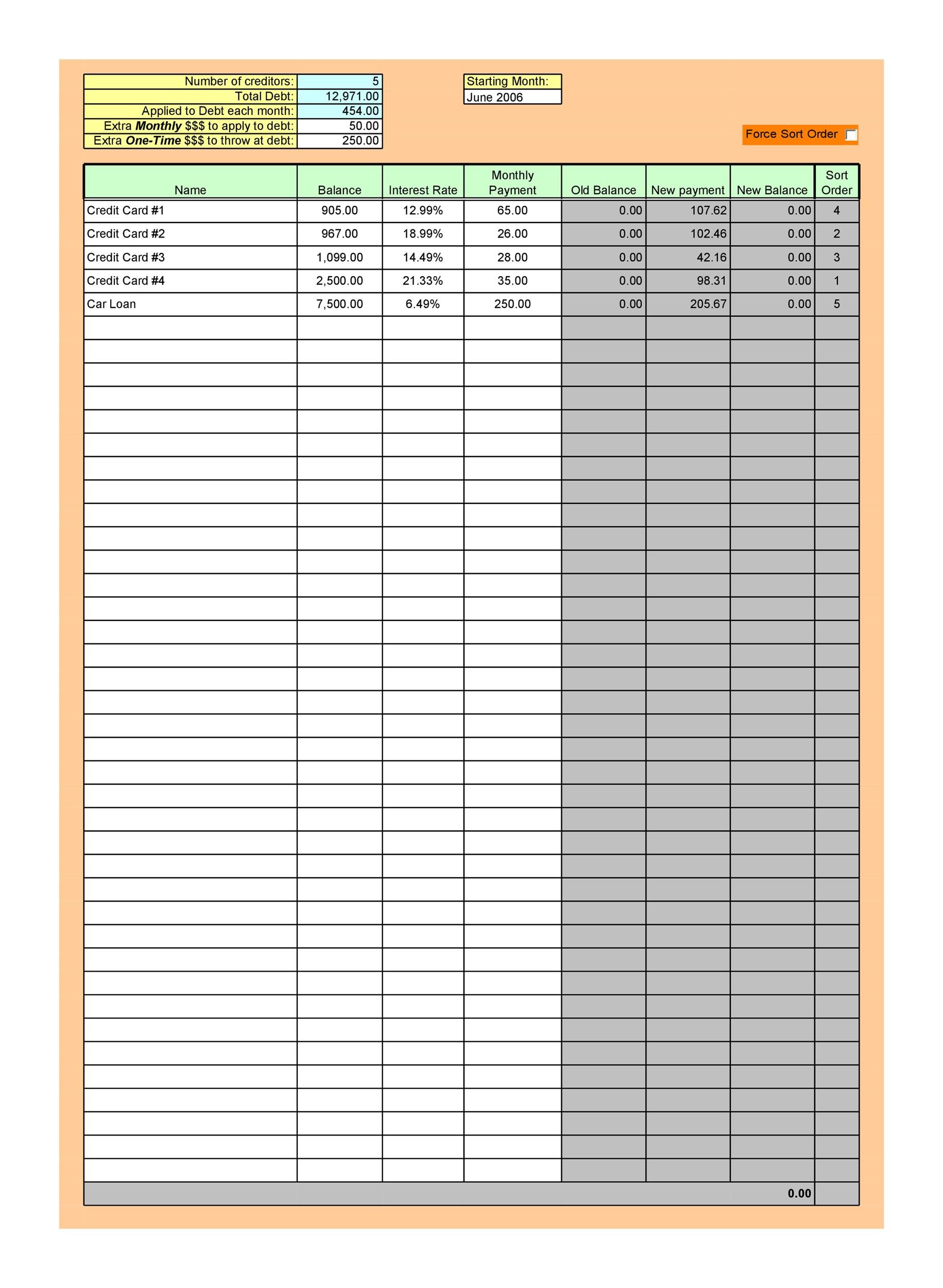

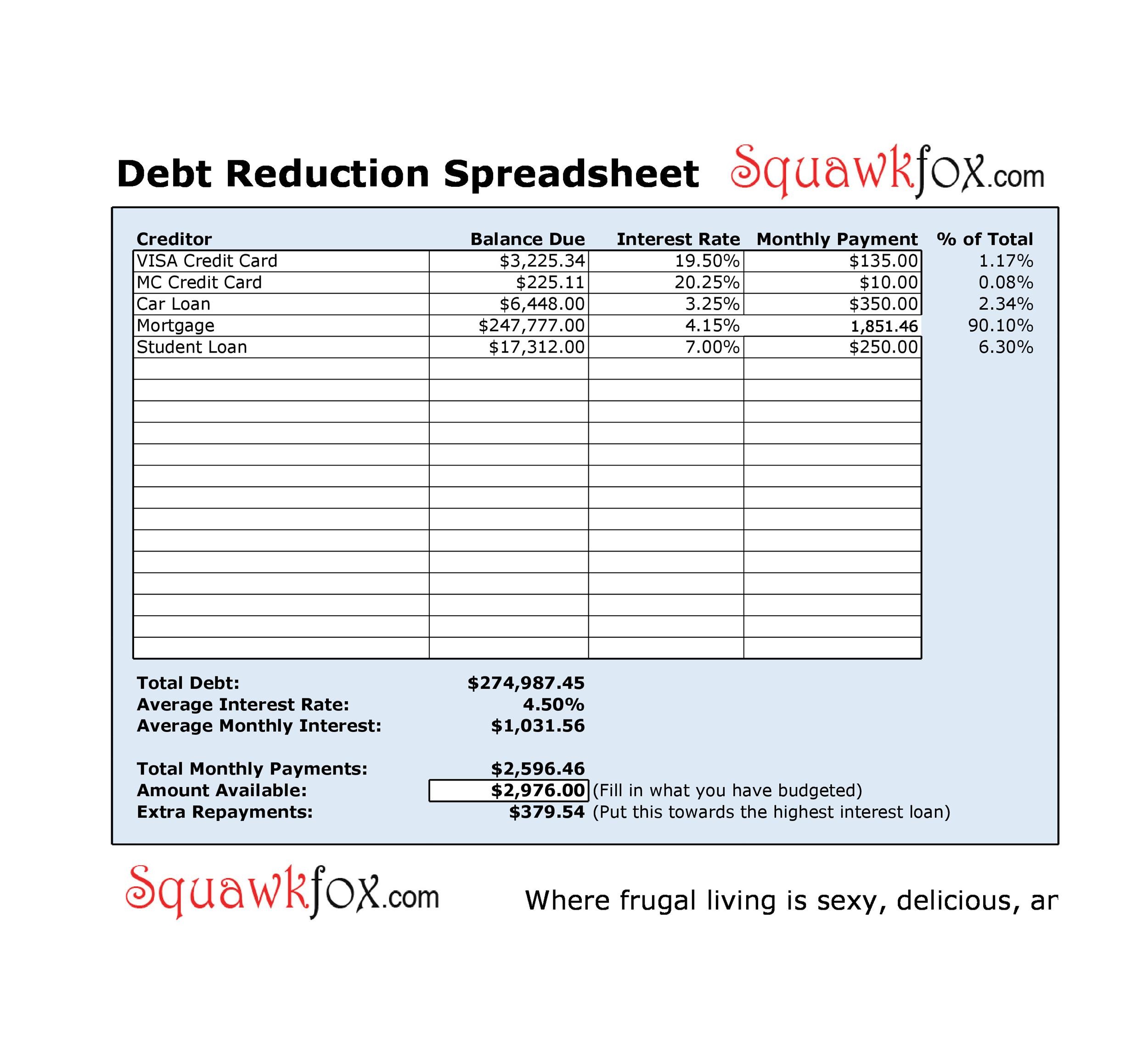

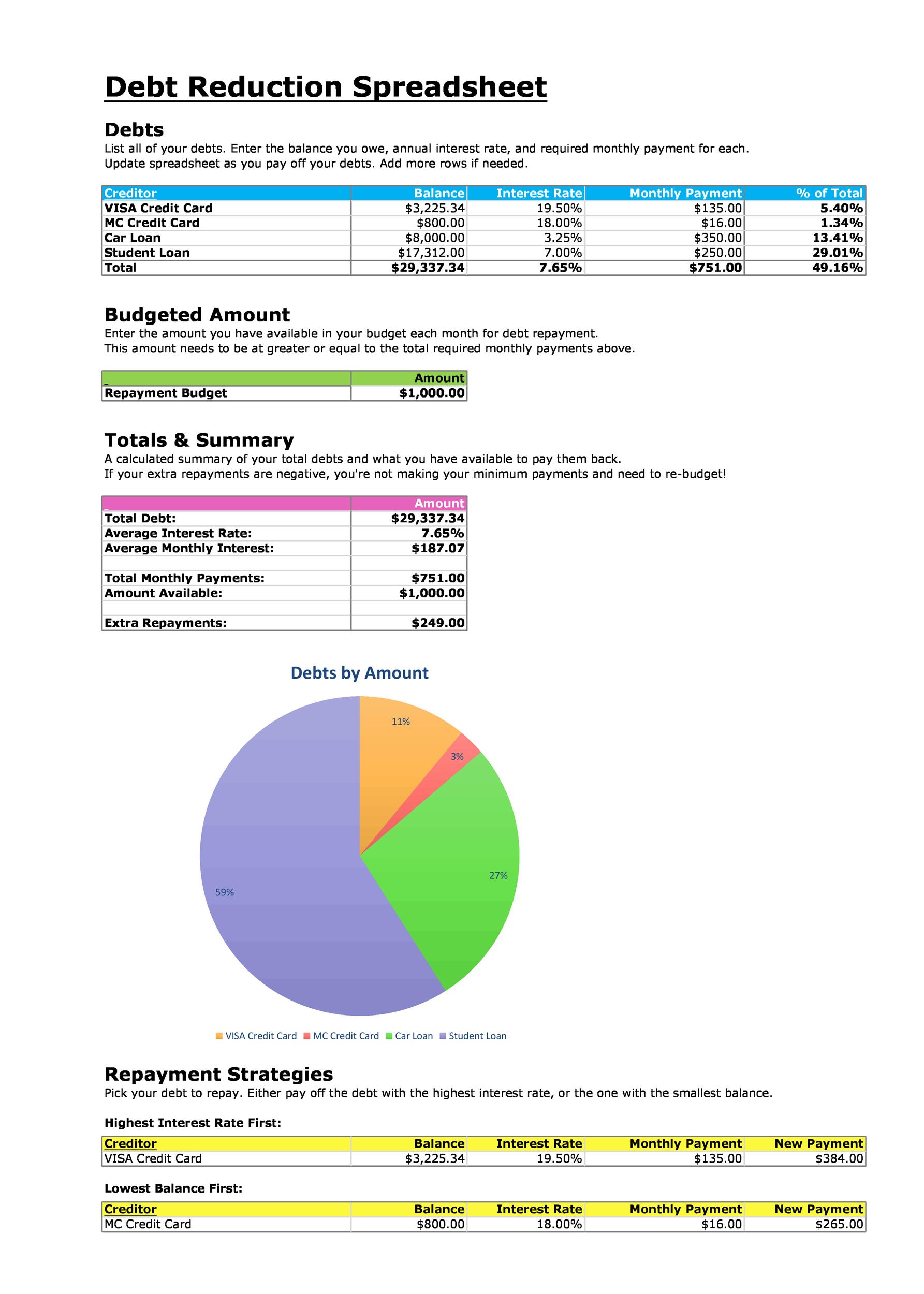

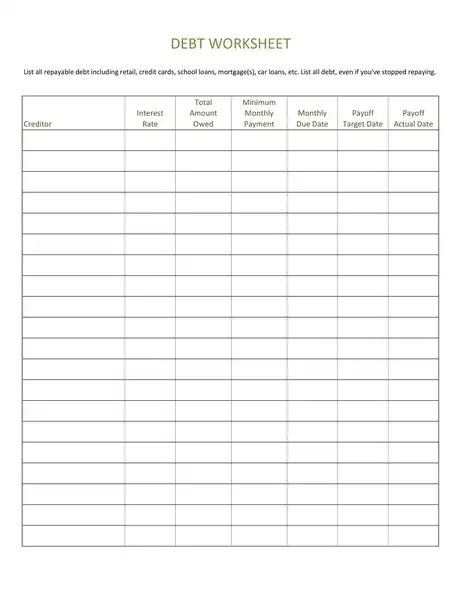

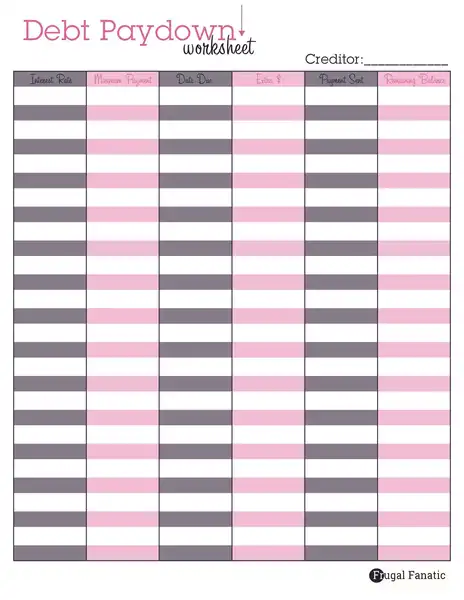

A Debt Snowball Form is a practical tool that can significantly aid individuals aiming to manage and eliminate their debts. This form, often available as a printable worksheet or a digital spreadsheet, is designed to implement the debt snowball method, a popular strategy for debt repayment.

A Debt Snowball Form typically includes sections listing all your debts, their balances, reasonable rates, and the lowest payments. It also has a section for tracking your monthly payments and the remaining balance for each debt. This form provides an organized overview of your obligations.

Start by listing all your debts in the form, from smallest to largest. Then, determine how much you can spend on your monthly obligations. This amount should be more than the total of your minimum payments. The extra amount will go towards paying off your smallest debt. As you complete costs per month, update your form. Record your expenses and adjust the remaining balances of your debts.

It provides a clear visual representation of your obligations, which can be a powerful motivator. Seeing your debts decrease and eventually disappear can offer you a sense of achievement and encourage you to attach to your project.

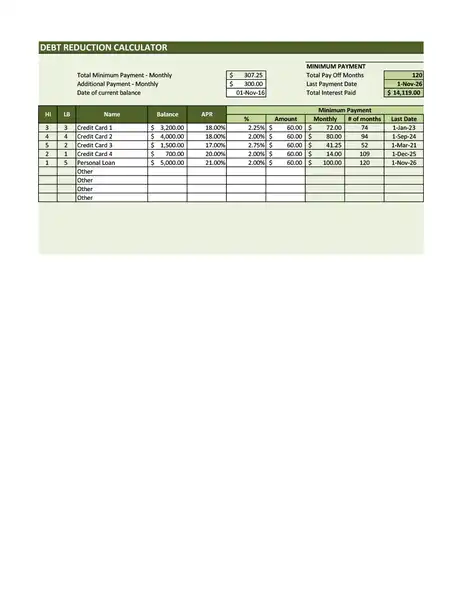

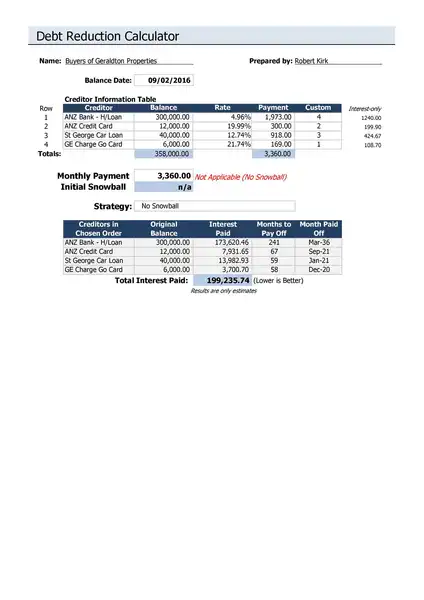

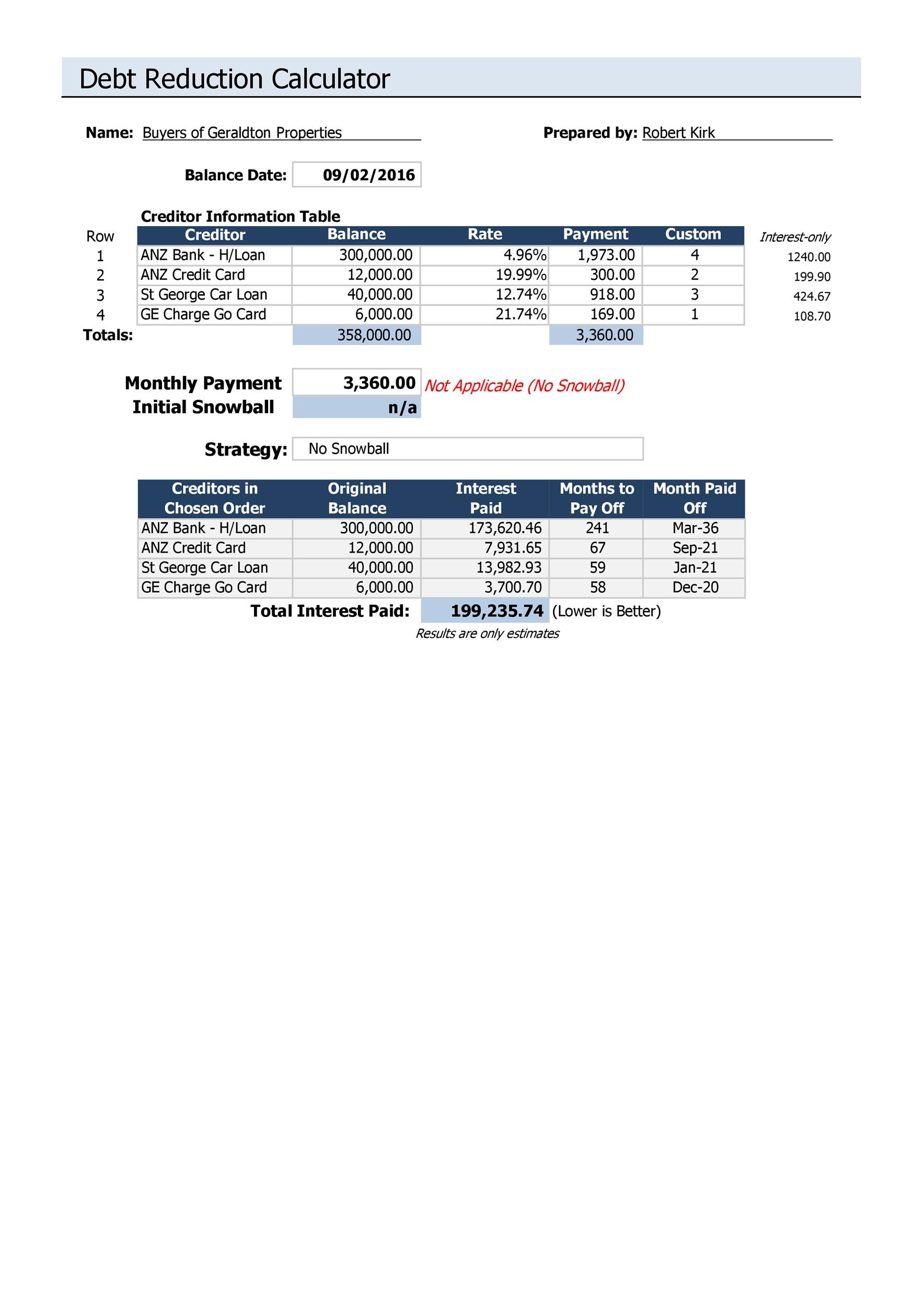

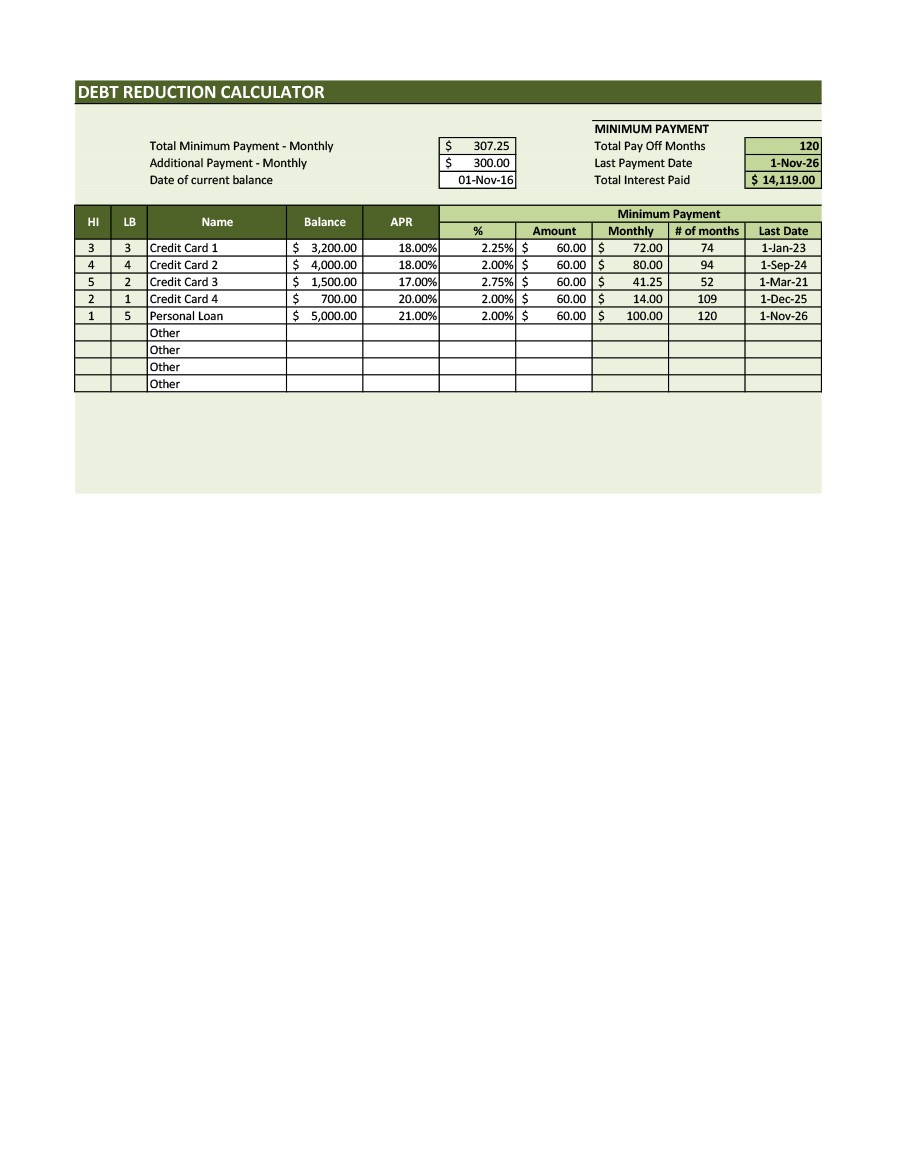

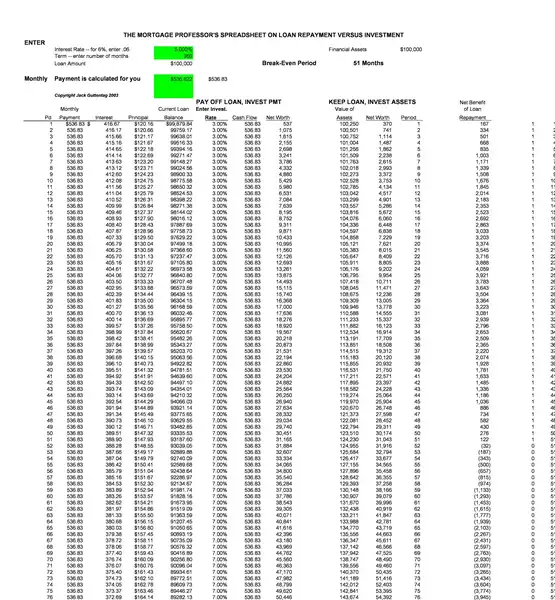

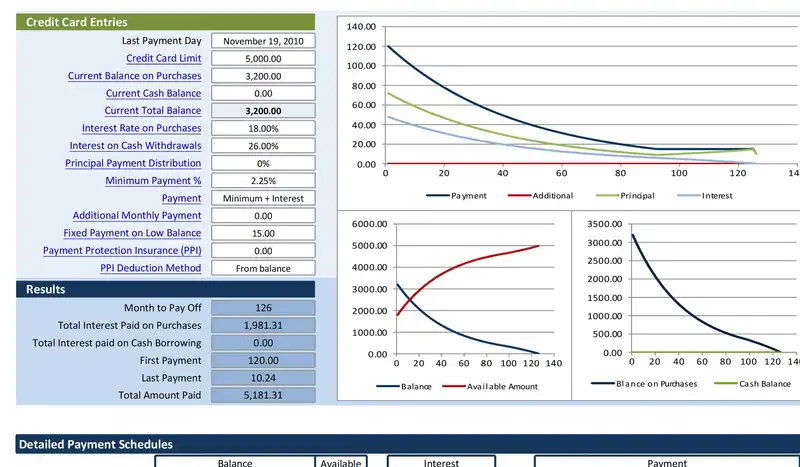

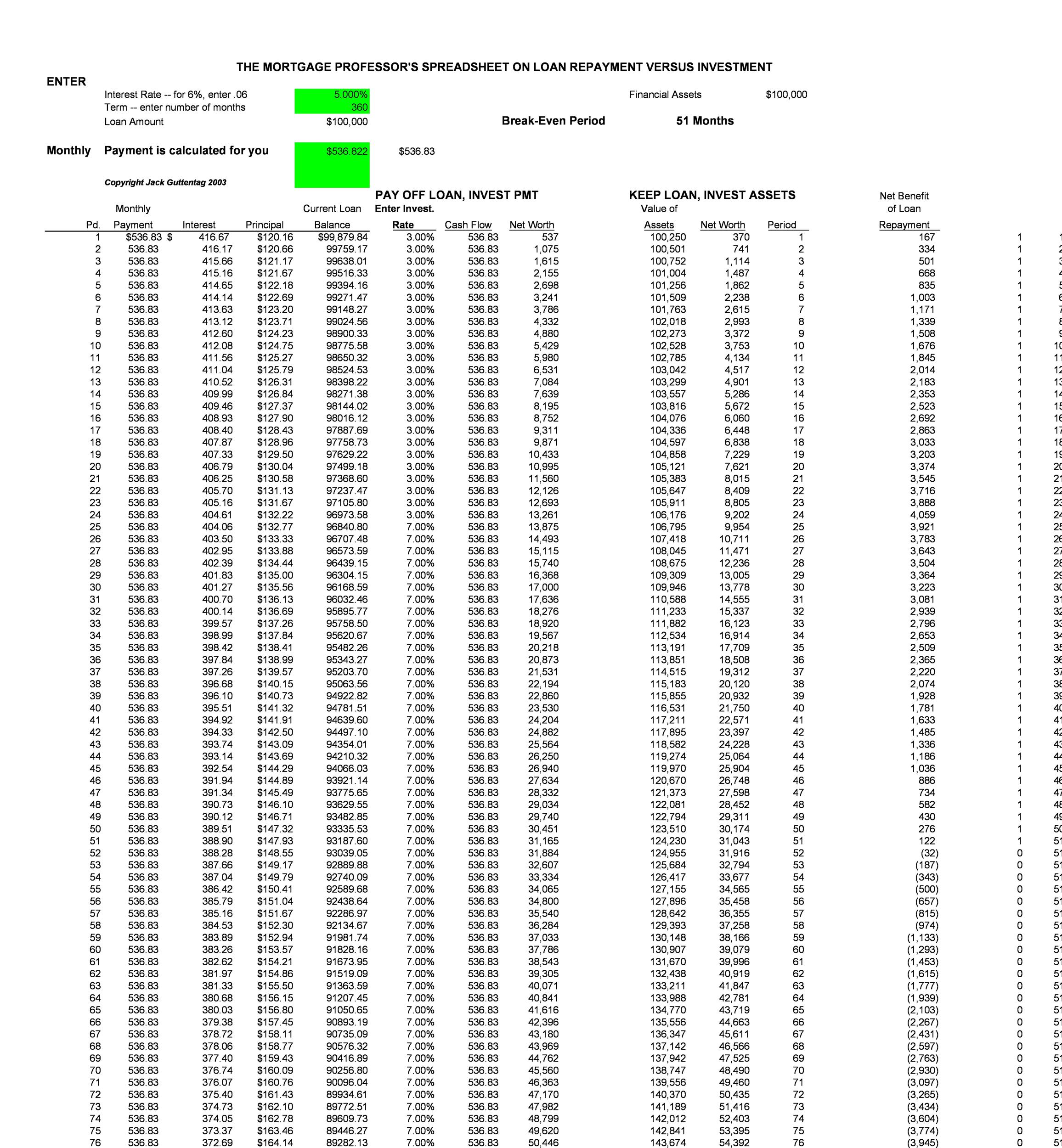

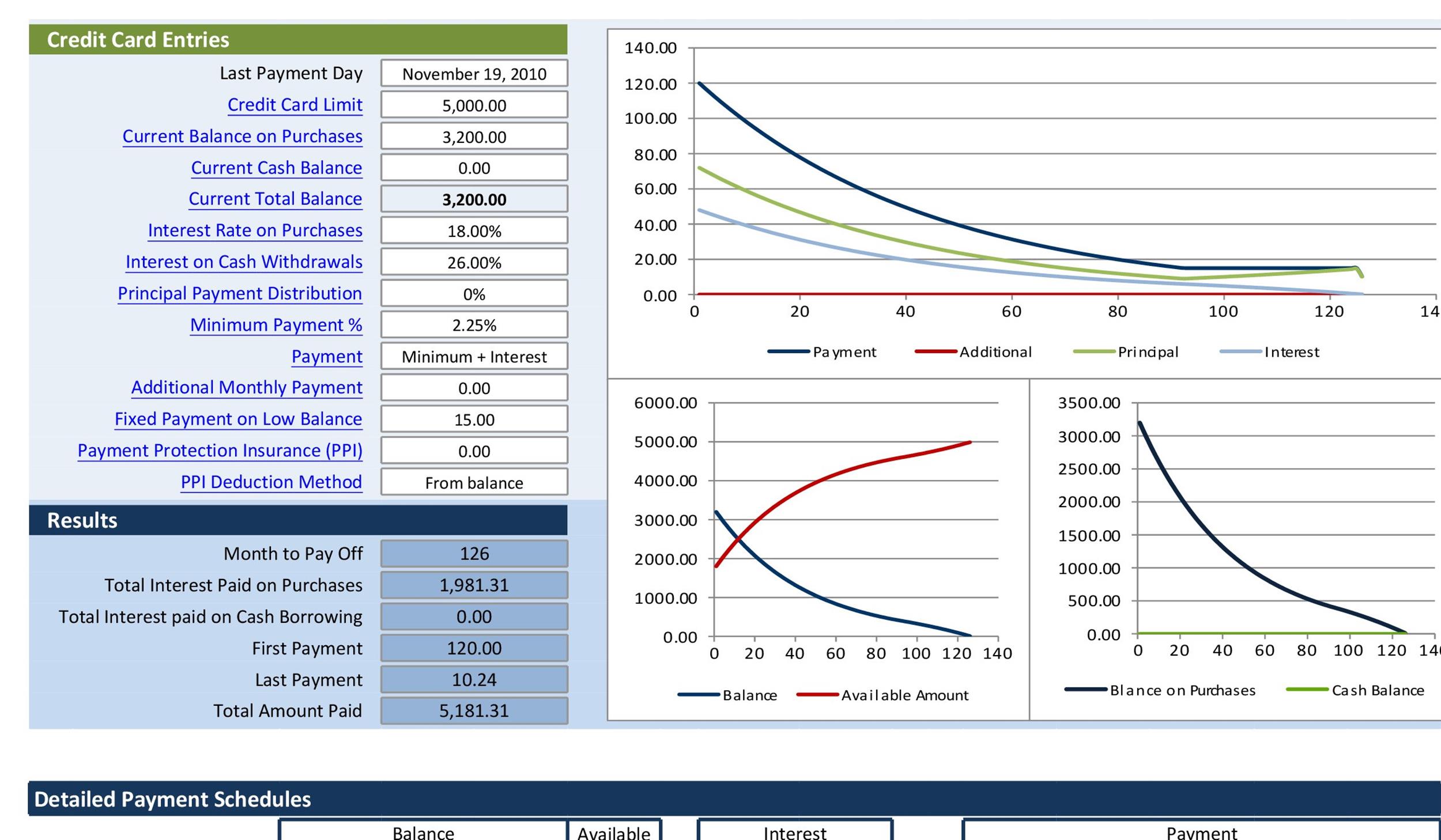

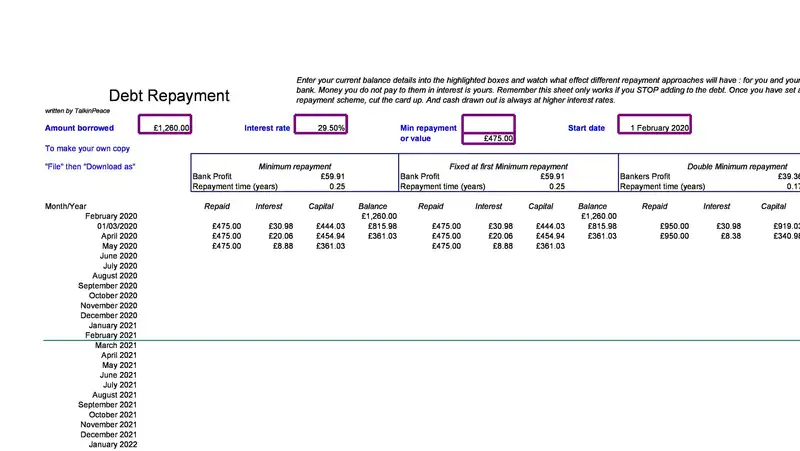

Debt Snowball Method Calculator

The digital tool assists in planning an obligation compensation technique. By inputting debts, their credits, and reasonable rates, the calculator provides a customized plan for obligation elimination.

It indicates how much to spend per obligation monthly and estimates the time required to evolve debt-free.

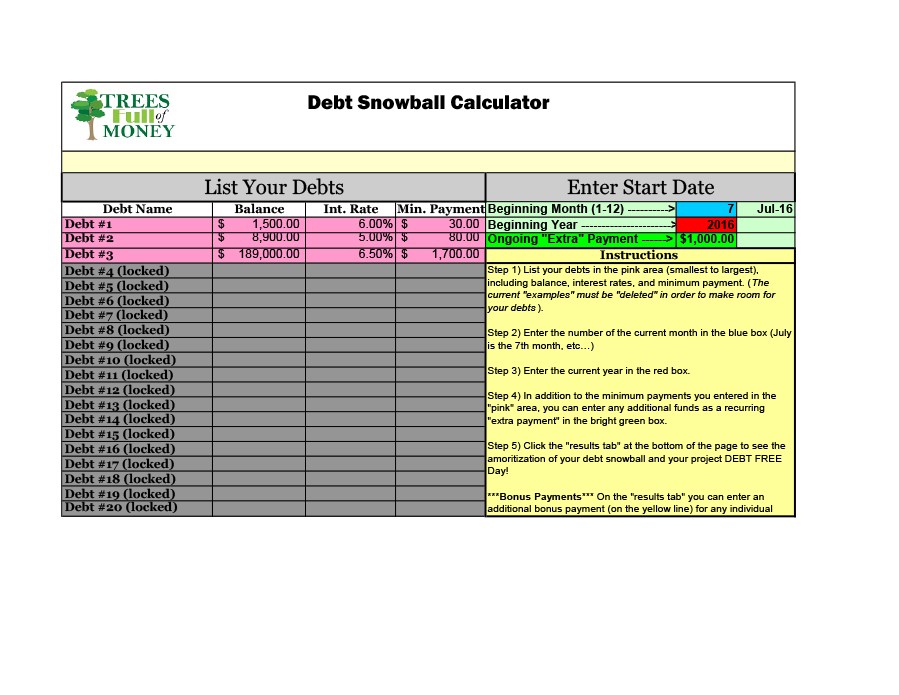

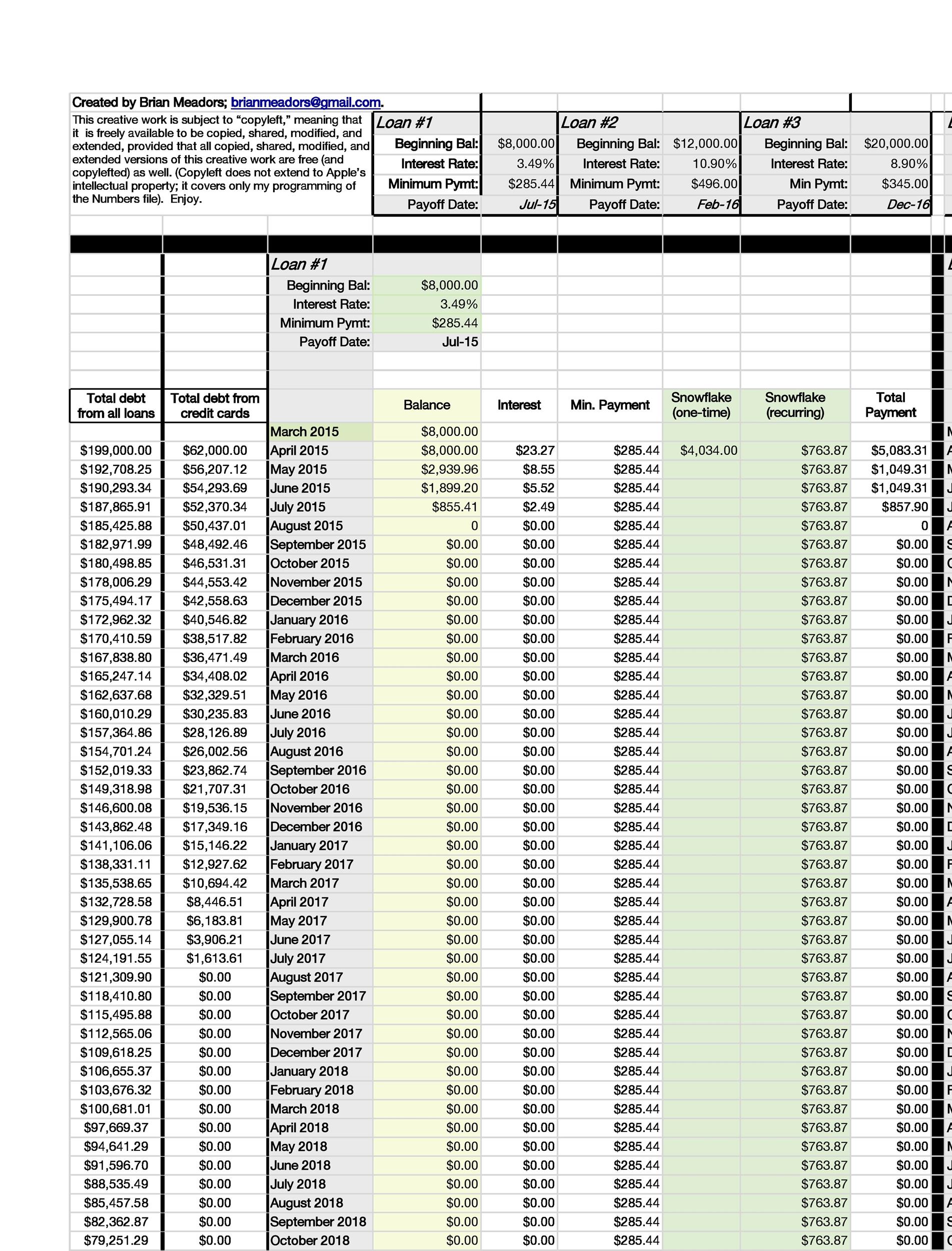

Debt Snowball Spreadsheets

It allows for recording all debts, tracking payments, and visualizing progress over time. These spreadsheets can be personalized to fit individual needs and be a motivational aid throughout the debt-free journey.

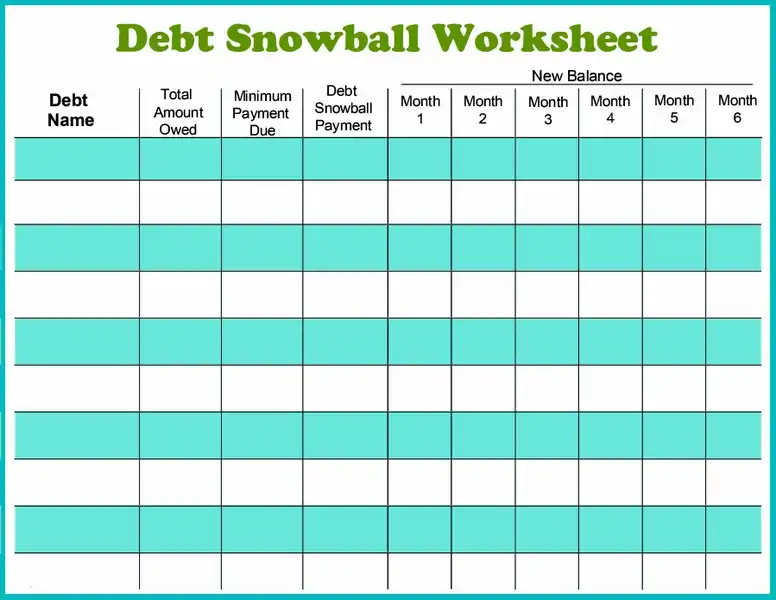

Debt Snowball Method Worksheet

It suits those who prefer working with paper rather than digital devices. The worksheet guides the user through listing obligations, creating payments, and tracking progress.

Debt Snowball Method for Paying Off Debt

Quick progress can be seen by concentrating on the least debt sooner, which is a strong motivator. As obligation is spent off, the accounts utilized for that obligation are rolled over to the next least debt, causing a ‘snowball effect’.

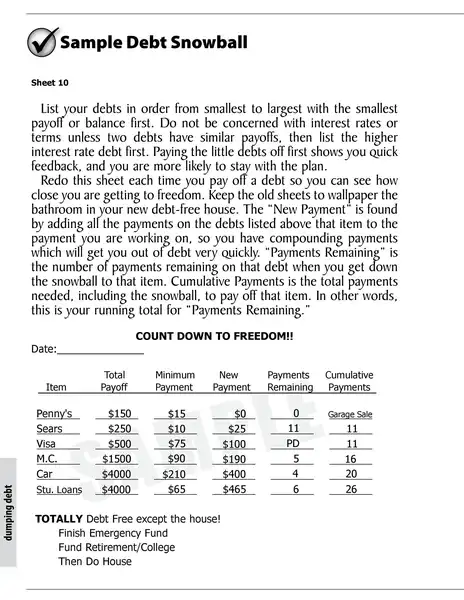

Debt Snowball Method Example

For illustration, you have three debts: $500, $1000, and $2000. You would start by spending off the $500 deficit sooner. Once that’s spent off, you accept the cash you were charging towards that obligation, apply it to the $1000 debt, and so on. This system allows you to develop a rate as you spend off each duty.

Debt Snowball Method Excel Excel

It is a powerful tool that can be utilized to implement the method spreadsheet can record debts, track payments, and calculate how long it will take to pay off each debt. There are also many pre-made Excel templates available online that are designed specifically for the debt snowball method.

Does the method always result in higher interest costs?

Not necessarily. While the method does prioritize spending off fewer debts first, regardless of a reasonable rate, this only sometimes means you’ll pay more interest.

It depends on the specific amounts and affordable rates of your debts. Plus, the monetary benefits of the method can lead to faster debt repayment overall, offsetting any extra interest costs.

Can I use the debt snowball method if I have significant debts?

Absolutely. It can be used regardless of the size of your debts. The key is to stay consistent with your payments and keep the rate going, no matter how significant your obligations are.

How often should I update my debt snowball template?

It’s a good idea to update your template each time you make a payment. It will assist you in keeping track of your improvement and remaining motivated. You can edit your template weekly or bi-weekly if you make multiple monthly payments.

Do I need a template to implement the debt snowball method?

While you don’t need a template, it can be a helpful tool. A template can keep you organized, make it easier to follow your improvement and deliver a visual presentation of your obligation repayment journey.

Can I switch to another debt repayment method after starting the debt snowball method?

Yes, you can switch to another. However, choosing a way you can stick with it is important. Consistency is key when it comes to debt repayment. If you’re considering switching methods, it may be worth speaking to a financial advisor to understand the potential impacts.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.