The Ultimate Guide to Make Loan Agreement Templates

The loan agreement letter is one of the legal forms and it is very useful yet valuable. This kind of Loan Agreement becomes a necessity no matter you are the lender or the one who apply for a loan. Any pre-defined term is clear and understandable stated in the document. This paperwork will also give protection for the party who lend the money since it acts as the loan evidence.

Why should we use a loan agreement template?

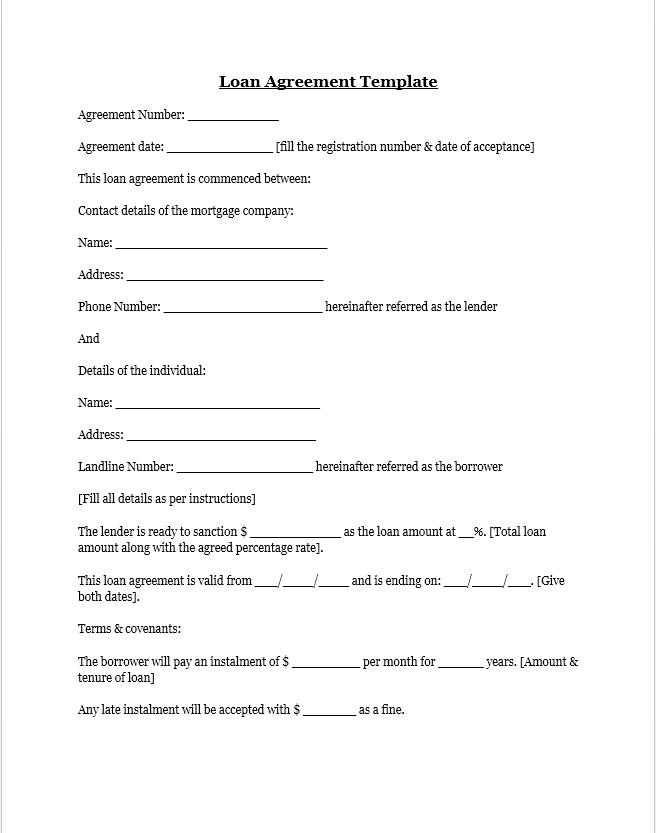

If you are not so sure about the format then you can use the loan agreement template. Besides, many websites have provided the templates for free so you can download and fill the form as you need. Any provision that applies to the loan will need to be included in the document. It will help to ensure both parties about both the terms and provision.

If you loan the money and want to make sure about the repayment terms then you can use the personal agreement form. Once you have signed the document, both borrower and lender cannot make any change towards the initial terms of an agreement. So, it is important that both parties, as well as the witness, acknowledge the rules.

What tasks would require a loan agreement template?

We will say that this document is a tool that will help you to draft a document related to a legal loan and it is such a careful task for sure. The document should include important information related to the loan as well as its repayment terms. The language should be easy to understand, concise, and also clear. Once the process is done, there would be no question allowed to be asked. However, if you will use it for friends or someone you know then you can use the personal loan agreement template instead.

What should be included in the agreement?

There are at least four important points that should be included in this document. The first thing is the end of term lump sum repayment. This is about the due date when the borrower should repay the loan.

The next point is the “Interest Only” term. This term refers to an agreement that a certain amount of money would not be a part of the main loan. The third point is the principal and interest repayment method. This point manages the requirement to repay the loan in a daily, monthly, or annually basis. And the last thing is the specified periodic increment. Of course, you can download the template of a loan agreement.

Loan Agreement

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.