So, what is an operating agreement?

Firstly, you have to know about an operating agreement – LLC operating agreement is the written legal agreement between your LLC or known as a Limited Liability Company. The LLC operating agreement will explain how your company will run, their rights and responsibilities of your LLC members, the removing or adding the process of LLC members and other necessary systems as well. Although the LLC agreement is not mandatory in all of the states, it usually highly recommended for LLCs to have this operating agreement. The LLC operating agreements can be made at the time of LLC formation or anytime after formation.

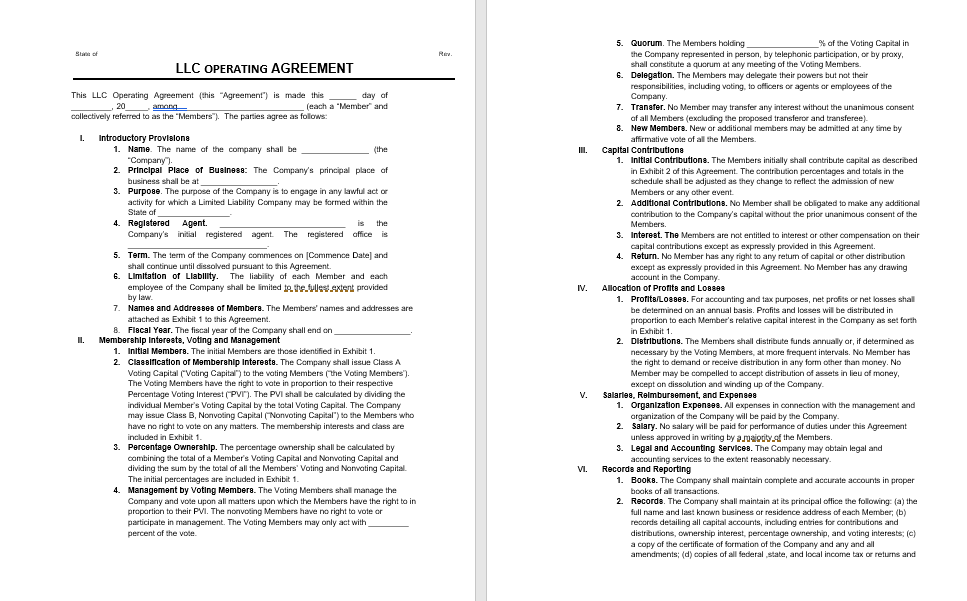

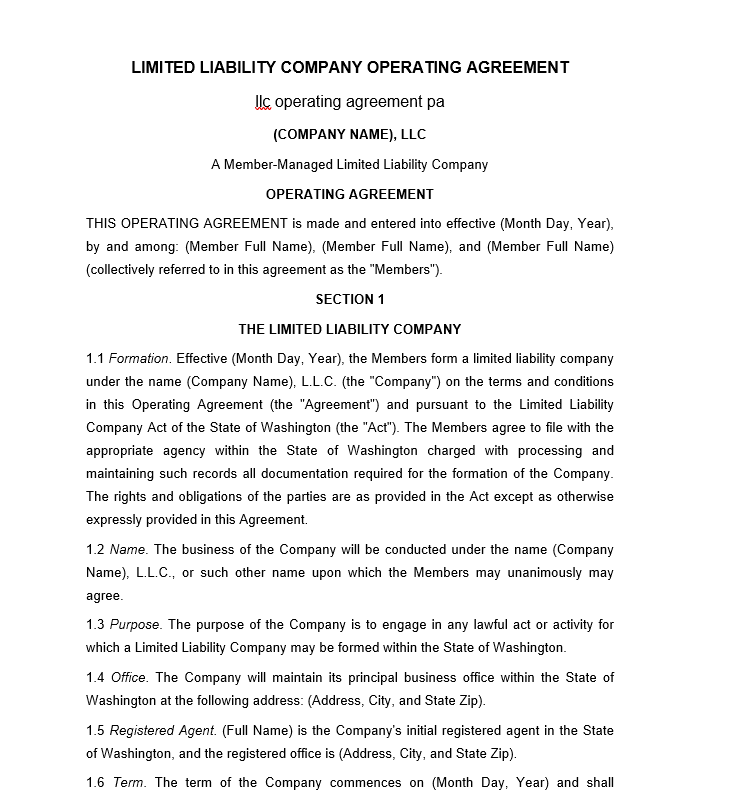

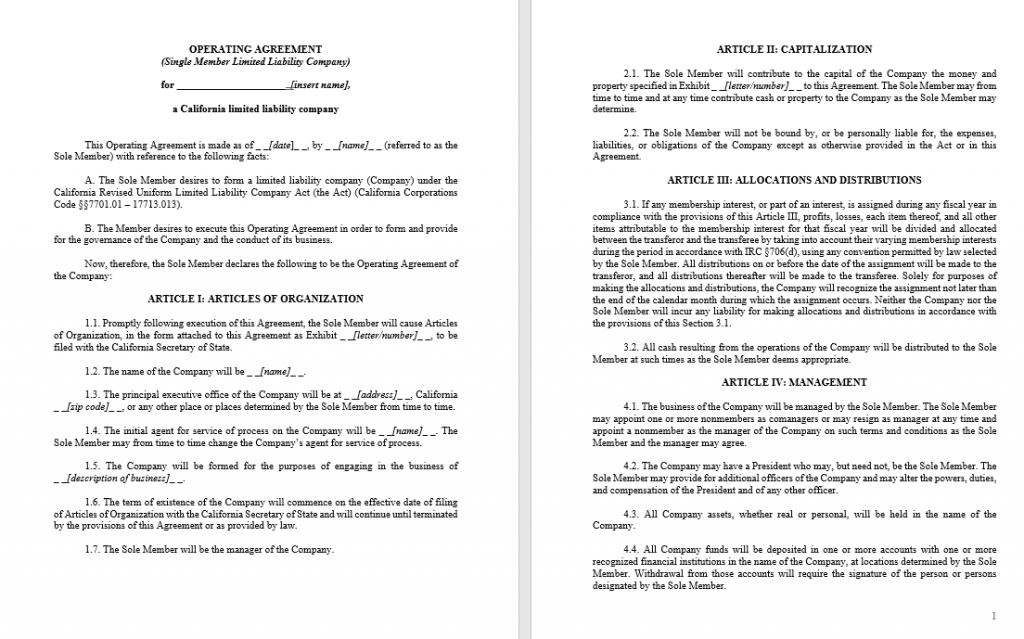

Operating Agreement

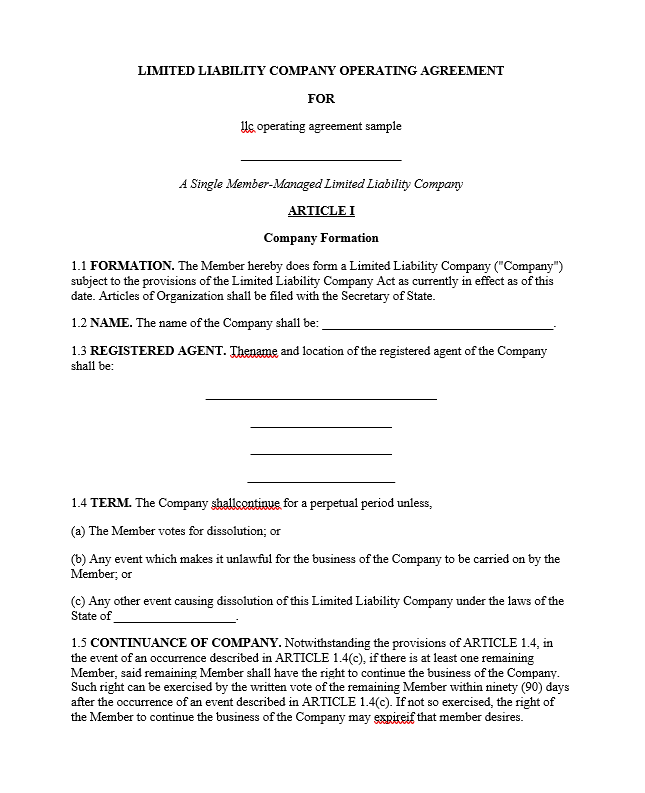

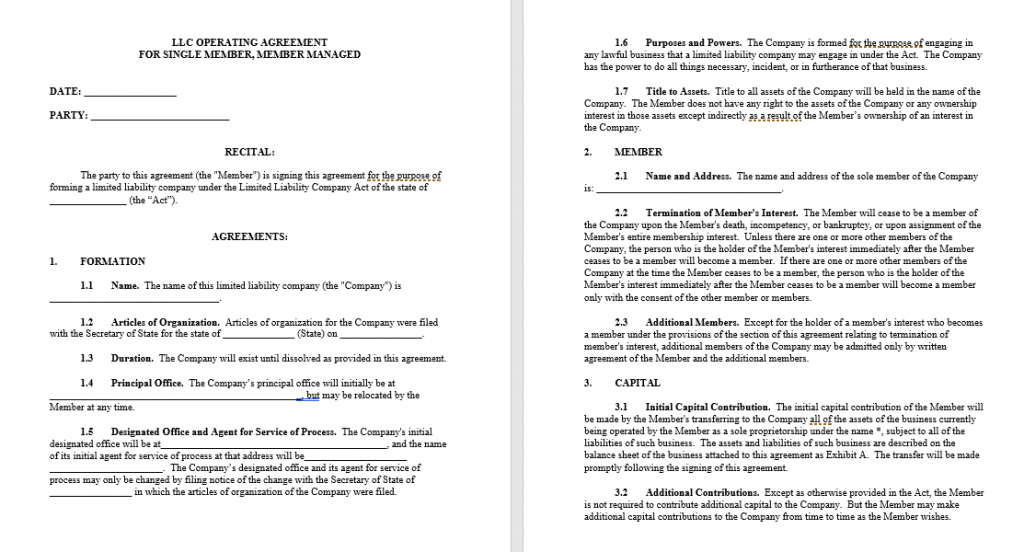

llc Operating Agreement Sample

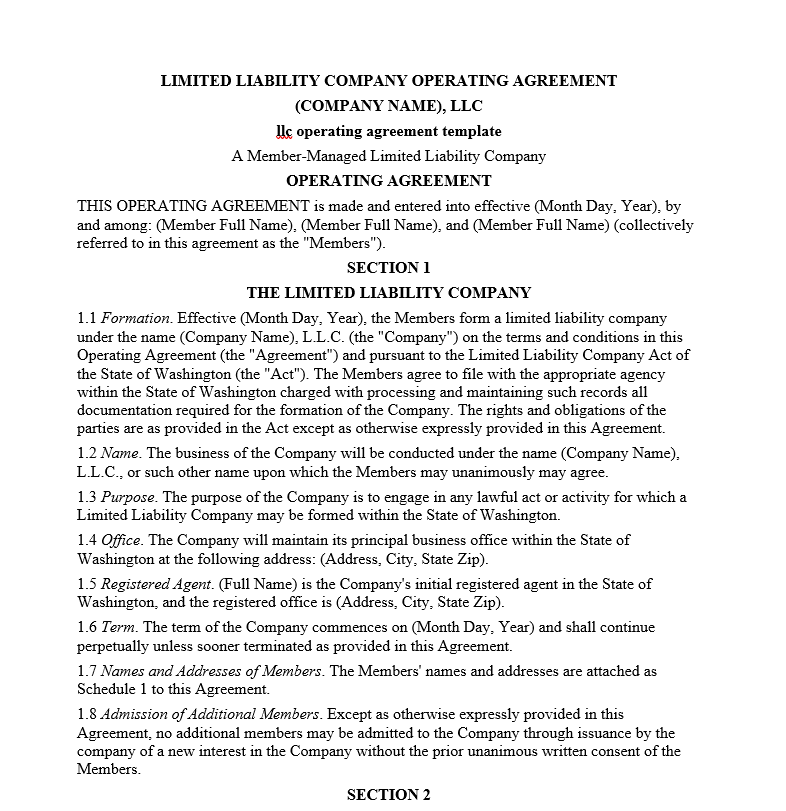

LLC Operating Agreement Template

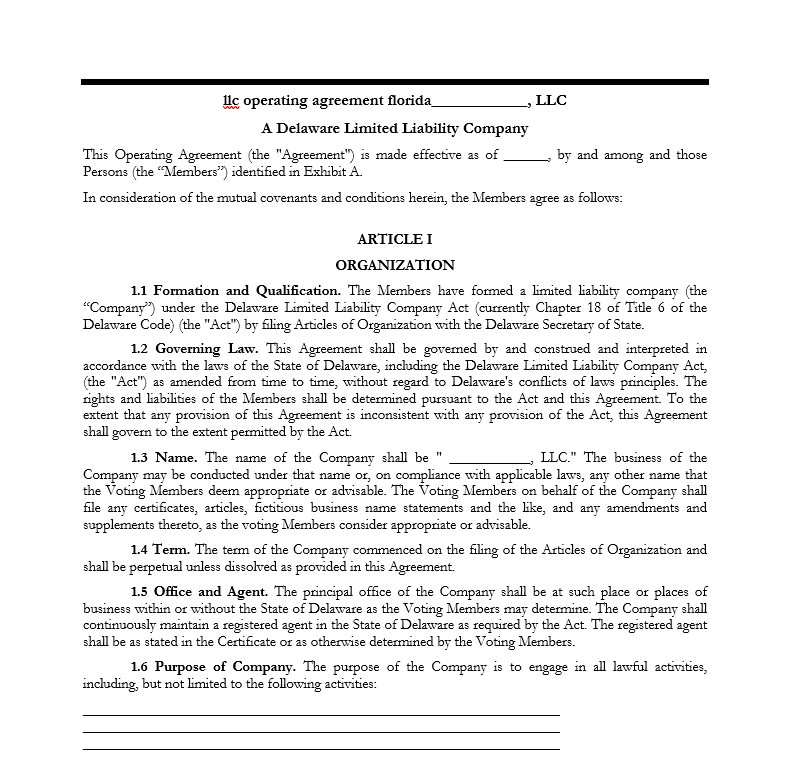

llc operating agreement florida

llc operating agreement pa

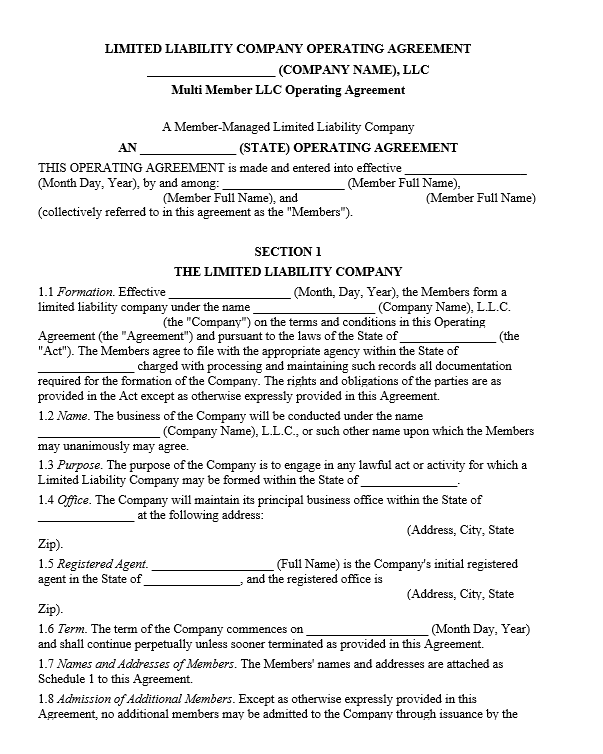

Multi member llc operating agreement

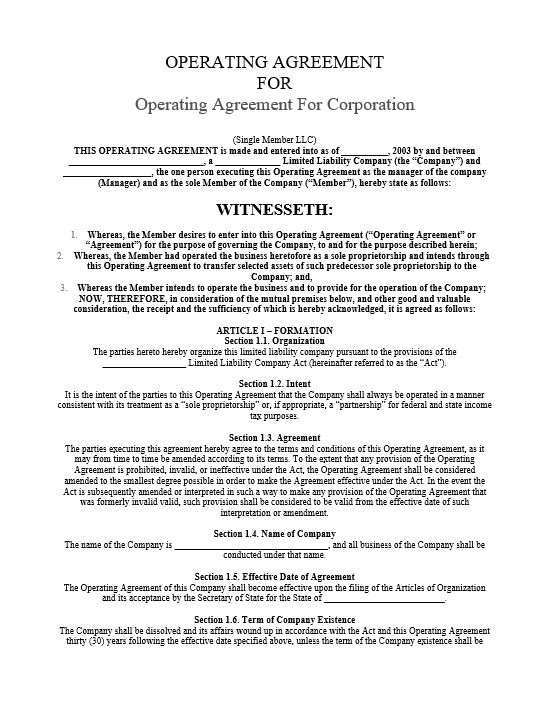

Operating agreement for corporation

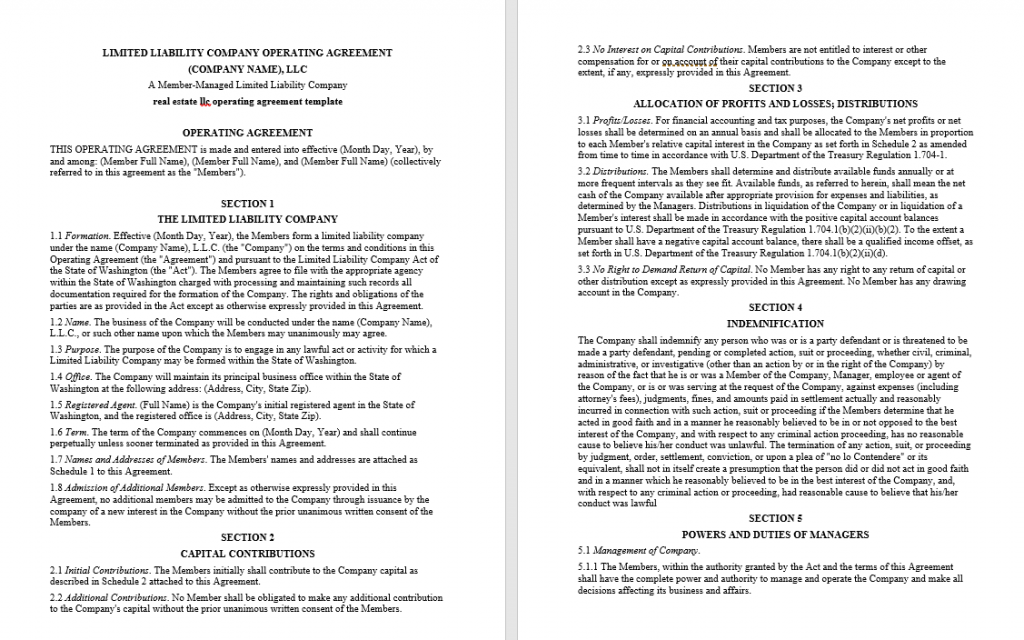

Real estate llc operating agreement template

Single member llc operating agreement

Single member llc operating agreement template

Other names of LLC agreements

When you just research for LLC Operating Agreements, then you have to know that this agreement was also called as:

- LLC Bylaws

- LLC Agreement

- LLC Operating Agreement

- Operating Agreement

- LLC Setup Agreement

Why this operating agreement is essential for Limited Liability Companies?

You should know that it is not only necessary but it also imperative. No one does not want to do full control over their companies and running them in their own way. The operating agreement will allow their members to set up the rule about many business operations which will govern the daily operation of companies.

It also allows the members to set up every owner’s percentage of ownership in the Limited Liability Companies, their share in profits, their rights and responsibilities and the process if their members want to sell their stakes in the company. Anytime any discrepancy rises up among members of the LLC, then this operating agreement will serve you as the guide to solve those conditions. So, there are some reasons to make an operating agreement. The operating agreement will bring you important advantages:

- Protect the limited liability of your company

- Minimalize the impact and number of the managerial disagreements

- It allows you to make a business structure which best suit with your specific needs

- The most important, without having an operating agreement, then the state laws can decide on how your company will run.

The legislation that allows the formation of LLC (Limited Liability Companies) was first passed by the Wyoming State in 1977 and today almost new companies which formed in United State are LLC. The Limited Liability Company was not definitely the corporation – this is only the legal form which brings you with the advantage of limited liability to its owners.

Making the Limited Liability Company is definitely one of the giant steps but it is only the beginning. After the formation of the company need some rules and regulations that will manage your company and ensure that the company operates and performs according to the standard and rule. All regulations and rules were covered in the LLC’s operating agreement. Shortly, this is like the torch in the dark that will guide the company’s members related to what step that they should take when they faced a certain situation.

I am not a lawyer, so how you can make your own LLC operating agreement?

You do not have to be thrifty when it comes to the LLC agreement. Absolutely, you will need a service of consultant or lawyer to cover all of the regulations which allow the members of a company to perform the full control over their LLC. But, if you want to know about when an agreement looks like, then you are able to get many online sources where they offer you with LLC agreement templates that you can see and understand what should be included into this agreement.

What things should be included in the LLC Operating Agreement?

When you want to make a draft of operating agreement to direct your business according to their needs, then you have to ensure it covers anything that it should.

The Ownership

Usually, the ownership of LLC was divided based on the initial investment. If you include 60 percent of the capital which been needed to start LLC, then you will get 60 percent of the company. But there are many times when people do not want the ownership divided in this way. Such as, if a business was built based on your partner’s idea, and you only use a bit of capital to make the company off the ground, then your partner might be entitled over their fair share of LLC.

Mention the rights and responsibilities of managers and members

The LLC members were generally its owners, however, those members are able to choose a manager to run a company if they do not want to involve

Responsibilities and rights of members and managers

The LLC members usually its owners, however, those members can choose a manager to run the company if they do not want to be involved its daily management. The LLC’s certificate of formation might have a section where you decide whether the company was directed by its manager or member. But you still able to decide what kind of responsibilities and roles and, if you have any, then the managers were running the company. You should include a plan to help solve any conflict among members or managers.

Decide on how to change owners

Most of the states, by default, will dissolve the LLC if one of the founding members decide to get off. This is can make a whole company in the state of disrepair, specifically if the remaining members want their business to continue. Therefore, if your LLC has so many members or owners, this is very important to accommodate the potential exit.

What do they expect in the term of compensation? How will their share of LLC distribute? And so on.

Distribution the profits and losses

With LLC, then every loss and profits were passed through a company, directly to the owners. It usually can be done according to the percent owned, therefore if one person has 75 percent of LLC, they were passed 75 percent of the profits or losses, which they will report on their personal tax returns. Many times, LLC members want to adjust the distribution.

The content creator team at calipsotree.com is dedicated to making topics accessible to everyone, with over 9 years of experience in writing and breaking down complex concepts into easy-to-understand articles that answer readers’ financial questions.