Is a charge-off ruining your credit score? You’re not alone! Millions of Americans struggle with these black marks on their financial records. But there’s good news: You can fight back! In this comprehensive guide, we’ll show you exactly how to use a charge-off removal letter template to wipe the slate clean. We’ll cover everything you need to know, from understanding what a charge-off is to crafting a persuasive letter that gets results. With a little effort and the right approach, you can say goodbye to that charge-off and say hello to a brighter financial future.

What’s a Charge-Off, and Why Does It Matter?

Think of a charge-off as a giant red flag on your credit report. It means a lender has given up trying to collect a debt you haven’t paid in a while (usually six months or more). This black mark can have serious consequences for your financial life.

Why You Can’t Ignore a Charge-Off

A charge-off is more than just a bad grade on your credit report. It can trigger a chain reaction of financial setbacks:

- Interest Rates Skyrocket: Lenders see you as a higher-risk borrower, which means they’ll charge you more for loans, credit cards, and even store financing. This could mean paying thousands of dollars extra for the same car or home – all because of a past mistake.

- Loans Become Difficult: Getting approved for loans, especially for large purchases like a house or starting a business, can become incredibly difficult with a charge-off on your report. Your dreams could be put on hold indefinitely.

- Credit Cards: No Thanks! Even if you do manage to get approved for credit, it will be on less-than-ideal terms. You’ll likely face lower credit limits, fewer rewards, and less flexibility.

- Life Gets Complicated: Charge-offs can even impact your ability to rent a nice apartment, get certain jobs, or even set up utilities.

But Here’s the Good News: You Have Options!

Don’t despair! There are steps you can take to remove a charge-off and get your financial life back on track:

- Regain Your Financial Freedom: Imagine being able to borrow money at reasonable rates, qualify for that dream home, and have more financial choices.

- Save Money: By getting rid of that charge-off, you can avoid paying excessive interest and fees, putting more money back in your pocket where it belongs.

- Build a Strong Foundation: A clean credit report is the key to a secure financial future. It opens doors to better opportunities and gives you peace of mind.

Writing a Letter That Gets Results: A Step-by-Step Guide

Let’s roll up our sleeves and get to work on crafting that charge-off removal letter. Remember, this letter is your chance to tell your story and convince the creditor to give you a second chance.

Step 1: Gather Your Ammunition

Before you start writing, gather all the relevant information about the charge-off:

- Account Number: This unique identifier is crucial for the creditor to locate your account.

- Date of Charge-Off: This helps establish the timeline of events.

- Original Amount Owed: This is the total amount of debt that was charged off.

- Current Balance: If you’ve made any payments since the charge-off, include the updated balance.

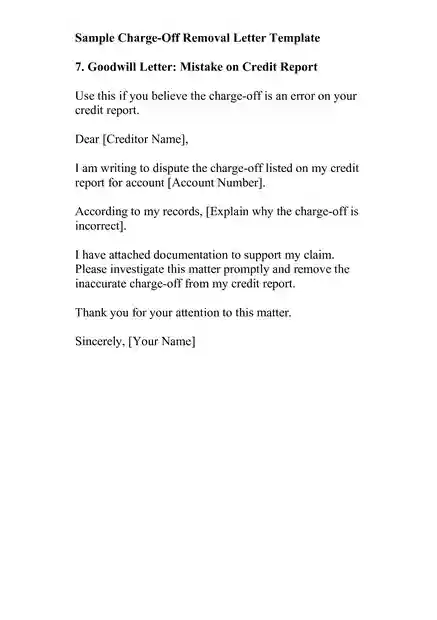

Double-check your credit report to make sure all the information is accurate. If you find any errors, dispute them with the credit bureau immediately.

Step 2: Choose Your Strategy

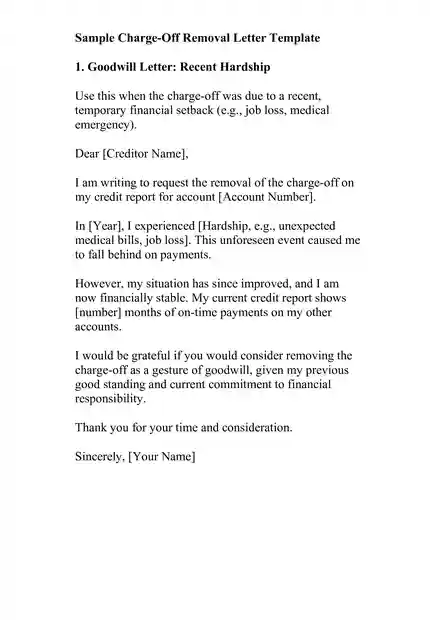

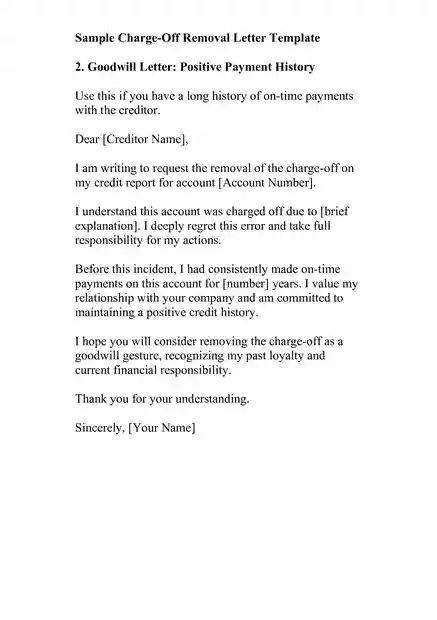

Now, decide which type of letter is best for your situation:

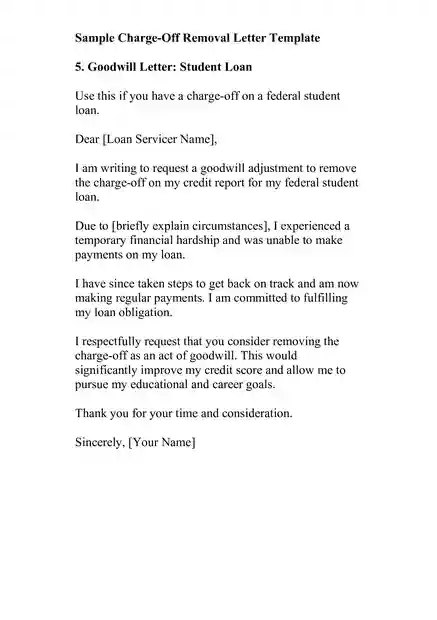

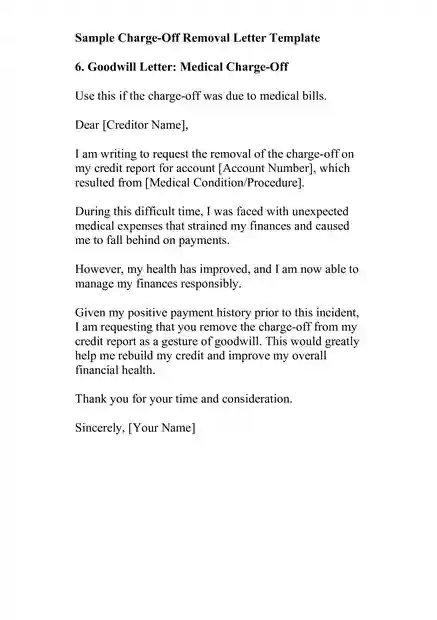

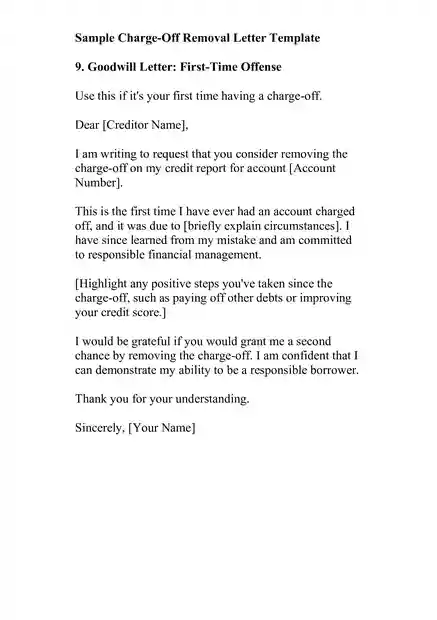

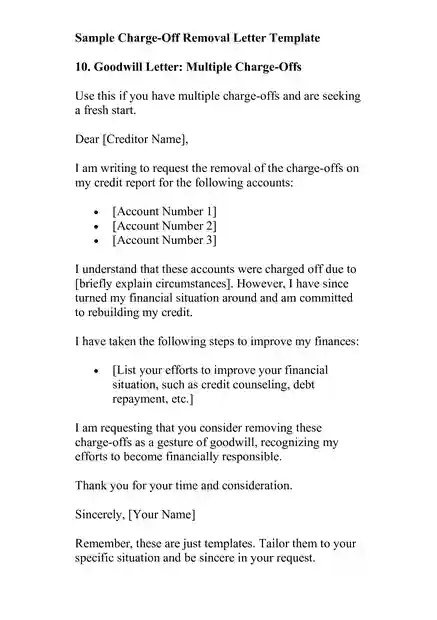

- Goodwill Letter: If you have a good payment history with the creditor and the charge-off was due to a temporary hardship or an unusual circumstance, a goodwill letter might be your best bet.

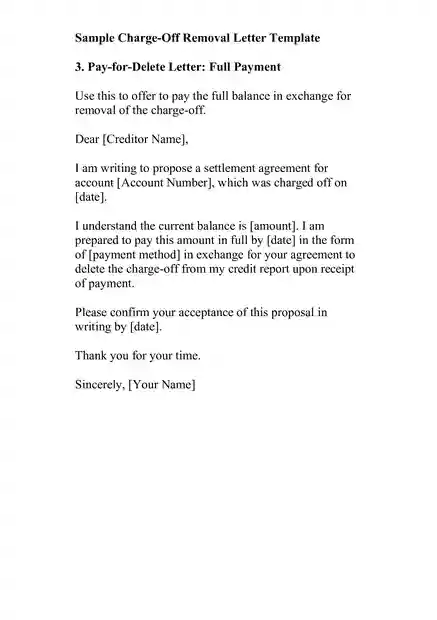

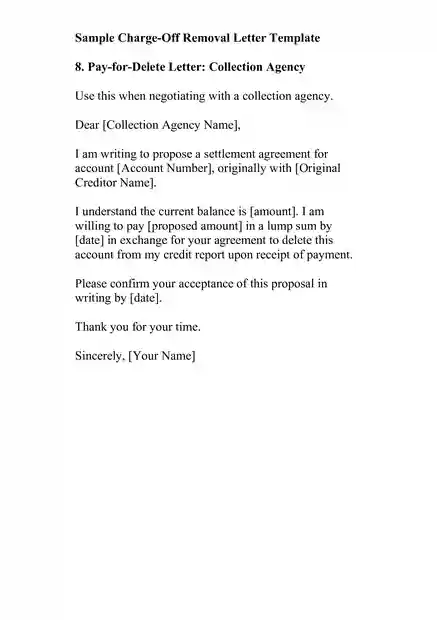

- Pay-for-Delete Letter: If you’re dealing with a debt collector or have a less-than-stellar payment history, a pay-for-delete letter might be a more realistic option.

Step 3: Craft Your Letter

Here’s where your writing skills come in handy. Keep these tips in mind:

- Be Professional: Use a formal tone, like you would in any business letter. Avoid slang, emojis, or overly emotional language.

- Get to the Point: In the very first sentence, clearly state that you’re requesting the charge-off to be removed from your credit report.

- Tell Your Story: Briefly explain the circumstances that led to the charge-off. Be honest and take responsibility for your actions, but also highlight any mitigating factors like a job loss, medical emergency, or other unforeseen hardship.

- Offer Solutions:

- Goodwill Letter: Emphasize your positive payment history and any recent improvements to your financial situation. Express your commitment to responsible financial behavior going forward.

- Pay-for-Delete Letter: Clearly state your willingness to pay off the debt (or a portion of it) in exchange for the charge-off removal. Be specific about the amount you’re willing to pay and propose a reasonable timeframe for payment.

- Keep it Concise: Your letter should be no longer than one page. Get to the point quickly and avoid rambling.

Example: Goodwill Letter

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Creditor Name] [Creditor Address]Re: Account Number [Account Number]

Dear [Creditor Name],

I am writing to respectfully request that you consider removing the charge-off on my credit report for the above-referenced account.

I understand that the account was charged off due to [briefly explain circumstances]. However, I have since taken steps to improve my financial situation and am committed to maintaining a positive payment history.

Prior to this incident, I had a good track record of making timely payments on this account. [Mention any positive payment history or recent improvements to your financial situation].

I would be grateful if you would consider removing the charge-off as a gesture of goodwill. This would greatly help me rebuild my credit and achieve my financial goals.

Thank you for your time and consideration.

Sincerely, [Your Signature] [Your Typed Name]

Example: Pay-for-Delete Letter

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Creditor Name] [Creditor Address]Re: Account Number [Account Number]

Dear [Creditor Name],

I am writing to propose a settlement agreement for the above-referenced account, which was charged off on [date].

I understand that the current balance on the account is [amount]. I am willing to pay [proposed amount] in exchange for your agreement to remove the charge-off from my credit report.

I am prepared to make this payment by [date]. Please confirm your agreement to this proposal by [date].

Thank you for your time and consideration.

Sincerely, [Your Signature] [Your Typed Name]

Essential Tips for Letter Writing:

Writing a compelling letter can significantly increase your chances of success. Here are some additional tips to keep in mind:

- Timing is Key: If you’ve recently paid off the debt, it’s a good time to send your letter. Creditors are more likely to be receptive when you’ve demonstrated your willingness to repay.

- Be Persistent: Don’t get discouraged if you don’t receive an immediate response or if your initial request is denied. Follow up with a phone call or another letter. Persistence can pay off!

- Professional Help: If you’re struggling with the process or need additional guidance, consider seeking help from a credit counselor. They can offer expert advice and even negotiate on your behalf.

Charge-Off Removal Letter Template

Here are sample templates for both goodwill and pay-for-delete letters. Remember to customize them to fit your specific situation:

Goodwill Letter Template

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Creditor Name] [Creditor Address]Re: Account Number [Account Number]

Dear [Creditor Name],

I am writing to respectfully request that you consider removing the charge-off on my credit report for the above-referenced account.

[Briefly explain the circumstances that led to the charge-off. Highlight any mitigating factors or recent positive changes in your financial situation.]Prior to this incident, I had a [positive payment history, e.g., “long and exemplary payment history” or “consistently made on-time payments”]. I am committed to maintaining a responsible financial lifestyle and have taken steps to ensure this won’t happen again.

I would be grateful if you would consider removing the charge-off as a gesture of goodwill. This would significantly improve my credit score and open up new financial opportunities for me.

Thank you for your time and consideration.

Sincerely, [Your Signature] [Your Typed Name]

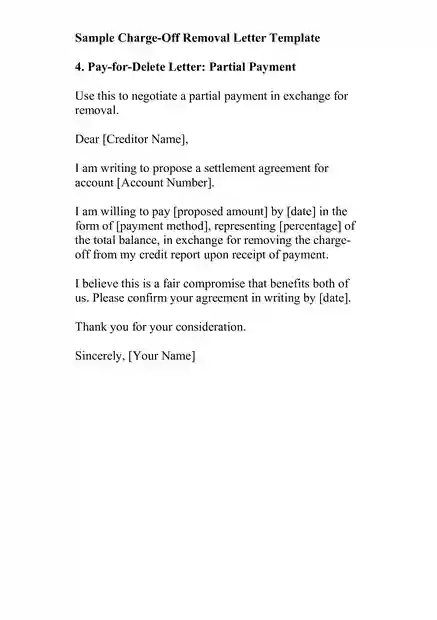

Pay-for-Delete Letter Template

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Creditor Name] [Creditor Address]Re: Account Number [Account Number]

Dear [Creditor Name],

I am writing to propose a settlement agreement for the above-referenced account, which was charged off on [date].

I understand that the current balance on the account is [amount]. I am willing to pay [proposed amount] in exchange for your agreement to remove the charge-off from my credit report upon receipt of payment.

I propose to make this payment by [date] in the form of [payment method]. Please confirm your agreement to this proposal in writing by [date].

Thank you for your time and consideration.

Sincerely, [Your Signature] [Your Typed Name]

Important Note: It’s crucial to get any pay-for-delete agreement in writing before making a payment.

Sample Charge-Off Removal Letter Template

Timeline for Charge-Off Removal

The charge-off removal process can take time. Typically, you can expect to hear back from the creditor within 30-45 days. If you haven’t received a response within this timeframe, follow up with a phone call or email.

Negotiating with Debt Collectors

Dealing with debt collectors can be intimidating, but remember, you have rights! Before negotiating any payment or settlement, request debt validation to ensure the debt is accurate and belongs to you. Be firm but polite in your communication, and familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) to protect yourself from any abusive tactics.

Your Rights and Options: Know Your Power!

The Fair Credit Reporting Act (FCRA) is a federal law that gives you the right to dispute any errors on your credit report, including incorrect charge-offs. Even if the charge-off is accurate, there are still strategies you can use to get it removed.

Types of Charge-Off Removal Letters

There are two main types of letters you can use to fight back:

- Goodwill Letter: This is your “nice guy/gal” approach. You explain your situation to the creditor, emphasize your good payment history (if applicable), and ask them to remove the charge-off as a gesture of goodwill.

- Pay-for-Delete Letter: This is more of a negotiation. You offer to pay off the debt (or a portion of it) in exchange for them removing the charge-off from your credit report.

What Determines Your Success?

Several factors influence your chances of getting a charge-off removed:

- Payment History: A good track public record of paying bills on time can make creditors more sympathetic to your request. A recent study by Credit Karma found that consumers with a positive payment history were 20% more likely to have a goodwill letter approved.

- Creditor Relationship: If you’re dealing with the original creditor rather than a debt collector, you might have a better shot. Original creditors often have more flexibility in their policies.

- Negotiation Skills: Being polite, persistent, and persuasive can go a long way. According to a survey by the National Foundation for Credit Counseling, 64% of consumers who negotiated with creditors were able to reach a favorable agreement.

FAQs About Charge-Off Removal

You’ve got questions? We’ve got answers!

Q: Can I remove a charge-off myself?

A: Absolutely! You don’t need to hire a fancy credit repair company. Many people successfully remove charge-offs on their own by writing effective letters and negotiating directly with creditors.

Q: Should I hire a credit repair company?

A: While credit repair companies can help, they often charge hefty fees for services you can do yourself. Start by trying the DIY approach outlined in this guide. If you hit a roadblock, then consider seeking professional help.

Q: Can I negotiate a pay-for-delete agreement with an original creditor?

A: It’s possible, but less common than with debt collectors. Some original creditors may be willing to negotiate a pay-for-delete agreement if you have a good payment history with them. It never hurts to ask!

Q: What happens if my request is denied?

A: Don’t give up! You can try negotiating further, escalate the issue to a supervisor, or consider seeking help from a credit counselor. Remember, persistence is key.

Q: How long does the charge-off removal process typically take?

A: The timeline can vary, but you should generally expect to hear back from the creditor within 30-45 days. If you haven’t received a response within that time frame, follow up with a phone call or email.

Legal Considerations: Know Your Rights

This guide is designed to provide helpful information and empower you to take action. However, it’s important to remember that it’s not a substitute for legal advice. If you have specific questions about your rights or the debt collection process, consult with an attorney.

Alternative Solutions:

If removing a charge-off isn’t possible, focus on other ways to improve your credit:

Make Timely Payments: Consistently paying bills on time will help rebuild your credit over time.

Pay Down Debt: Reducing your overall debt burden can significantly improve your credit score.

Become an Authorized User: Becoming an authorized user on a responsible person’s credit card can help boost your credit.

Real-Life Success Story: From Charged-Off to Homeowner

Meet David, a hardworking father of two who was denied a mortgage due to a charge-off on his credit report. Determined to provide a better future for his family, David followed our guide, wrote a persuasive goodwill letter, and successfully had the charge-off removed. Within a few months, his credit score improved dramatically, and he was able to secure a loan to purchase his dream home.

Additional Resources

We’re here to support you on your journey to credit repair! Here are some additional resources that can help:

Preventing Future Charge-Offs: Your Action Plan

The best way to deal with charge-offs is to prevent them from happening in the first place. Follow these tips to stay on top of your finances:

- Budgeting 101: Track your income and expenses to stay on top of your bills. Create a budget that works for you and stick to it.

- Debt Management: If you’re struggling with debt, don’t ignore it. Consider options like debt consolidation or credit counseling to get back on track.

- Credit Monitoring: Regularly check your credit reports to catch errors or signs of trouble early. Sign up for free credit monitoring services to stay informed about your credit health.

SEO Conclusion

Don’t let a charge-off control your financial future. With the right tools and knowledge, you can take charge of your credit and erase past mistakes. Remember, it’s never too late to start fresh. Download our free charge-off removal letter template and start your journey to a cleaner credit report and a brighter financial future today!

Daniel Wilson Is a Seasoned communications professional and letter-writing expert. With over a decade of experience in corporate and non-profit sectors, Has developed a deep understanding of the power of effective communication.

Specializes in creating versatile letter templates that can be tailored to any situation. In this blog, Daniel shares a passion for the art of letter writing, offering practical tips, customizable templates, and inspiring ideas to help you communicate with clarity, confidence, and impact.